Montana Appointment of Successor Trustee

Description

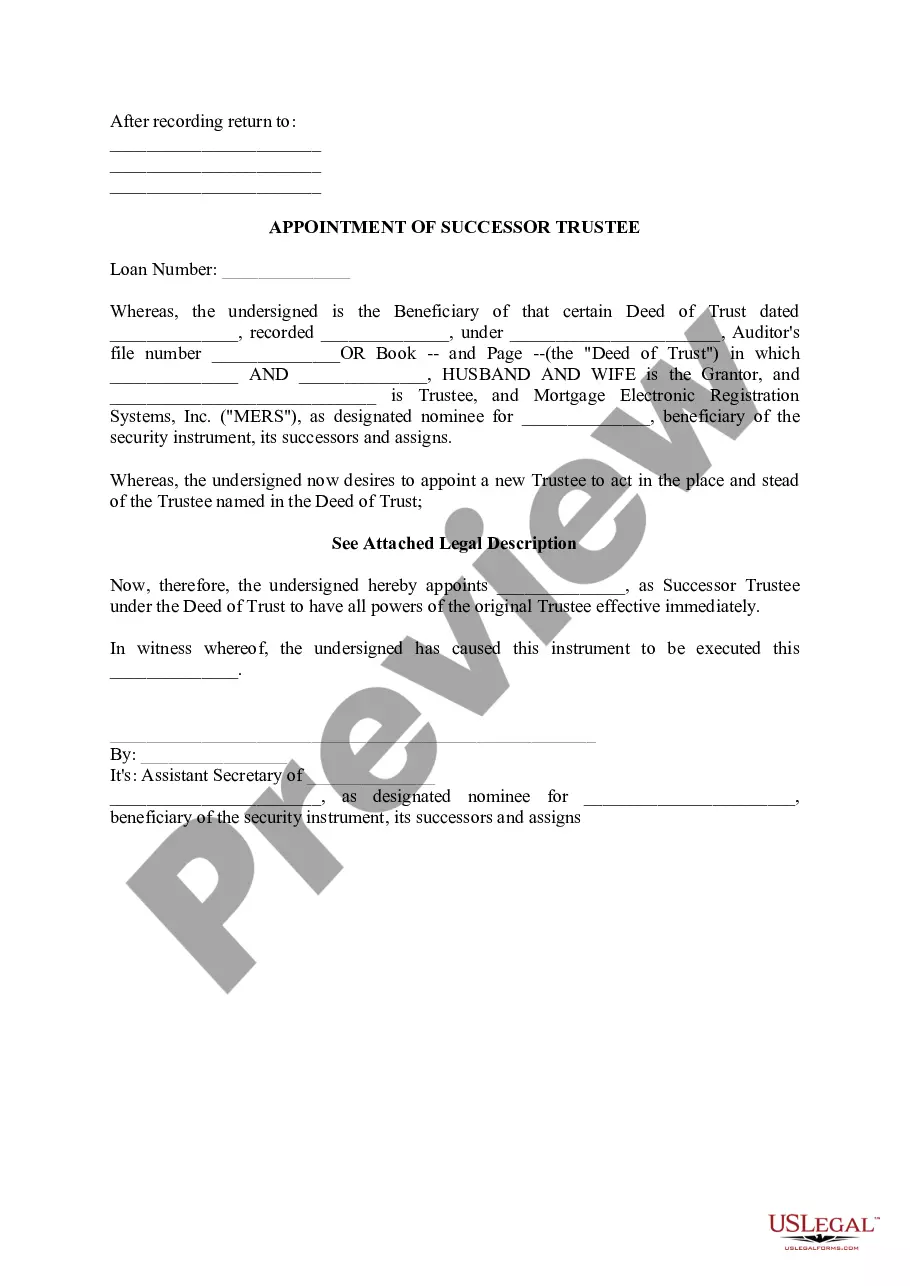

How to fill out Montana Appointment Of Successor Trustee?

Obtain a printable Montana Appointment of Successor Trustee within just several mouse clicks in the most extensive library of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top provider of reasonably priced legal and tax forms for US citizens and residents online starting from 1997.

