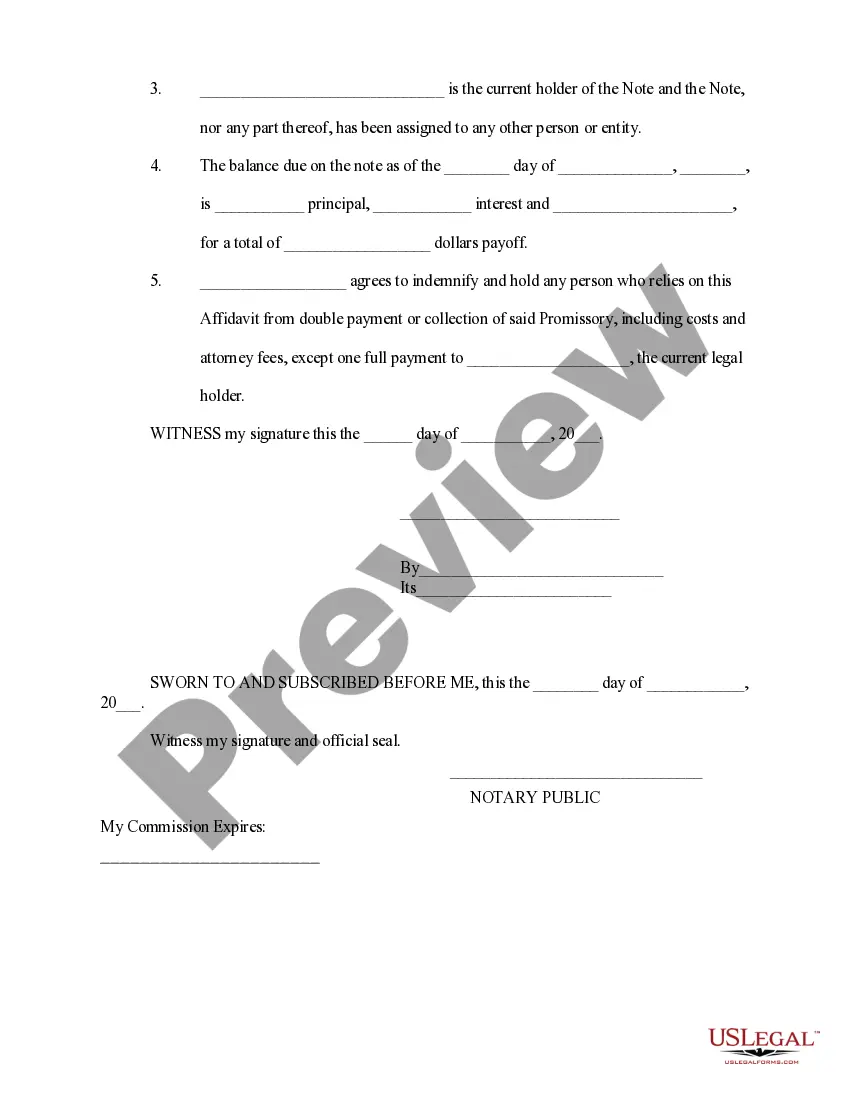

Montana Affidavit of Lost Promissory Note

Description

How to fill out Affidavit Of Lost Promissory Note?

If you want to obtain, procure, or print authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Leverage the site’s straightforward and user-friendly search to find the documents you require.

A range of templates for business and personal purposes are categorized by types and states or keywords.

Step 4. Once you find the form you need, click the Download now button. Choose the pricing plan you prefer and provide your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to obtain the Montana Affidavit of Lost Promissory Note with just a few clicks.

- If you are an existing US Legal Forms user, Log In to your account and click on the Download button to locate the Montana Affidavit of Lost Promissory Note.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Confirm you have selected the correct city/region form.

- Step 2. Utilize the Preview option to review the content of the form. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A lost note affidavit is a sworn statement made by the lender that it has lost the original note. The affidavit also contains factual representations from the lender about the status of the note and the loan.

A promissory note is a written agreement to pay someone essentially an IOU. But it's not something to be taken lightly. "It is a legally binding written document effectuating a promise to repay money," says Andrea Wheeler, a business attorney and owner of Wheeler Legal PLLC of Florida.

Even if you have the original note, it may be void if it was not written correctly. If the person you're trying to collect from didn't sign it and yes, this happens the note is void. It may also become void if it failed some other law, for example, if it was charging an illegally high rate of interest.

You can get a copy of your Master Promissory Notes by going to studentloans.gov and entering your FSA ID. Click on Completed Master Promissory Notes under the menu bar heading that says My Loan Documents. The completed Master Promissory Notes will appear, and you can download them directly.

Losing the original note or a copyThe original copy of a valid promissory note is usually held by the lender, but the borrower should also keep a copy of the signed document. If the borrower does not repay the loan, the lender can pursue appropriate legal action.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

1. Request loan paperwork from your lender. The lender can provide copies of the documents signed at closing. If the loan has changed hands, contact the most current servicer for a copy of your mortgage or deed of trust documents.

The lender holds the promissory note while the loan is outstanding. When the loan is paid off, the note is marked as "paid in full" and returned to the borrower.

Even if a promissory note is lost, the legal obligation to repay the loan remains. The lender has a right to re-establish the note legally as long as it has not sold or transferred the note to another party.

After issuance, a Promissory Note must be stamped according to the regulations of the Indian Stamp Act. The common practice is to use a revenue stamp on the note which is then signed by the promissory and/or cross signed by the borrower.