Mississippi Employee Agreement Incentive Compensation and Stock Bonus

Description

How to fill out Employee Agreement Incentive Compensation And Stock Bonus?

US Legal Forms - one of many greatest libraries of lawful varieties in the United States - provides a wide range of lawful file templates you are able to down load or produce. Using the website, you can find 1000s of varieties for enterprise and personal reasons, categorized by groups, claims, or key phrases.You can get the latest variations of varieties such as the Mississippi Employee Agreement Incentive Compensation and Stock Bonus in seconds.

If you have a registration, log in and down load Mississippi Employee Agreement Incentive Compensation and Stock Bonus in the US Legal Forms local library. The Obtain option will appear on every type you look at. You get access to all formerly downloaded varieties within the My Forms tab of your respective bank account.

In order to use US Legal Forms for the first time, allow me to share easy recommendations to help you get began:

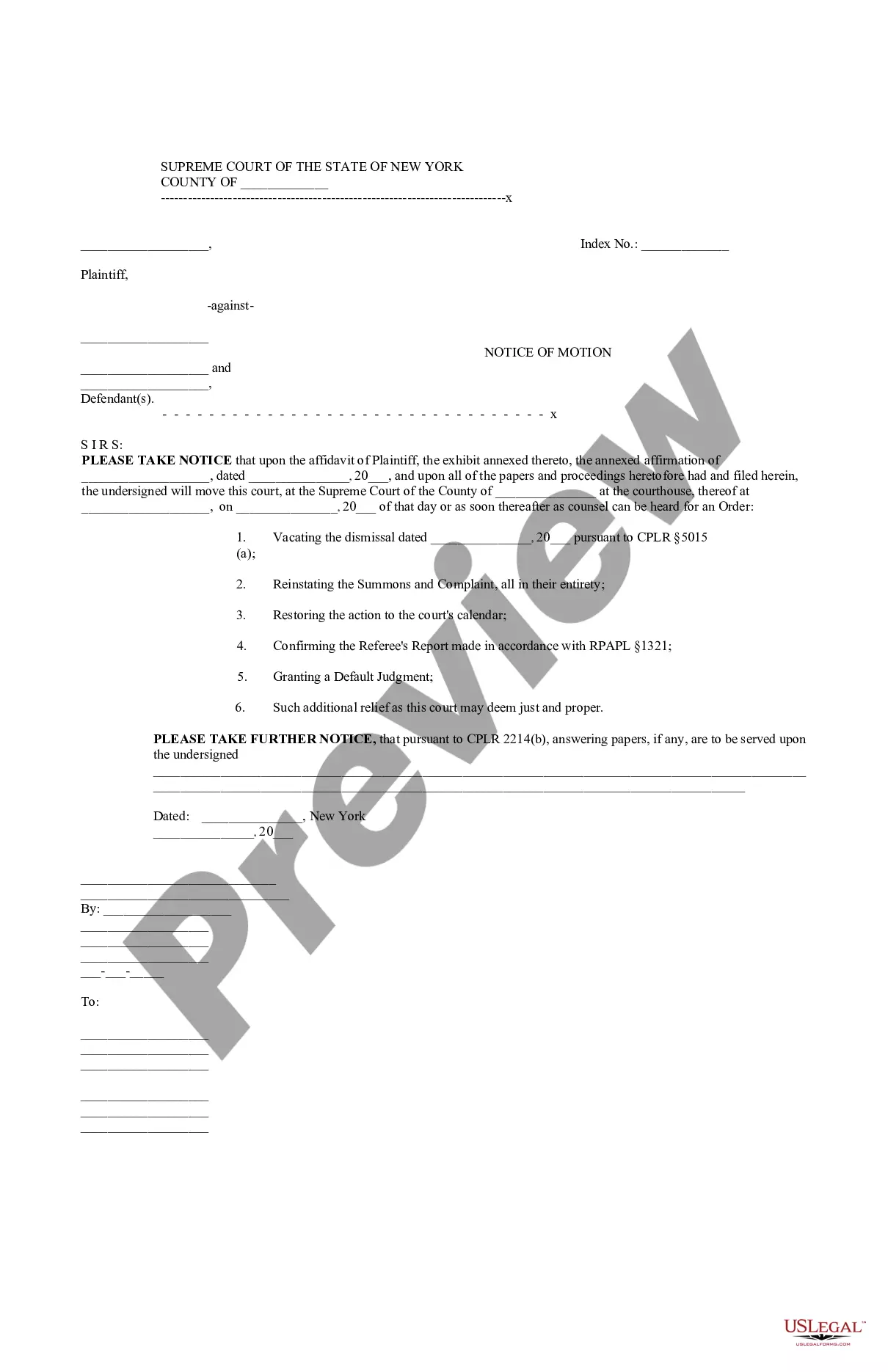

- Ensure you have picked out the best type for your personal area/region. Go through the Review option to analyze the form`s content. Read the type explanation to ensure that you have selected the appropriate type.

- In case the type does not satisfy your specifications, make use of the Lookup industry at the top of the display to find the one who does.

- When you are pleased with the form, confirm your decision by visiting the Purchase now option. Then, opt for the costs plan you want and supply your qualifications to register to have an bank account.

- Approach the deal. Make use of your credit card or PayPal bank account to perform the deal.

- Select the structure and down load the form on the system.

- Make alterations. Complete, modify and produce and sign the downloaded Mississippi Employee Agreement Incentive Compensation and Stock Bonus.

Every single template you included with your money does not have an expiry date which is your own forever. So, if you would like down load or produce an additional duplicate, just proceed to the My Forms section and click about the type you will need.

Gain access to the Mississippi Employee Agreement Incentive Compensation and Stock Bonus with US Legal Forms, probably the most substantial local library of lawful file templates. Use 1000s of professional and state-specific templates that meet your business or personal demands and specifications.

Form popularity

FAQ

How to set up ? and implement ? an employee bonus scheme. Decide if this is right for your business. ... Speak with your team. ... Write down your business goals. ... Set individual goals. ... Outline the reward amount. ... Pay on time. ... Regularly revisit.

A Standard Clause that can be included in a collective bargaining agreement (CBA) to confirm that an employer an employer retains sole discretion over the timing and amounts of, and reasons for, bonuses paid to employees during the CBA's term.

The performance bonus A performance bonus is normally paid for good performance, and should be based as a percentage of the employee's salary or wages. A performance bonus can also be paid as a lump sum to a department, and split up in equal amounts to each employee in that department.

An annual bonus of 5-10% of your yearly salary is standard in a lot of industries, just as a 5-10% annual raise is considered standard. However, if you work on commission, you may see a significantly higher percentage.

If the bonus is contractual, the employer must make these payments if the employee meets the required criteria. For example, if you set clear performance targets and the employee meets them, you will need to pay out the bonus.

California law requires all wages earned by employees to be paid, on time and in full. Bonuses are wages that must be paid when they have been earned. When employees are not paid the bonuses that they have earned, the employment lawyers at Minnis & Smallets help them recover the wages that they are entitled to receive.

4 tips for structuring sign-on bonuses Paying a portion upfront and the rest after a probationary period. Paying in installments, with later payments due only if the employee remains for a set period, such as six months or a year.

A bonus structure is an employee incentive program. These plans include rewards or incentives beyond an employee's salary. They are a perk and are conditional based on metrics being met or a goal being complete. Each company's bonus structure setup might look different depending on its type and size.