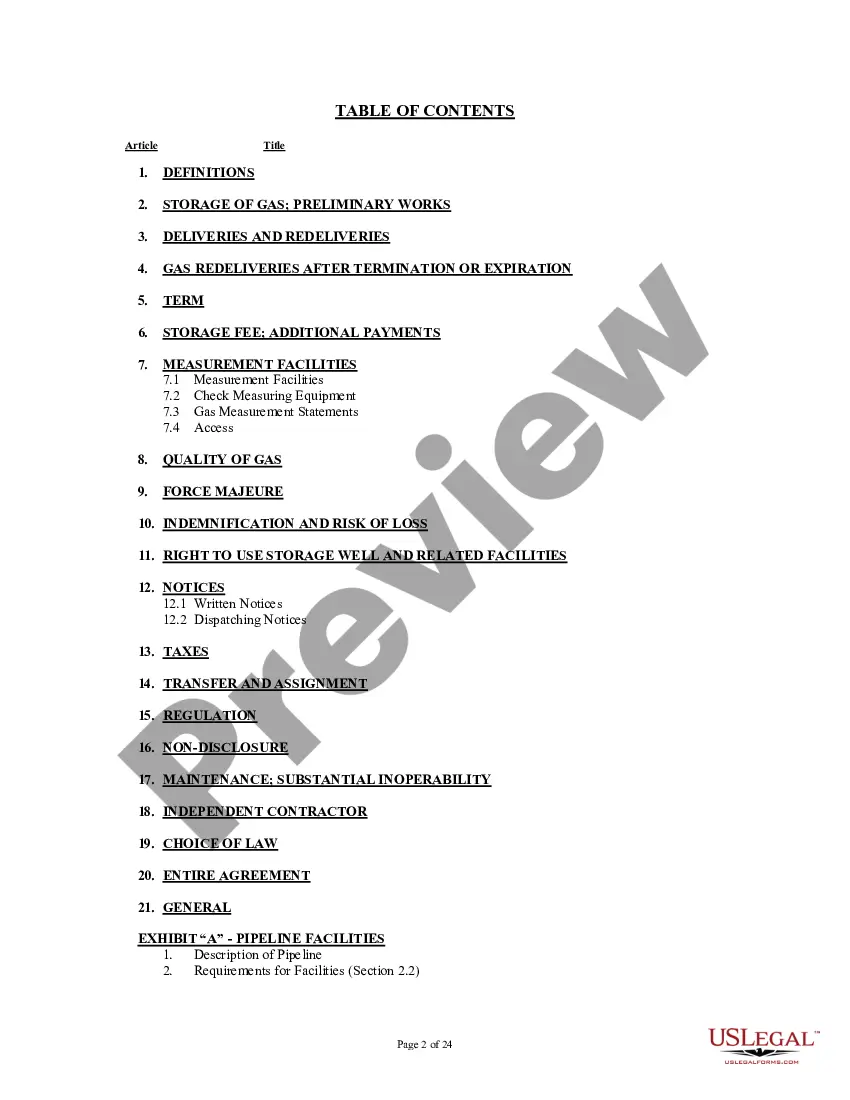

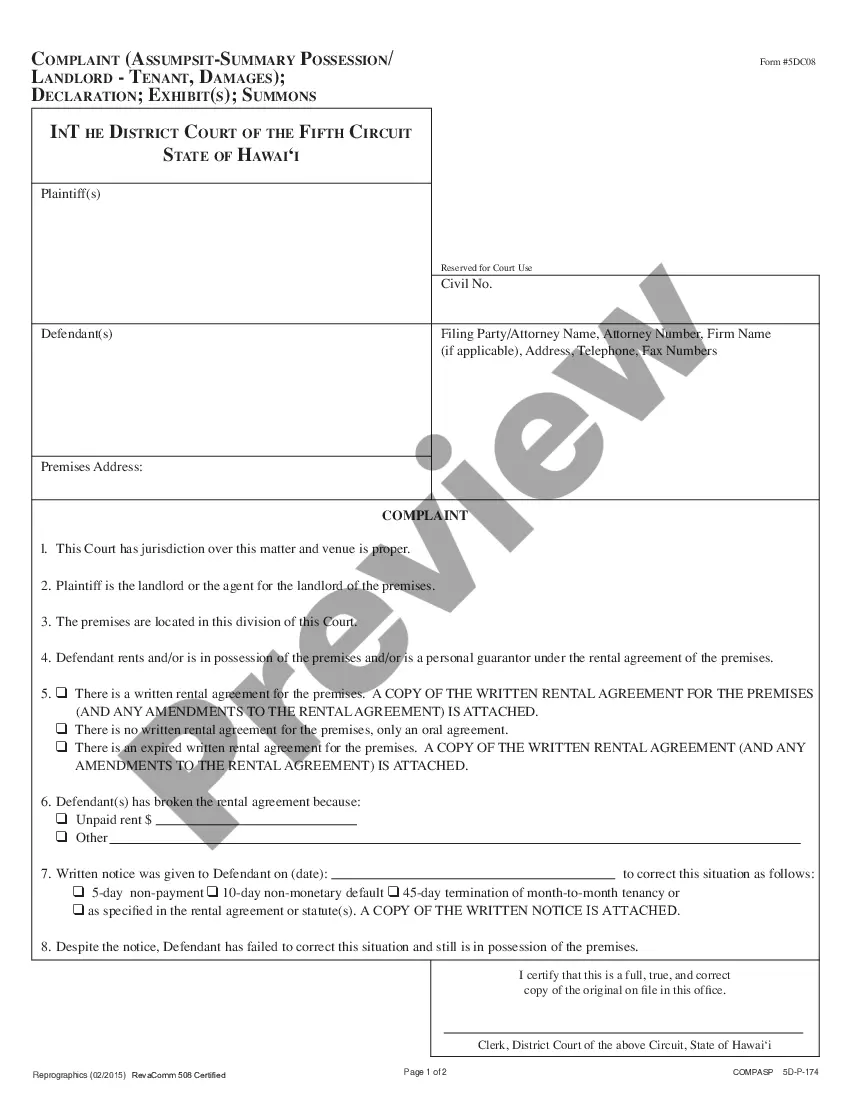

Mississippi Gas Storage Agreement

Description

How to fill out Gas Storage Agreement?

Are you currently in the placement where you need documents for either company or person uses just about every working day? There are tons of legal papers layouts available on the net, but locating ones you can trust is not effortless. US Legal Forms delivers a huge number of form layouts, like the Mississippi Gas Storage Agreement, that are written to fulfill state and federal specifications.

When you are presently familiar with US Legal Forms internet site and also have your account, basically log in. Following that, you may obtain the Mississippi Gas Storage Agreement format.

If you do not have an account and would like to start using US Legal Forms, abide by these steps:

- Find the form you want and ensure it is to the proper metropolis/state.

- Make use of the Review option to review the shape.

- Look at the outline to actually have chosen the correct form.

- When the form is not what you are looking for, take advantage of the Lookup industry to obtain the form that meets your requirements and specifications.

- When you get the proper form, click Get now.

- Pick the rates prepare you would like, fill in the desired information and facts to make your money, and buy an order making use of your PayPal or bank card.

- Select a convenient paper structure and obtain your duplicate.

Locate all of the papers layouts you might have bought in the My Forms food list. You may get a further duplicate of Mississippi Gas Storage Agreement at any time, if required. Just click on the needed form to obtain or print out the papers format.

Use US Legal Forms, the most considerable collection of legal varieties, in order to save some time and prevent faults. The assistance delivers professionally manufactured legal papers layouts that you can use for a selection of uses. Generate your account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

It is most commonly held in inventory underground under pressure in three types of facilities. These underground facilities are depleted reservoirs in oil and/or natural gas fields, aquifers, and salt cavern formations. Natural gas is also stored in liquid or gaseous form in above?ground tanks.

