Mississippi Form of Anti-Money Laundering Policy

Description

How to fill out Form Of Anti-Money Laundering Policy?

Discovering the right authorized record format might be a have a problem. Of course, there are a variety of web templates available on the Internet, but how would you obtain the authorized develop you need? Use the US Legal Forms internet site. The services offers a huge number of web templates, like the Mississippi Form of Anti-Money Laundering Policy, which can be used for organization and personal requires. All the types are checked by pros and satisfy state and federal needs.

In case you are currently authorized, log in for your account and click on the Download button to obtain the Mississippi Form of Anti-Money Laundering Policy. Make use of your account to check from the authorized types you have purchased in the past. Go to the My Forms tab of the account and acquire yet another version in the record you need.

In case you are a whole new consumer of US Legal Forms, listed here are basic directions for you to follow:

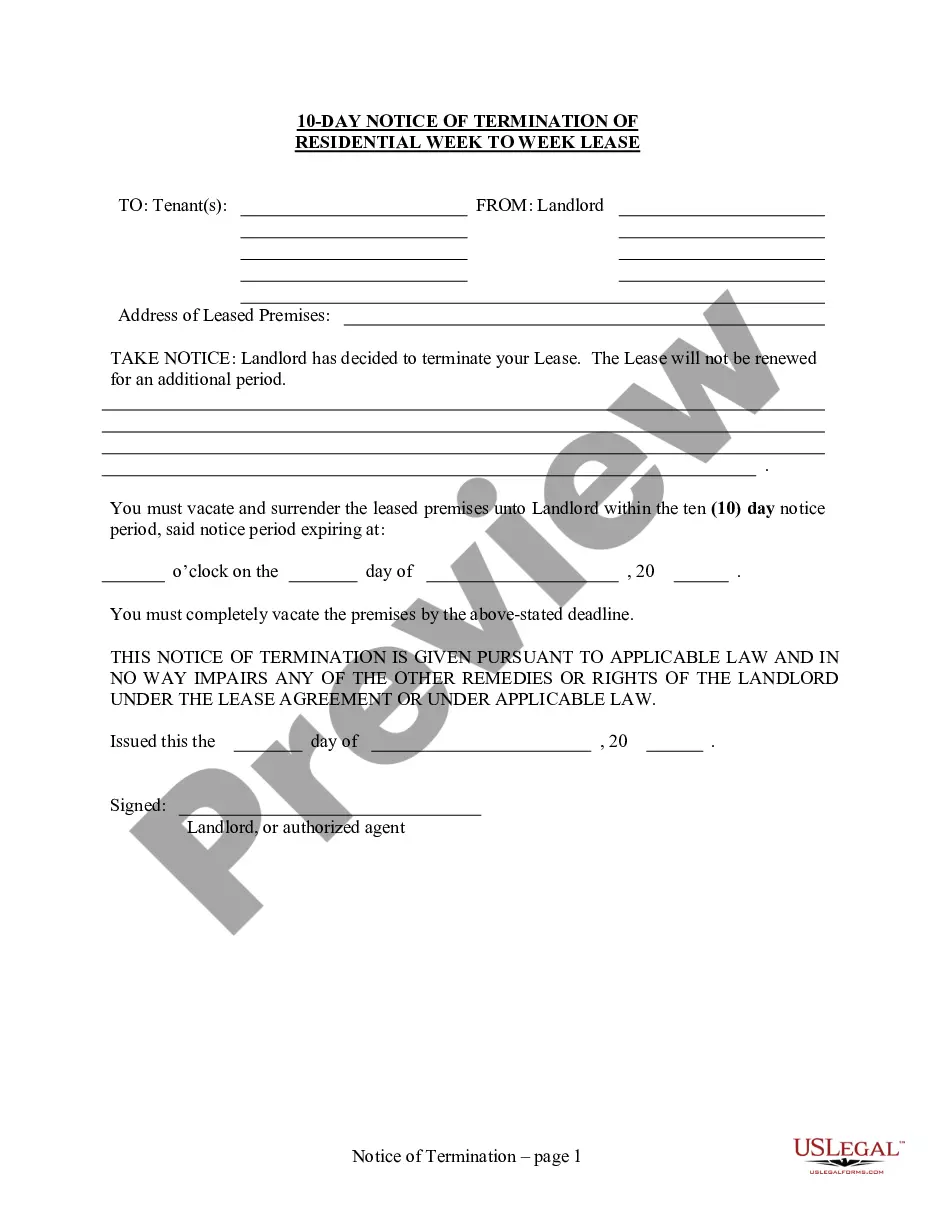

- Very first, make sure you have chosen the right develop for your personal metropolis/county. You are able to examine the shape using the Review button and study the shape outline to make certain this is the best for you.

- If the develop fails to satisfy your expectations, utilize the Seach area to obtain the correct develop.

- When you are certain the shape is proper, select the Acquire now button to obtain the develop.

- Choose the prices plan you would like and enter the essential info. Build your account and buy the order making use of your PayPal account or charge card.

- Choose the data file structure and download the authorized record format for your product.

- Comprehensive, modify and print and signal the attained Mississippi Form of Anti-Money Laundering Policy.

US Legal Forms will be the largest local library of authorized types in which you will find a variety of record web templates. Use the service to download expertly-created files that follow express needs.

Form popularity

FAQ

Who regulates the process? Steps to creating an AML policy. Step 1: draft an AML policy statement. Step 2: appoint a Money Laundering Reporting Officer (MLRO) Step 3: perform Customer Due Diligence (CDD) Step 4: verifying client identity. Step 5: report to Financial Intelligence Units (FIU)

Valid passport with full MRZ (machine readable zone). Valid photo card driving licence (full and provisional). Valid national identity card with MRZ. Valid firearms certificate/shotgun licence.

This Anti-Money Laundering Policy contains the following sections: Introduction. Scope of Policy. What is Money Laundering? Money Laundering Reporting Officer (MLRO) Suspicions of Money Laundering. Consideration of the Disclosure by the MLRO. Customer Identification and Due Diligence. Ongoing Monitoring.

The Bank Secrecy Act, among other things, requires financial institutions, including broker-dealers, to develop and implement AML compliance programs. Members are also governed by the anti-money laundering rule in FINRA Rule 3310. FINRA Rule 3310 sets forth minimum standards for broker-dealers' AML compliance programs.

The program must include appropriate risk-based procedures for conducting ongoing customer due diligence, including (i) understanding the nature and purpose of customer relationships for the purpose of developing a customer risk profile; and, (ii) conducting ongoing monitoring to identify and report suspicious ...

FINRA provides a template for small firms to assist them in fulfilling their responsibilities to establish the Anti-Money Laundering (AML) compliance program required by the Bank Secrecy Act (BSA) and its implementing regulations and FINRA Rule 3310.

Who regulates the process? Steps to creating an AML policy. Step 1: draft an AML policy statement. Step 2: appoint a Money Laundering Reporting Officer (MLRO) Step 3: perform Customer Due Diligence (CDD) Step 4: verifying client identity. Step 5: report to Financial Intelligence Units (FIU)