Users who already have a subscription, need to log in in to their US Legal Forms account, down load the Montana Appointment of Successor Trustee see it saved in the My Forms tab. Customers who never have a subscription must follow the steps listed below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If readily available, review the form to find out more content.

- Once you’re sure the form is right for you, just click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay through PayPal or credit card.

- Download the template in Word or PDF format.

Once you have downloaded your Montana Appointment of Successor Trustee, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

Successor trustees are appointed in the trust document itself. The trustor will specify who they want to take over management of the trust if and when they can't do it themselves.

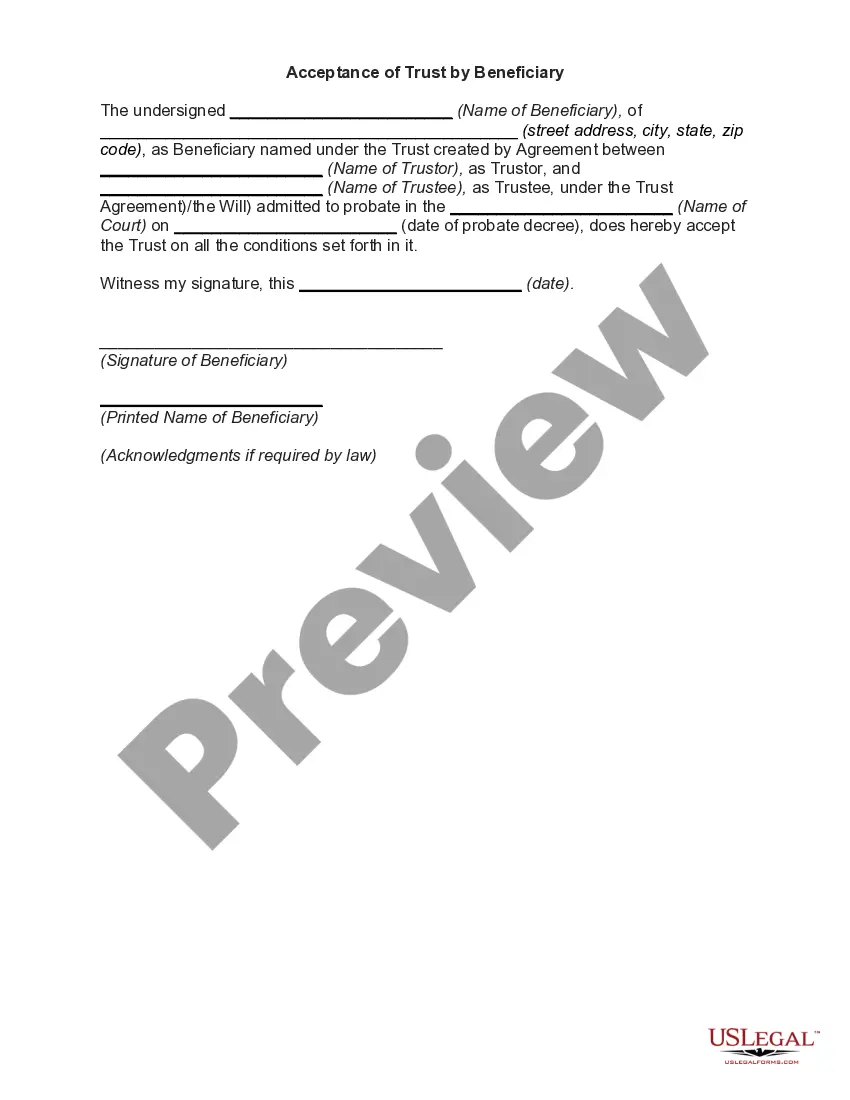

When the grantor dies, the trust becomes irrevocable and management or distribution of the assets passes to a successor trustee. Most trusts name the successor trustee when the trust is established; however, if you need to change or add a successor trustee, you can do so by amending the document.

After the grantor's passing, the successor trustee assumes the trustee's duties and must transfer documents to themselves so they can legally transfer trust property to the beneficiaries.

