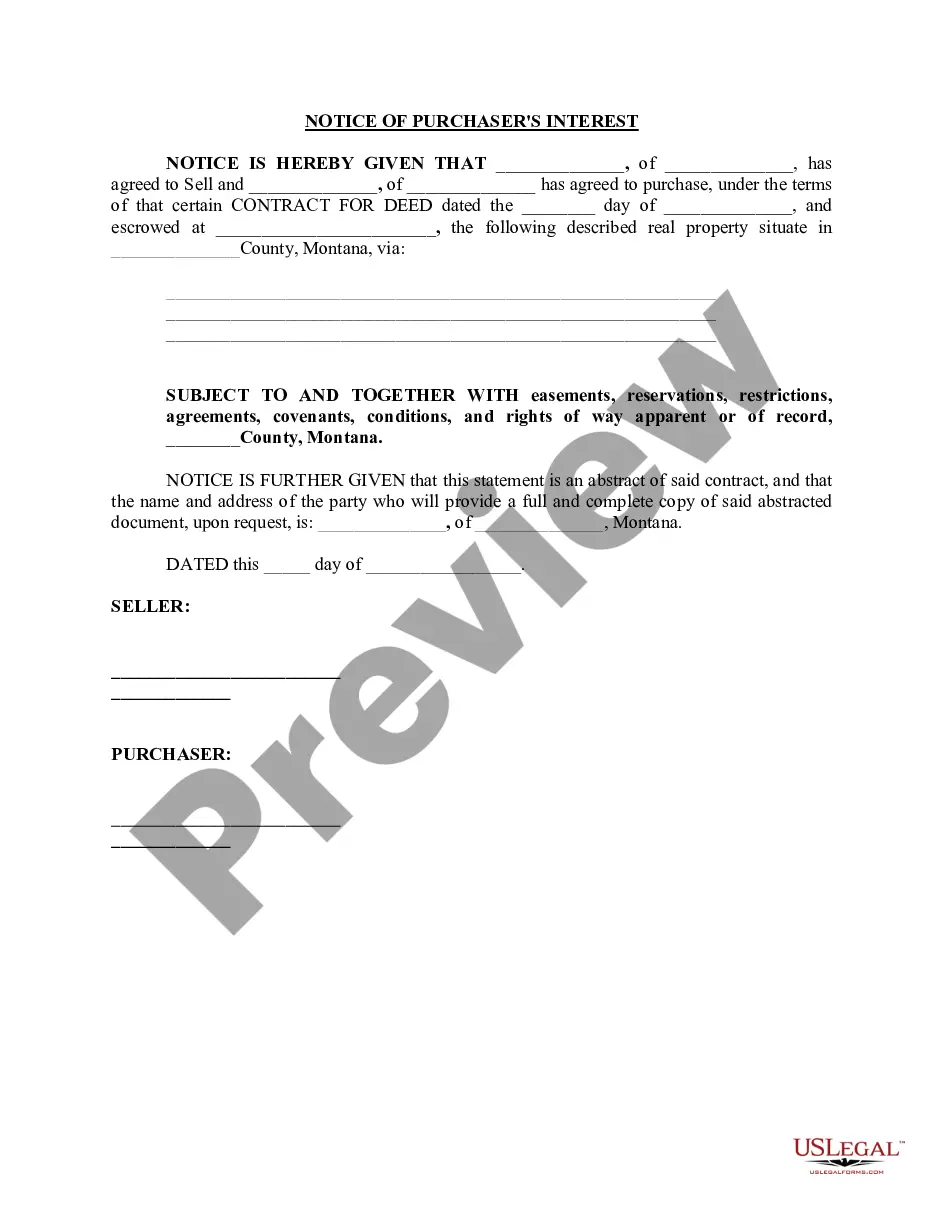

Montana Notice of Purchaser's Interest

Description

Unless an assignment is qualified in some way, it is

generally considered to be a transfer of the transferor's

entire interest in the interest or thing assigned.

Key Concepts & Definitions

Notice of Purchaser's Interest: A legal document filed in some real estate transactions in the United States indicating the buyer's intent to acquire an interest in a property. This notice is typically used to protect the buyer's rights during the transaction process.

Title Insurance: Insurance that protects property buyers and mortgage lenders against defects or problems with a title when there is a transfer of property ownership.

Real Estate: Refers to property consisting of land and the buildings on it, along with its natural resources. The term also encompasses the business of buying, selling, or renting these properties.

Property Management: The operation, control, maintenance, and oversight of real estate. This term is most commonly used in connection to rental properties.

Step-by-Step Guide on Filing a Notice of Purchaser's Interest

- Identify the Need: Recognize the necessity for a notice when purchasing an investment property or dream property to secure your legal rights.

