Mississippi Tax Release Authorization

Description

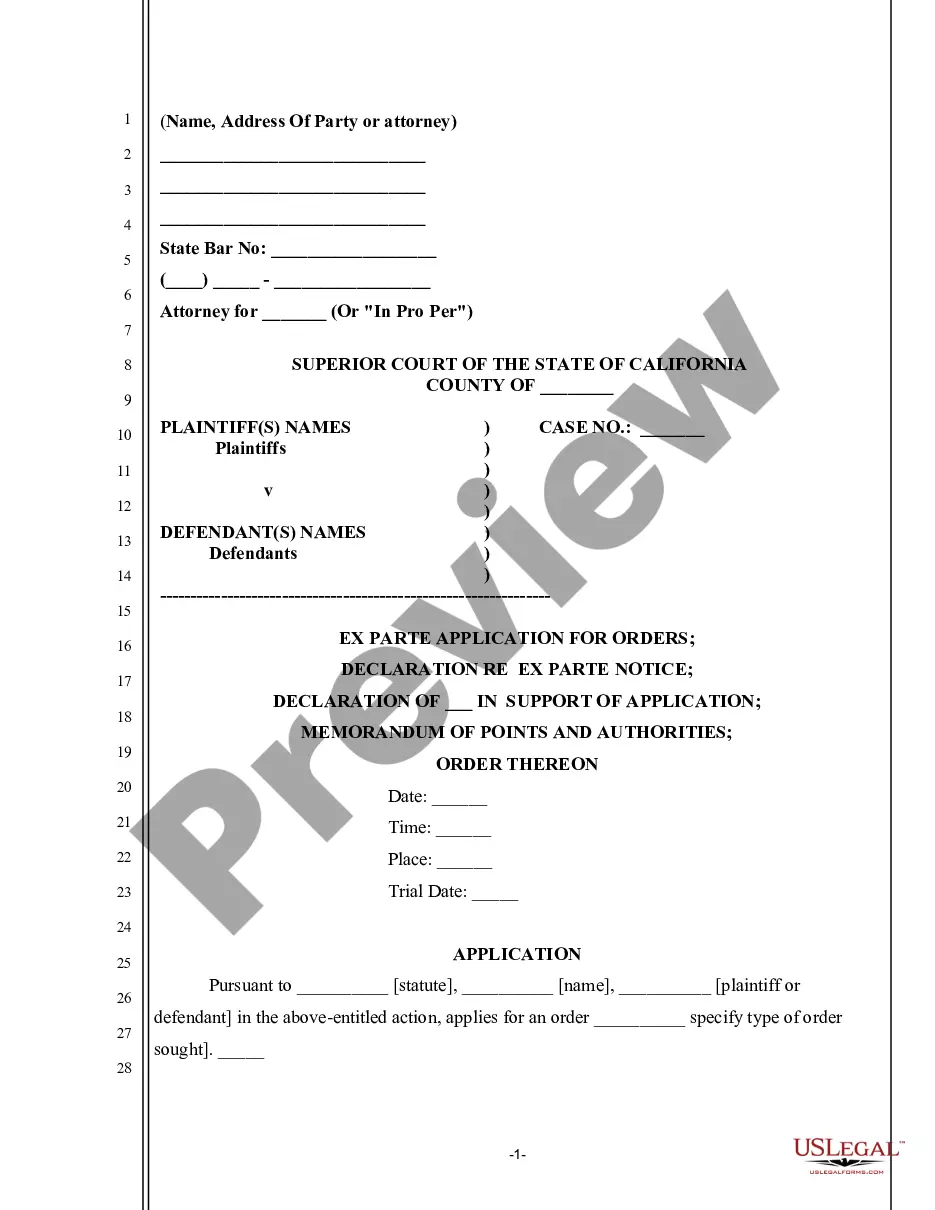

How to fill out Tax Release Authorization?

If you have to complete, acquire, or print lawful record web templates, use US Legal Forms, the largest selection of lawful forms, which can be found on the web. Take advantage of the site`s simple and easy hassle-free lookup to discover the documents you need. Various web templates for enterprise and person purposes are sorted by types and says, or keywords. Use US Legal Forms to discover the Mississippi Tax Release Authorization in a handful of mouse clicks.

In case you are already a US Legal Forms buyer, log in to the account and then click the Acquire button to have the Mississippi Tax Release Authorization. You can also access forms you in the past downloaded from the My Forms tab of your own account.

If you work with US Legal Forms initially, refer to the instructions below:

- Step 1. Ensure you have chosen the shape for that appropriate city/land.

- Step 2. Use the Review option to examine the form`s content. Do not neglect to learn the outline.

- Step 3. In case you are not satisfied with all the kind, utilize the Search area towards the top of the display screen to find other variations from the lawful kind web template.

- Step 4. After you have located the shape you need, click the Acquire now button. Select the prices prepare you choose and include your accreditations to sign up for the account.

- Step 5. Method the financial transaction. You may use your bank card or PayPal account to accomplish the financial transaction.

- Step 6. Select the format from the lawful kind and acquire it in your device.

- Step 7. Complete, modify and print or signal the Mississippi Tax Release Authorization.

Every single lawful record web template you buy is the one you have eternally. You have acces to each kind you downloaded with your acccount. Go through the My Forms portion and select a kind to print or acquire once more.

Contend and acquire, and print the Mississippi Tax Release Authorization with US Legal Forms. There are thousands of skilled and state-specific forms you can use for your enterprise or person needs.

Form popularity

FAQ

Mississippi State Tax Refund Status Information Mississippi Refund State Tax Status Information - OnLine Taxes at olt.com. You may also call the automated refund line at 601-923-7801.

If you e-filed your tax return, allow ten business days before calling about your refund. All other returns which are filed early are processed before and usually more quickly than returns filed closer to the due date.

Once you determine that your small business needs a Mississippi state tax ID, the most convenient channel to apply is online. You can complete the online application in a matter of minutes, then wait a few days to a few weeks for the application to fully process.

Use Where's My Refund, call us at 800-829-1954 (toll-free) and use the automated system, or speak with a representative by calling 800-829-1040 (see telephone assistance for hours of operation). If you filed a married filing jointly return, you can't initiate a trace using the automated systems.

Use the IRS Where's My Refund tool or the IRS2Go mobile app to check your refund online. This is the fastest and easiest way to track your refund. The systems are updated once every 24 hours. You can contact the IRS to check on the status of your refund.

Mississippi does not provide for the use of formal resale certificates. Instead, Mississippi requires resellers who are registered to collect Mississippi sales tax to give vendors their Mississippi resale sales tax number located on the sales tax permit.

In Mississippi, all a business has to do is apply for and obtain their sales tax permit. They do not need to apply for a separate resale certificate. Instead, their seller's permit also functions as a Mississippi resale certificate.

Mississippi Refund State Tax Status Information - OnLine Taxes at olt.com. You may also call the automated refund line at 601-923-7801.

You may check the status of your refund online at TAP. If you cannot check online, you may call (601) 923-7801. Office representatives do not have any information that you cannot view online in TAP.

A few common reasons you may not have received your refund: An incorrect or incomplete mailing address was on your return. Your refund is being held because of a prior year tax liability. Examples: Income Tax, Sales Tax, Withholding Tax, etc.