This form is an official Montana form which complies with all applicable state codes and statutes. USLF updates all state forms as is required by state statutes and law.

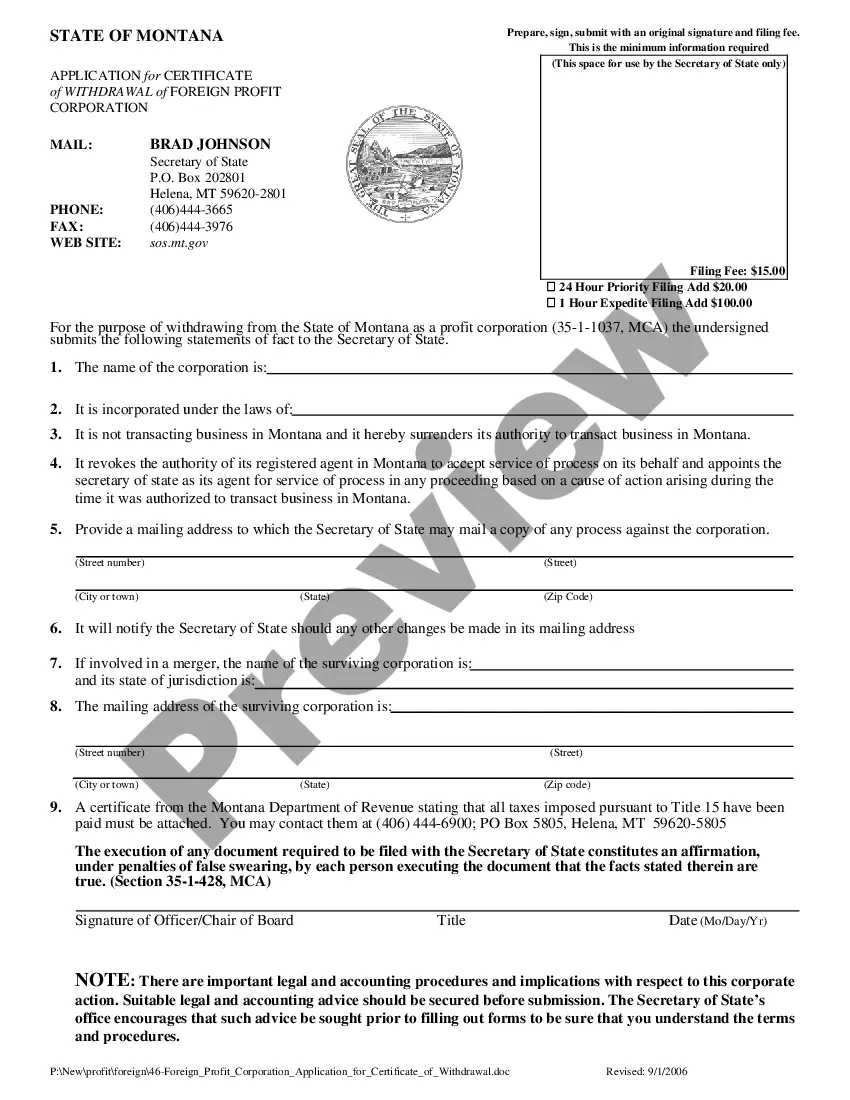

Montana Application for Certificate of Withdrawal of Foreign Nonprofit Corporation

Description

How to fill out Montana Application For Certificate Of Withdrawal Of Foreign Nonprofit Corporation?

Obtain a printable Montana Application for Certificate of Withdrawal of Foreign Nonprofit Corporation within several clicks in the most complete library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top supplier of reasonably priced legal and tax forms for US citizens and residents online since 1997.

Customers who already have a subscription, must log in in to their US Legal Forms account, get the Montana Application for Certificate of Withdrawal of Foreign Nonprofit Corporation see it saved in the My Forms tab. Users who never have a subscription must follow the tips listed below:

- Ensure your template meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If offered, review the form to see more content.

- Once you are confident the form fits your needs, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out via PayPal or bank card.

- Download the template in Word or PDF format.

Once you’ve downloaded your Montana Application for Certificate of Withdrawal of Foreign Nonprofit Corporation, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

A foreign corporation is a corporation that is incorporated in one state, but authorized to do business in one or more other states. For example, a corporation may be formally registered in Delaware, but authorized to do business in California, Florida, and Texas.

A foreign corporation is corporation organized, authorized, or existing under the laws of any foreign country4 A foreign corporation is either a resident - a corporation engaged in trade or business in the Philippines5, or a non-resident - a corporation not engaged in trade or business in the Philippines6.

Foreign Entity - Any business organization that transacts business outside of its state of formation is recognized as foreign in the states in which it obtains a certificate of authority. Foreign Qualification - Refers to registering your business or nonprofit outside its state of formation.

A corporation conducting business in one state when incorporated in another is considered a foreign corporation and must qualify as a foreign corporation to legally do business in that state.

A controlled foreign corporation is one that operates outside the U.S. with 50% or more U.S. shareholders. U.S. shareholders, directors, or officers of a controlled foreign corporation must report their income from that corporation and pay tax on it.

You can register a foreign (out-of-state) corporation in California by filing a Statement and Designation by Foreign Corporation (Form S&DC-S/N), along with a Certificate of Good Standing, to the Secretary of State's office. There is a $100 filing fee.

Foreign corporation is a term used in the United States to describe an existing corporation (or other type of corporate entity, such as a limited liability company or LLC) that conducts business in a state or jurisdiction other than where it was originally incorporated.

A domestic corporation is one formed in the state in which it is doing business. A foreign corporation is one incorporated in another state or country and does business across state lines.Many people choose to incorporate in their home state.