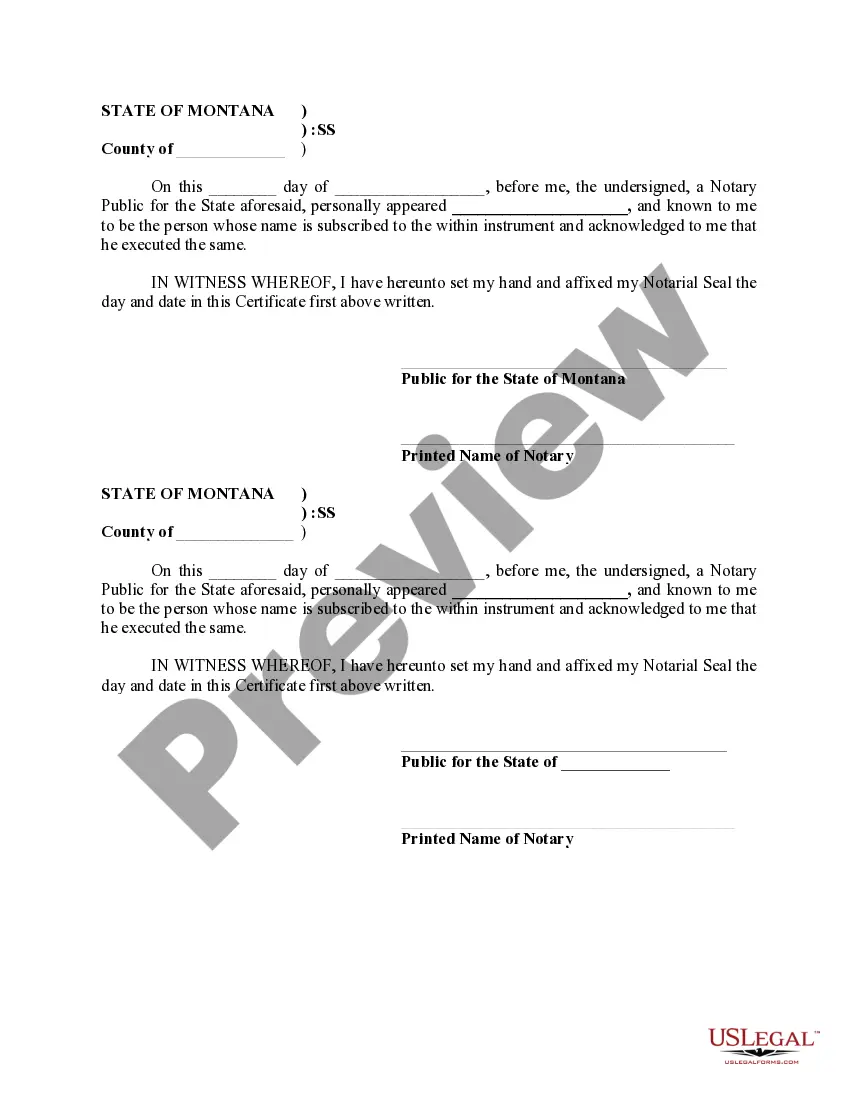

- Consult Professionals: Engage with a real estate lawyer or a title insurance company to provide guidance on the preparation and specifics of the notice.

