This office lease guaranty states that the guarantor's obligations under this guaranty shall be unaffected by any discharge or release of the tenant, its successors or assigns, or any of their debts, in connection with any bankruptcy, reorganization, or other insolvency proceeding or assignment for the benefit of creditors.

Mississippi Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy

Description

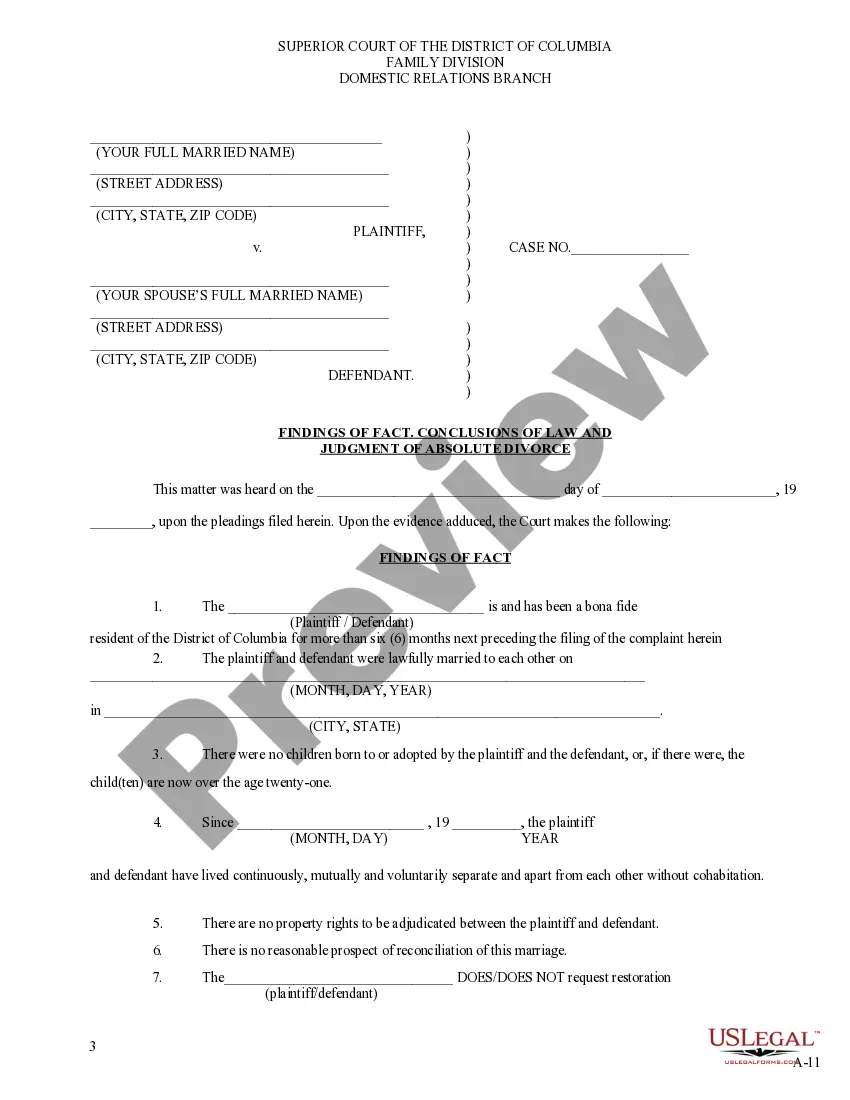

How to fill out Guarantor Waiver Which Avoids Release Of Guarantor By Reason Of The Tenant Discharge Release Or Bankruptcy?

Are you currently in the situation in which you need to have files for sometimes organization or person reasons nearly every day time? There are a lot of authorized papers layouts available online, but locating ones you can rely on isn`t simple. US Legal Forms provides thousands of develop layouts, just like the Mississippi Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy, that happen to be created to fulfill federal and state specifications.

In case you are previously acquainted with US Legal Forms site and have a merchant account, simply log in. Afterward, you can acquire the Mississippi Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy design.

Unless you come with an profile and would like to begin to use US Legal Forms, adopt these measures:

- Find the develop you will need and ensure it is for the proper area/state.

- Make use of the Review option to analyze the form.

- Look at the information to actually have chosen the proper develop.

- In case the develop isn`t what you`re trying to find, use the Search discipline to get the develop that fits your needs and specifications.

- Once you obtain the proper develop, click on Buy now.

- Choose the costs strategy you want, submit the specified details to generate your bank account, and purchase the transaction with your PayPal or charge card.

- Pick a convenient file format and acquire your backup.

Discover all of the papers layouts you might have purchased in the My Forms menus. You can get a more backup of Mississippi Guarantor Waiver Which Avoids Release of Guarantor by Reason of the Tenant Discharge Release or Bankruptcy anytime, if required. Just click on the required develop to acquire or print out the papers design.

Use US Legal Forms, the most comprehensive collection of authorized forms, in order to save efforts and stay away from faults. The services provides appropriately manufactured authorized papers layouts that can be used for an array of reasons. Create a merchant account on US Legal Forms and initiate producing your lifestyle a little easier.

Form popularity

FAQ

Guaranties are commonly used by creditors to limit their risk by shifting the risk of loss in a transaction to a third party (the guarantor) who will agree to pay the obligations owed by the person or entity primarily liable for the debt (the principal obligor) if the principal obligor defaults on its obligations.

A priority claim is debt that is entitled to special treatment in the bankruptcy process and will get paid ahead of non-priority claims. These might include bank lenders, employees, the government if any taxes are due, suppliers, and investors who have unsecured bonds. Creditor's Perspective: What is Creditor Priority & How Does It Work? x-claim.com ? blog ? creditors-perspective-... x-claim.com ? blog ? creditors-perspective-...

The guarantor waives all rights and defenses that the guarantor may have because the debtor's debt is secured by real property. This means, among other things: (1) The creditor may collect from the guarantor without first foreclosing on any real or personal property collateral pledged by the debtor.

You are filing bankruptcy, and someone signed your personal guarantee: If someone signed a personal guarantee to assist you in obtaining a loan, that person will still be liable after you file for bankruptcy, but you can discharge your own debts. What is a Personal Guarantee in Bankruptcy? - Sawin & Shea sawinlaw.com ? blog ? what-is-a-personal-g... sawinlaw.com ? blog ? what-is-a-personal-g...