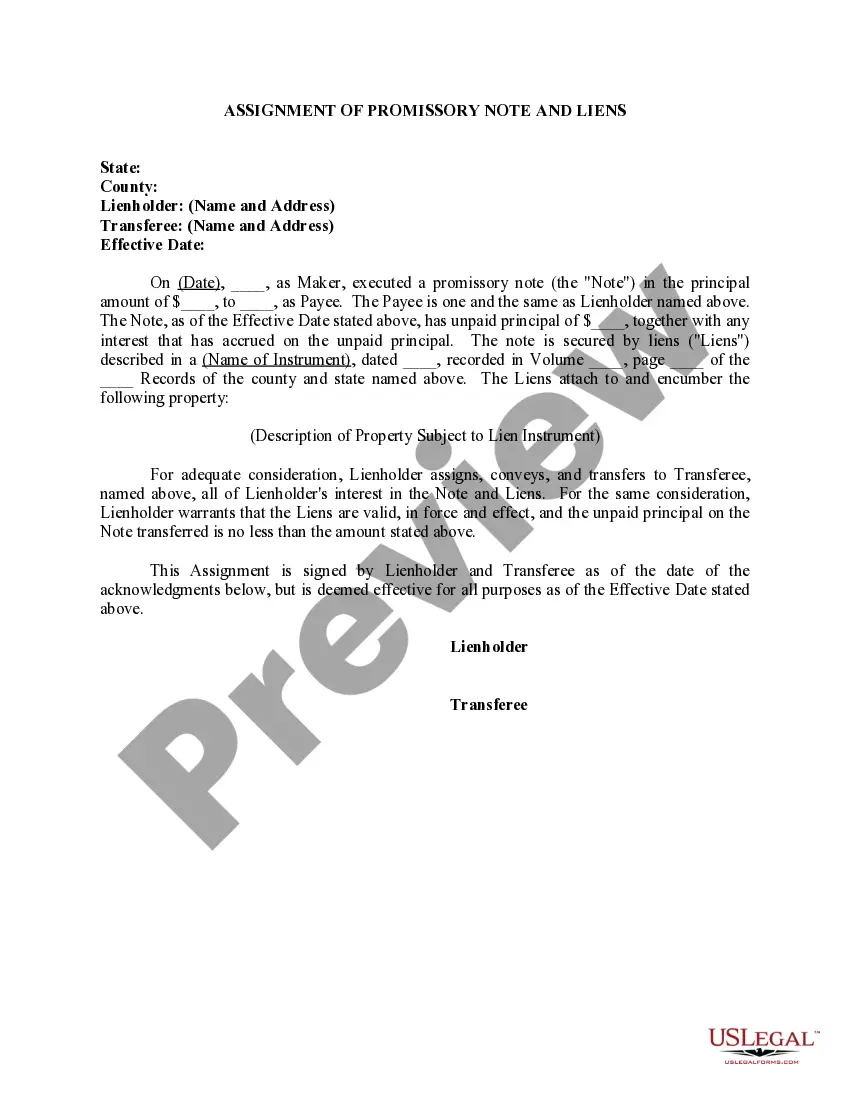

Mississippi Assignment of Promissory Note & Liens

Description

How to fill out Assignment Of Promissory Note & Liens?

Have you been within a situation in which you will need documents for sometimes company or personal reasons almost every day time? There are a lot of authorized file templates available on the net, but finding types you can depend on is not simple. US Legal Forms provides thousands of develop templates, just like the Mississippi Assignment of Promissory Note & Liens, which can be published to satisfy state and federal requirements.

If you are previously informed about US Legal Forms web site and possess an account, just log in. Next, you can download the Mississippi Assignment of Promissory Note & Liens design.

Unless you offer an accounts and wish to start using US Legal Forms, follow these steps:

- Obtain the develop you want and make sure it is for your proper town/region.

- Use the Review key to review the form.

- Read the outline to actually have selected the proper develop.

- In the event the develop is not what you`re looking for, utilize the Look for field to get the develop that meets your needs and requirements.

- Once you obtain the proper develop, just click Get now.

- Choose the rates prepare you need, submit the desired details to produce your bank account, and pay for an order making use of your PayPal or credit card.

- Pick a hassle-free data file structure and download your version.

Discover all of the file templates you might have bought in the My Forms food selection. You can obtain a more version of Mississippi Assignment of Promissory Note & Liens at any time, if necessary. Just select the necessary develop to download or produce the file design.

Use US Legal Forms, by far the most considerable collection of authorized varieties, to save time as well as stay away from errors. The support provides skillfully created authorized file templates that you can use for an array of reasons. Produce an account on US Legal Forms and begin producing your daily life a little easier.

Form popularity

FAQ

Promissory notes do not need to be notarized. The borrower only needs to sign the document to make it legally enforceable. A witness may be helpful if one party contests the note, but a notary is not necessary.

An unconditional promise to pay a certain amount of money to a named party or the holder of the note, or to deposit that money as such persons direct. A promissory note must be in writing and signed by the maker of the promise.

It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements. The note must clearly mention only the promise of making the repayment and no other conditions.

Promissory notes are generally governed by state law. The most common restrictions cover interest rates and secured loans.

If the promissory note is ?nonnegotiable?, then the payee must bring suit within six years after payment was due (or, if the payee has ?accelerated? the note, then suit must be brought within 6 years after the date of acceleration.) Nonnegotiable promissory notes can take several forms.

Every state has adopted Article 3 of the Uniform Commercial Code (UCC), with some modifications, as the law governing negotiable instruments. The UCC defines a negotiable instrument as an unconditioned writing that promises or orders the payment of a fixed amount of money.

In Mississippi, the statutes of limitation for civil law cases range from one year to seven years.

Statutes of Limitations in Mississippi Injury to PersonThree years (Miss. Code § 15-1-49)Libel/SlanderOne year (Miss. Code § 15-1-35)FraudThree years (Miss. Code § 15-1-49(1))Injury to Personal PropertyThree years (Miss. Code § 15-1-49(1))6 more rows

In Mississippi you must normally file a claim for a breach of contract within three (3) years.

(1) An action to enforce the obligations of a party to pay a nonnegotiable promissory note payable at a definite time must be commenced within six (6) years after the due date or dates stated in the promissory note, or if a due date is accelerated, within six (6) years after the accelerated date.