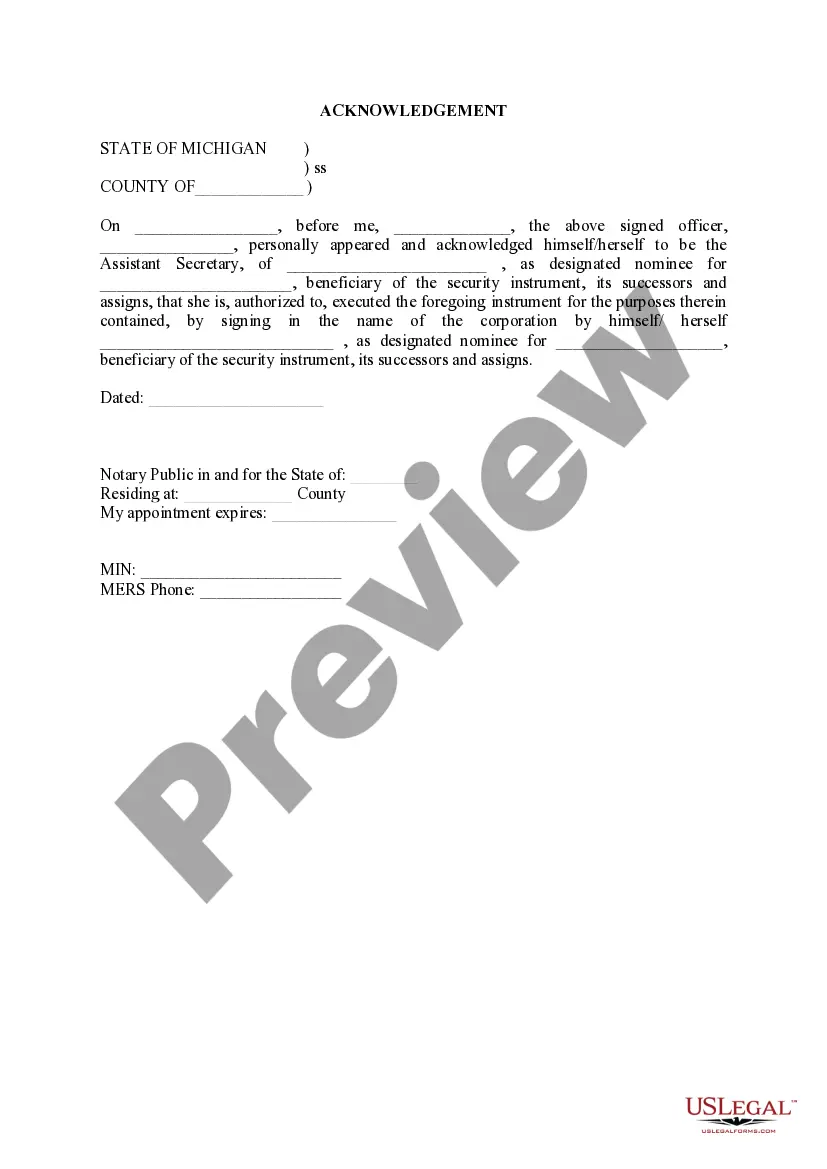

Successor trustees have to willingly accept their role usually by signing a consent to serve or affidavit of appointment. If an existing trustee wishes to change their successor trustee, they must make an actual amendment to the trust. Most courts won't accept informal, self-made changes.

A power of attorney is a legal document that gives one person authority to perform actions on behalf of another person. A trustee can implement a power of attorney to allow a third person to sign a deed on behalf of the trustee.

- Notify all banks so you can start writing checks as the Successor Trustee. Each bank will require a death certificate, copy of the Certificate of Trust or complete Trust document, and personal identification from the Successor Trustee.

As the trustee or successor trustee, you must endorse the check. Sign your name just as you are identified in the trust document, for example "Jane Doe, Trustee, John Doe Revocable Trust." If another trustee is named, you do not need her signature to make the deposit.

Your successor trustee is tasked with managing the assets in your trust as he or she sees fit. The successor trustee will do so until the time comes to transfer the assets to your beneficiaries. This responsibility only kicks in, however, once you can no longer effectively serve as your own trustee.

If there are no successor trustees nominated or they are unable or unwilling to act, the court must take immediate action to ensure that somebody is appointed.If there are no family members or other relatives willing to serve as the trustee, the court may appoint a professional fiduciary to serve as the trustee.