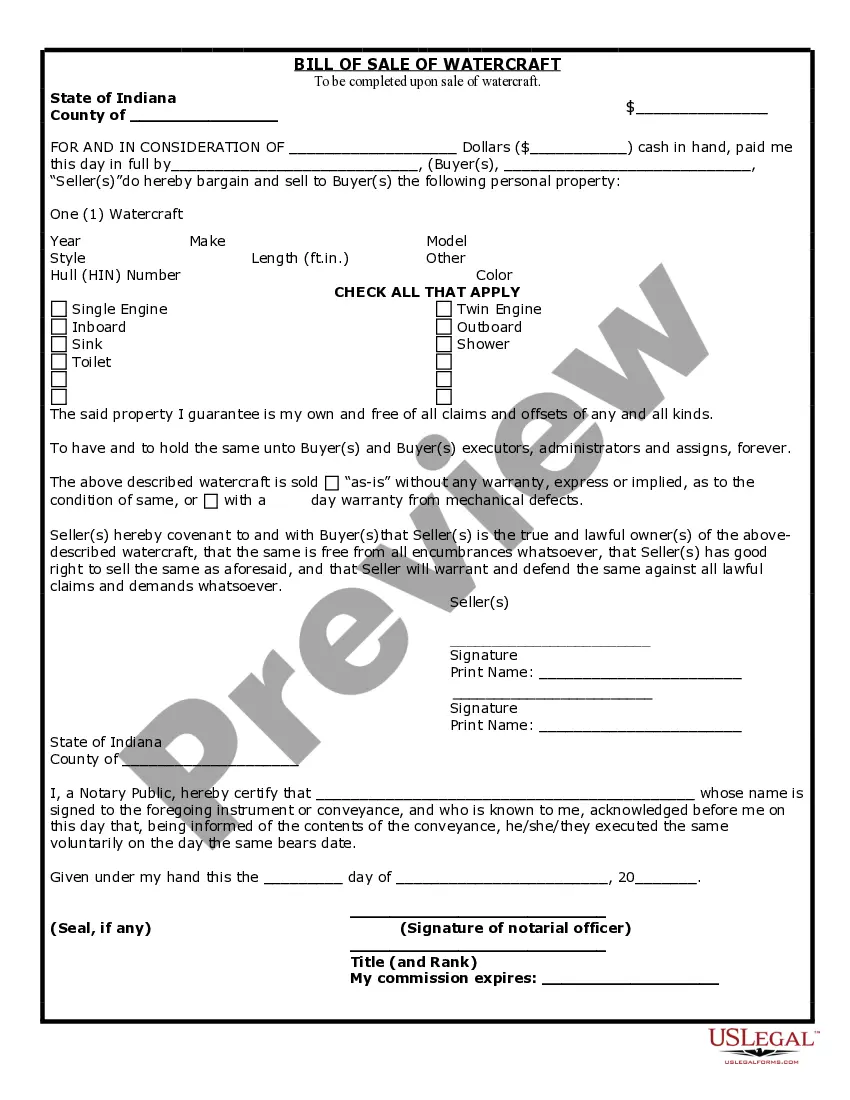

- Prepare the Document: Draft the notice, making sure it is duly executed with all required formalities such as seller and buyer details, sales price, and closing date.

- File the Notice: Submit the notice to the relevant local authorities or property registry before the closing date to ensure it's legally recorded.

Risk Analysis

- Legal Risks: Failure to file a notice could lead to disputes in property ownership or interests, particularly in competitive real estate markets.

- Financial Risks: Without a notice, a buyer's investment in property may be at risk if another party claims a legal interest in the property.

- Reputation Risks: Property management firms face potential reputation harm if they fail to adequately manage these legal tools on behalf of clients.

Best Practices

- Tailor to Legal Requirements: Ensure that the notice meets all local legal requirements, which can vary by state and municipality.

- Timely Submission: Submit the notice well ahead of the closing date to prevent any administrative delays or potential legal complications.

- Professional Assistance: Always seek legal or professional advice when dealing with complex real estate transactions to avoid common pitfalls.

Common Mistakes & How to Avoid Them

- Incorrect Information: Double-check all details in the notice such as sales price and property description to avoid errors. Comprehensive review prevents legal issues down the line.

- Late Filing: Late filing of the notice can lead to serious complications. Set reminders and work with professionals to ensure timelines are met.

- Lack of Professional Advice: Failing to consult with real estate professionals or legal advisors can lead to overlooking essential aspects of the filing process.

How to fill out Montana Notice Of Purchaser's Interest?

