Mississippi Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool)

Description

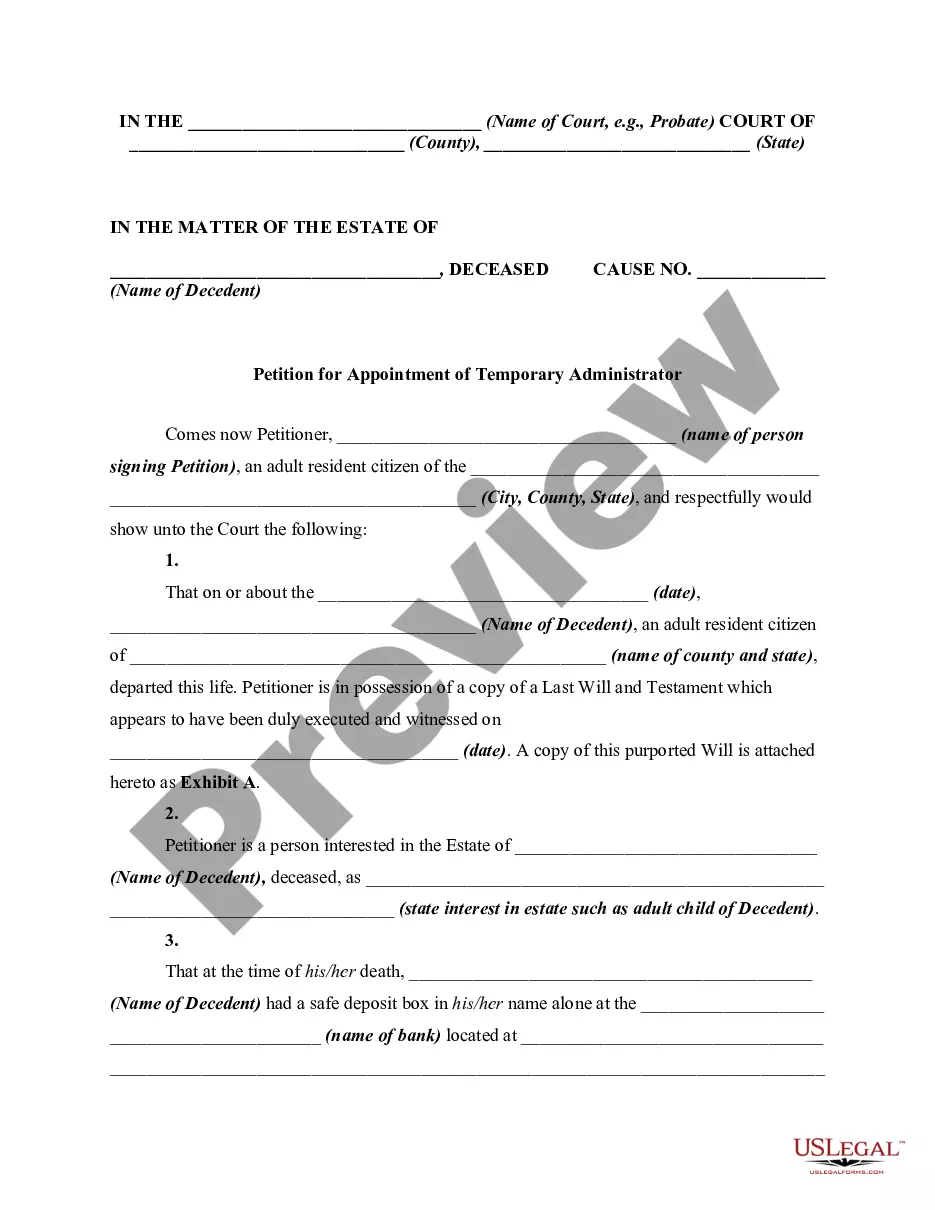

How to fill out Assignment Of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right To Pool)?

US Legal Forms - one of many most significant libraries of legitimate varieties in the States - provides a wide range of legitimate record templates you may download or print out. Making use of the website, you will get 1000s of varieties for company and specific uses, categorized by groups, suggests, or search phrases.You will find the latest types of varieties like the Mississippi Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) in seconds.

If you currently have a monthly subscription, log in and download Mississippi Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) through the US Legal Forms collection. The Down load switch will show up on each and every kind you view. You gain access to all in the past delivered electronically varieties inside the My Forms tab of your own accounts.

If you want to use US Legal Forms the very first time, listed below are straightforward instructions to help you get began:

- Make sure you have selected the best kind to your metropolis/area. Click the Review switch to analyze the form`s content. See the kind explanation to ensure that you have chosen the proper kind.

- In case the kind doesn`t suit your requirements, utilize the Research industry near the top of the monitor to find the one who does.

- If you are satisfied with the form, confirm your option by clicking the Acquire now switch. Then, opt for the rates program you want and supply your references to register to have an accounts.

- Procedure the purchase. Use your Visa or Mastercard or PayPal accounts to complete the purchase.

- Find the file format and download the form on the device.

- Make adjustments. Fill up, revise and print out and indicator the delivered electronically Mississippi Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool).

Every format you put into your money lacks an expiration time which is the one you have permanently. So, if you want to download or print out another duplicate, just visit the My Forms portion and click about the kind you want.

Gain access to the Mississippi Assignment of Overriding Royalty Interest (Non-Producing, Single Lease, Reserves Right to Pool) with US Legal Forms, one of the most considerable collection of legitimate record templates. Use 1000s of expert and condition-particular templates that satisfy your business or specific demands and requirements.

Form popularity

FAQ

Calculating Overriding Royalty Interest An ORRI is a straight percentage. For example, a 2% override would appear on the royalty statement as 0.02 interest in the proceeds from the sale of the leased hydrocarbons.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

Participating Royalty Interest (NPRI) is an interest in oil and gas production which is created from the mineral estate. Like the plain ?royalty interest? it is expensefree, bearing no operational costs of production.

Essentially, NPRI is the royalty severed from minerals just as minerals are severed from the surface interest. Unlike mineral owners, non-participating royalties do not have executive rights in lease negotiations, leasing incentives, or rental payments. They just receive the actual production proceeds.