Montana Employment Application for Accountant

Description

How to fill out Employment Application For Accountant?

US Legal Forms - one of the biggest collections of legal documents in the United States - provides a variety of legal form templates that you can download or print.

By utilizing the website, you will obtain numerous forms for commercial and personal use, categorized by types, states, or keywords. You can find the latest versions of forms like the Montana Employment Application for Accountant in just moments.

If you possess a membership, Log In to download the Montana Employment Application for Accountant from the US Legal Forms database. The Download button will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your account.

Complete the transaction. Use a credit card or PayPal account to finish the purchase.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Montana Employment Application for Accountant.

Each template you save to your account does not have an expiration date and is yours permanently. Therefore, if you wish to obtain or print another copy, just go to the My documents section and click on the form you need.

Access the Montana Employment Application for Accountant with US Legal Forms, the largest repository of legal document templates. Utilize a multitude of professional and state-specific templates that meet your business or personal requirements.

- Ensure you have selected the correct form for your area/region.

- Click the Preview button to see the form's details.

- Review the form description to confirm that you have chosen the right one.

- If the form does not fulfill your needs, utilize the Search box at the top of the page to find one that does.

- After you are satisfied with the document, confirm your choice by pressing the Get now button.

- Then, choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Tips for sending an application via emailFind an actual person to address in your email.Use the right email address.Add the recipient's email address last.Keep your message short.Check your attachments' names.Consider converting attachments to PDF.

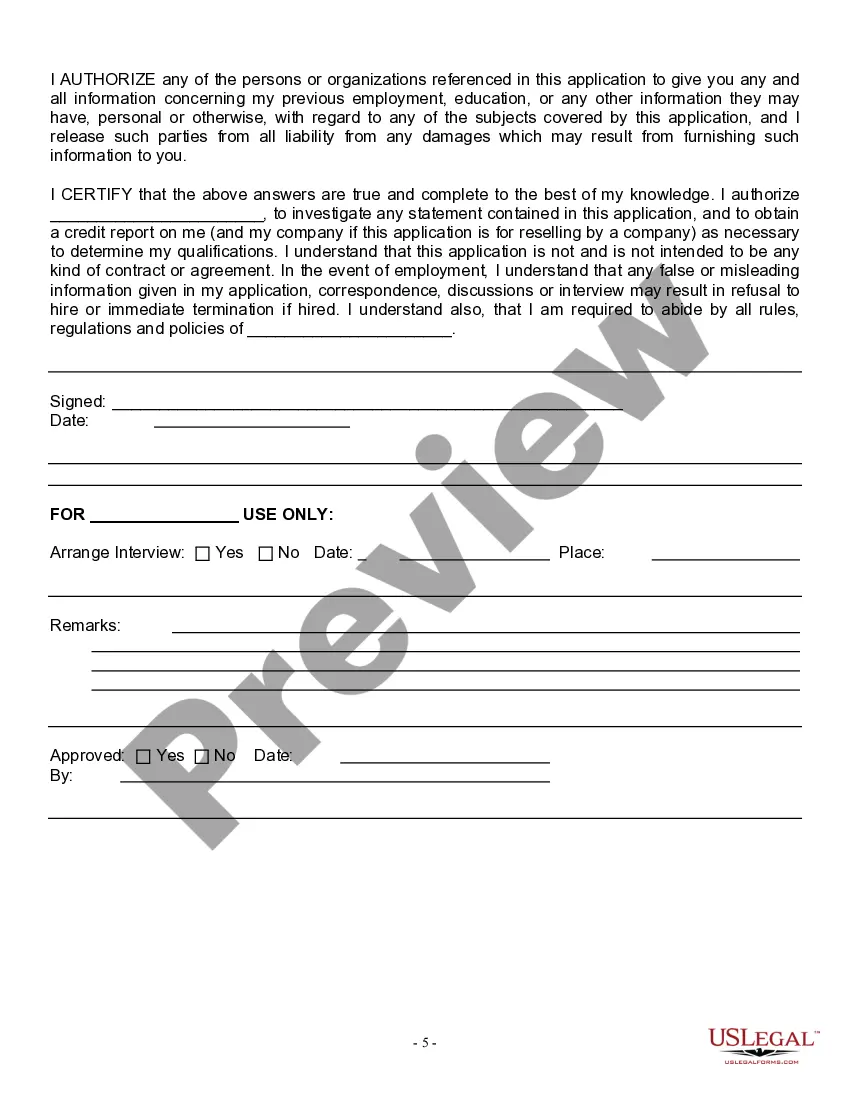

In addition to providing personal information, work history, education, qualifications, and skills, you will also be asked to attest to the fact that all the information you are giving is accurate.

An application form will usually include sections on personal information, education, work experience and employment history, as well as competency-based questions and a personal statement. Application forms are usually completed and submitted online, although paper versions may be accepted in some cases.

How to2026 FILL OUT A JOB APPLICATIONBe Prepared. Make sure you know the correct names, dates, places and other information you will need.Ask If You May Take A Blank Application Home.Read The Form.Be Neat.Answer All Questions Completely And Correctly.Be Positive.Be Clear.Alert References Beforehand.More items...

How to2026 FILL OUT A JOB APPLICATIONBe Prepared. Make sure you know the correct names, dates, places and other information you will need.Ask If You May Take A Blank Application Home.Read The Form.Be Neat.Answer All Questions Completely And Correctly.Be Positive.Be Clear.Alert References Beforehand.More items...

Information Required to Complete a Job Application.Personal Information.Education and Experience.Employment History.Resume and Cover Letter.References.Availability.Certification.More items...?

Find information such as names, phone numbers, job titles, and the company's mailing address. If you left your job on good terms, consider contacting your former employer to get the full name or phone number of your supervisor.

How to complete an online applicationAttach a file of your resume. Many applications allow you to browse for a file on your computer or USB drive.Copy and paste your entire resume into the online application. Open your resume file.Enter your work history manually one field at a time.

Information Needed to Complete a Job ApplicationName.Address.City, State, Zip Code.Phone Number.Email Address.Eligibility to work in the U.S.Felony Convictions (in some locations)If underage, working paper certificate.

Employment InformationNames, addresses, and phone numbers of previous employers.Supervisor's Name.Dates of Employment.Salary.Reason for Leaving.