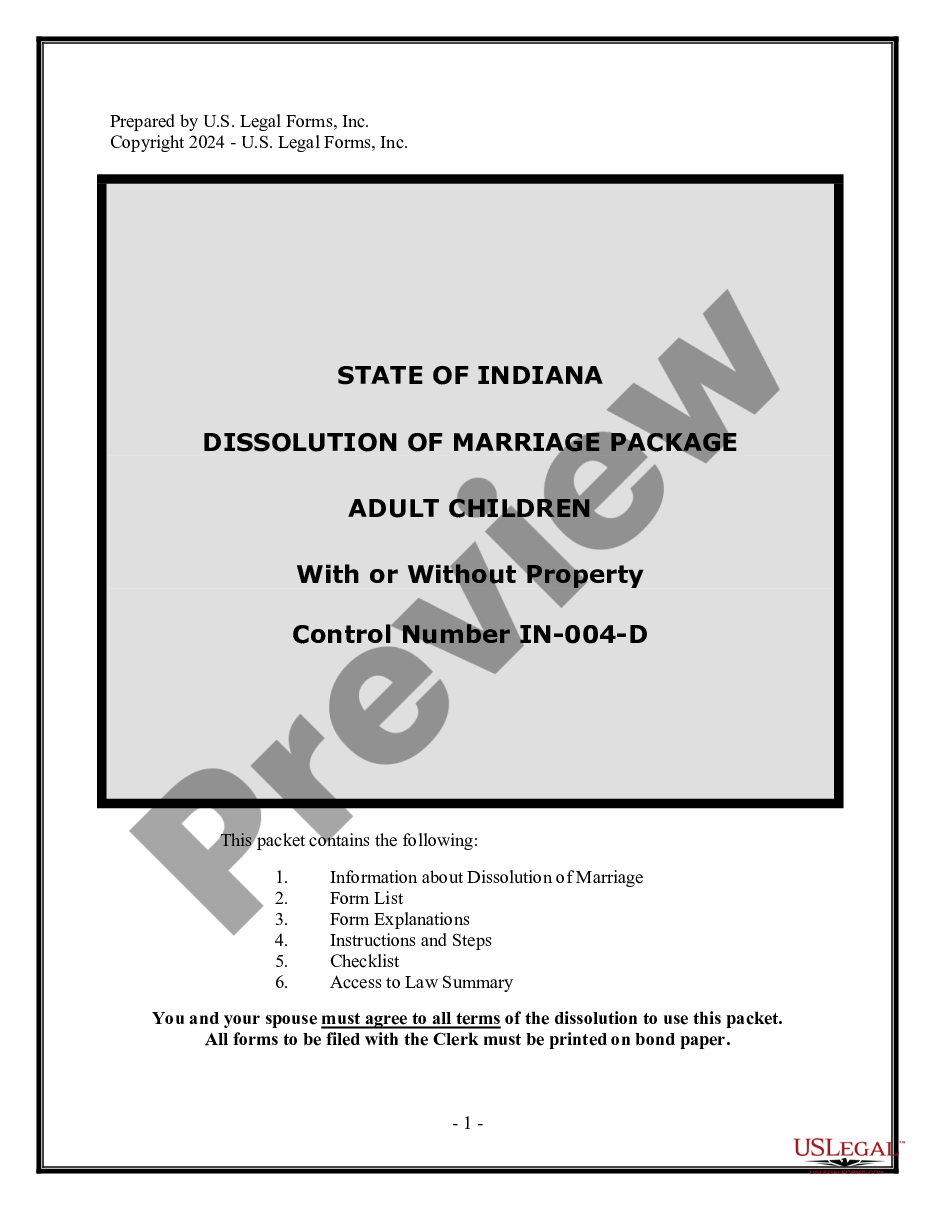

Avoid costly lawyers and find the Montana Notice of Purchaser’s Interest you need at a affordable price on the US Legal Forms website. Use our simple groups functionality to find and download legal and tax files. Read their descriptions and preview them well before downloading. In addition, US Legal Forms enables users with step-by-step tips on how to download and complete each form.

US Legal Forms subscribers merely have to log in and download the specific form they need to their My Forms tab. Those, who have not got a subscription yet need to stick to the guidelines below:

- Make sure the Montana Notice of Purchaser’s Interest is eligible for use in your state.

- If available, look through the description and use the Preview option well before downloading the sample.

- If you’re confident the template meets your needs, click on Buy Now.

- In case the template is incorrect, use the search engine to find the right one.

- Next, create your account and select a subscription plan.

- Pay out by card or PayPal.

- Select download the form in PDF or DOCX.

- Just click Download and find your template in the My Forms tab. Feel free to save the template to your device or print it out.

Right after downloading, it is possible to complete the Montana Notice of Purchaser’s Interest by hand or with the help of an editing software program. Print it out and reuse the form multiple times. Do more for less with US Legal Forms!

Form popularity

FAQ

Land in Montana isn't getting any cheaper. If you are looking to buy land, Montana is the last best place and the best way to buy without the middle man is to buy Montana land for sale by owner.

Statewide, the median price per acre of land sold in 2017 (just land with improvement values removed) was just around $1,000 per acre. The comparative median price of property on the market as of early January 2018 was over 2x the 2017 at $2,111 per acre.

In the case of the home buyer's title insurance policy, it's customary for the seller to pay the costs of the policy issued to the new homeowner. Mortgage lenders also require a title insurance policy. It's customary for the lender's policy to be paid by the home buyer.

However, buying bare land in Montana is one of the best investments you can make.The Moment You Buy It, It Doesn't Depreciate In Value Unlike buying a new car and driving it off the lot, land in Montana doesn't depreciate like that2026 and it been increasing in value.

While the buyers will typically be responsible for the lion's share, sellers should expect to pay between 1-3% of the home's final sale price at closing.

Almost all lenders require the borrower to purchase a lender's title insurance policy to protect the lender in the event the seller was not legally able to transfer the title of ownership rights.Owner's title insurance, often purchased by the seller to protect the buyer against defects in the title, is optional.

Normally the seller purchases title insurance for the new buyer in the amount of the purchase price and the borrower purchases title insurance for the lender in the amount of the mortgage. When the mortgage is paid off, the lender's title insurance contract expires.

Seller agrees to give Purchaser prompt notice of any fire or other casualty occurring at or to the Property between the date of this Agreement and the Closing Date, or of any actual or threatened condemnation of all or any part of the Land of which Seller has knowledge.

As a general rule of thumb, the homebuyer is responsible for purchasing both lender's title insurance and owner's title insurance. This expense can range from between $150 to $1,000 or more depending on the amount of coverage you want.