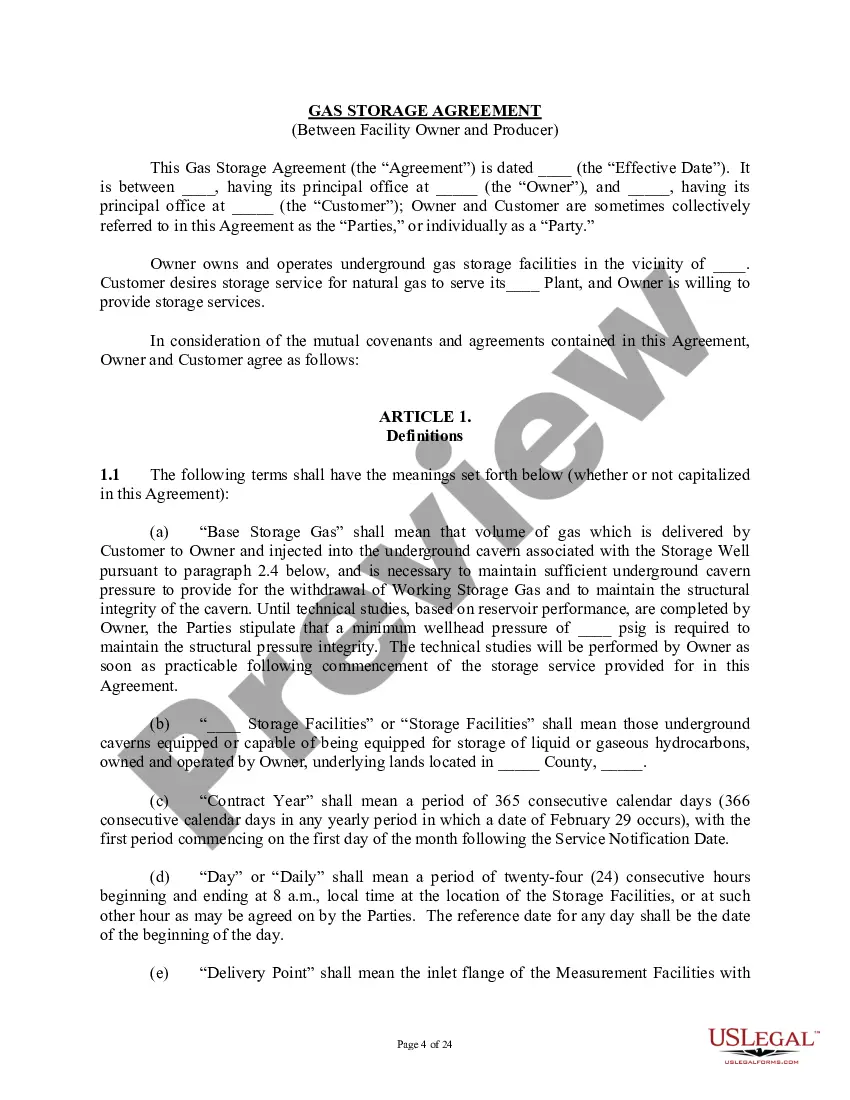

Gas Storage Agreement means a contract entered into between a person and the Facility Operator, pursuant to which a person is entitled to utilise the Facility for the injection, storage and delivery of Natural Gas, (as amended, supplemented, assigned or novated from time to time);

The market part of the storage value has two components: intrinsic and extrinsic value. While intrinsic value is a static view of the forward curve, extrinsic value is a complex function of the seasonal spread, spot price volatility, forward spread volatility, asset flexibility and individual optimisation strategies.

The storage value is a portfolio of complex spread options. The value of the spread option is a function of the value of the forward contracts plus the risk-neutral expectation of the future forward value spread. The factor driving the spread option values (storage value) is the variability of the forward curve.

The intrinsic valuation methodology derives value from time spreads in the price of gas. Months for which the forward price is relatively low are chosen from the current forward curve for entering into a long position and injecting gas into the facility.

Deliverability is most often expressed as a measure of the amount of gas that can be delivered (withdrawn) from a storage facility on a daily basis. Also referred to as the deliverability rate, withdrawal rate, or withdrawal capacity, deliverability is usually expressed in terms of million cubic feet per day (MMcf/d).

The basic approach to storage valuation is to calculate the optimal position given the available forward curve and take this position on the forward market. This intrinsic value approach captures the predictable seasonal pattern in gas prices and secures a sure profit.

There are approximately 400 active storage facilities in 30 states. Approximately 20 percent of all natural gas consumed during the five-month winter heating season each year is supplied by underground storage.