Montana Accounts Receivable - Guaranty

Description

How to fill out Accounts Receivable - Guaranty?

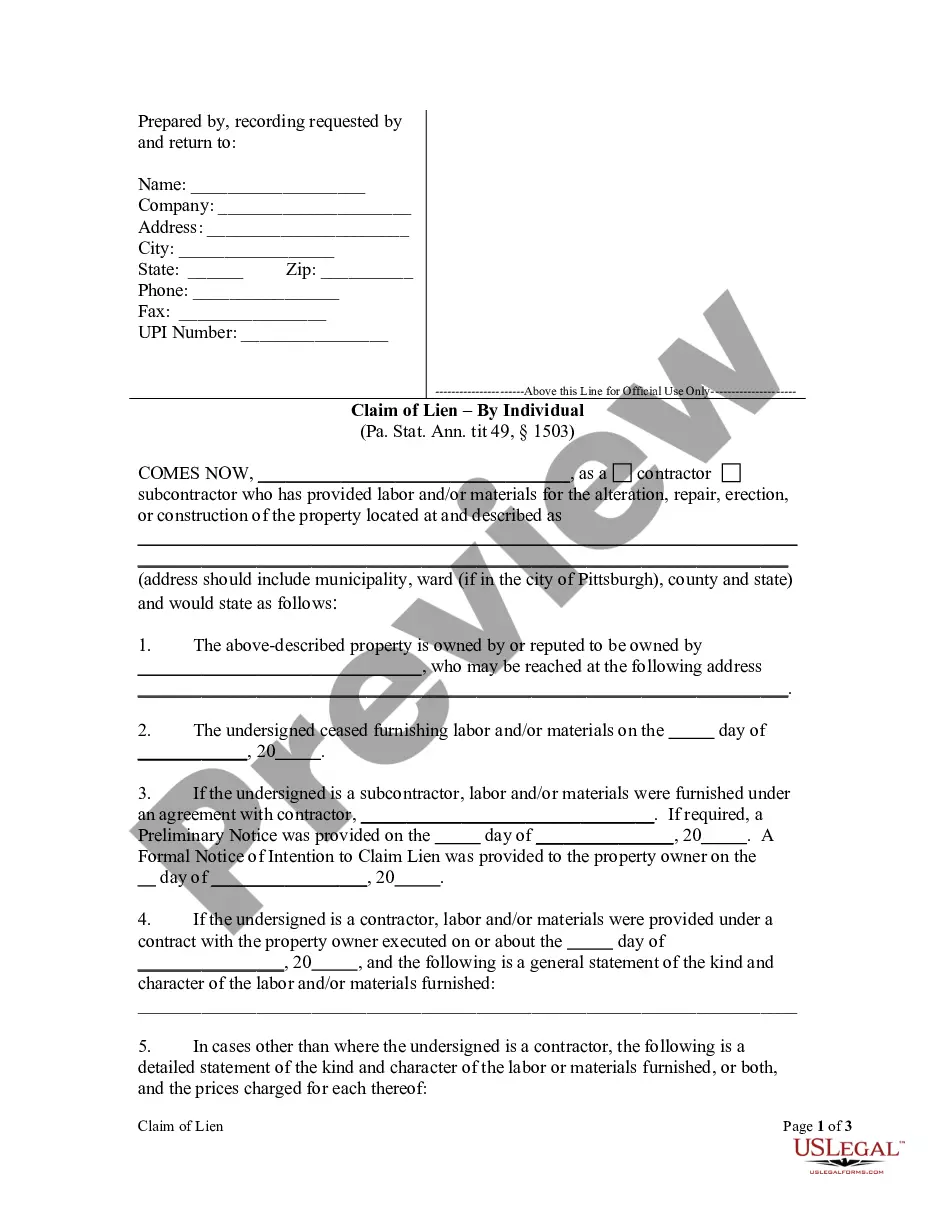

You can dedicate multiple hours online looking for the official document format that fulfills both federal and state requirements you will need. US Legal Forms offers thousands of legal templates that are reviewed by experts.

It is easy to download or print the Montana Accounts Receivable - Guaranty from the service. If you already possess a US Legal Forms account, you can sign in and click the Download button. Afterward, you can complete, edit, print, or sign the Montana Accounts Receivable - Guaranty.

Every legal document format you receive is yours permanently. To obtain another copy of any downloaded form, navigate to the My documents section and click the corresponding button. If you are using the US Legal Forms site for the first time, follow the simple instructions below: First, ensure that you have selected the correct document format for your area/city of choice. Review the document details to confirm that you have chosen the appropriate form. If available, utilize the Review button to examine the document format as well.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- To find another version of your document, use the Search field to locate the format that fits your needs.

- Once you have identified the format you desire, click Purchase now to proceed.

- Choose the pricing plan you prefer, enter your information, and create your account on US Legal Forms.

- Complete the transaction. You can use your Visa or Mastercard or PayPal account to pay for the legal document.

- Select the format of your document and download it to your device.

- Make adjustments to your document if needed. You can complete, edit, sign, and print the Montana Accounts Receivable - Guaranty.

- Download and print thousands of document templates using the US Legal Forms website, which provides the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

Form popularity

FAQ

You can contact the state of Montana through various channels, including phone, email, and online resources. The official Montana government website lists contact information for different departments. If you seek assistance related to accounts receivable, consider reaching out to Montana Accounts Receivable - Guaranty for expert support. They can guide you through any challenges you may face with state-related inquiries.

To locate your state of Montana refund, you can visit the official Montana Department of Revenue website. They provide a tool to check the status of your refund online. If you need assistance navigating this process, Montana Accounts Receivable - Guaranty services can help streamline your inquiries. This way, you can focus on other important aspects of your financial management.

In Montana, debt collectors can pursue you for a period of up to eight years, depending on the type of debt. This timeframe, known as the statute of limitations, begins when the debt becomes due. If you are struggling with accounts receivable issues, understanding this timeline is crucial. You may benefit from Montana Accounts Receivable - Guaranty services to manage and resolve your debts efficiently.