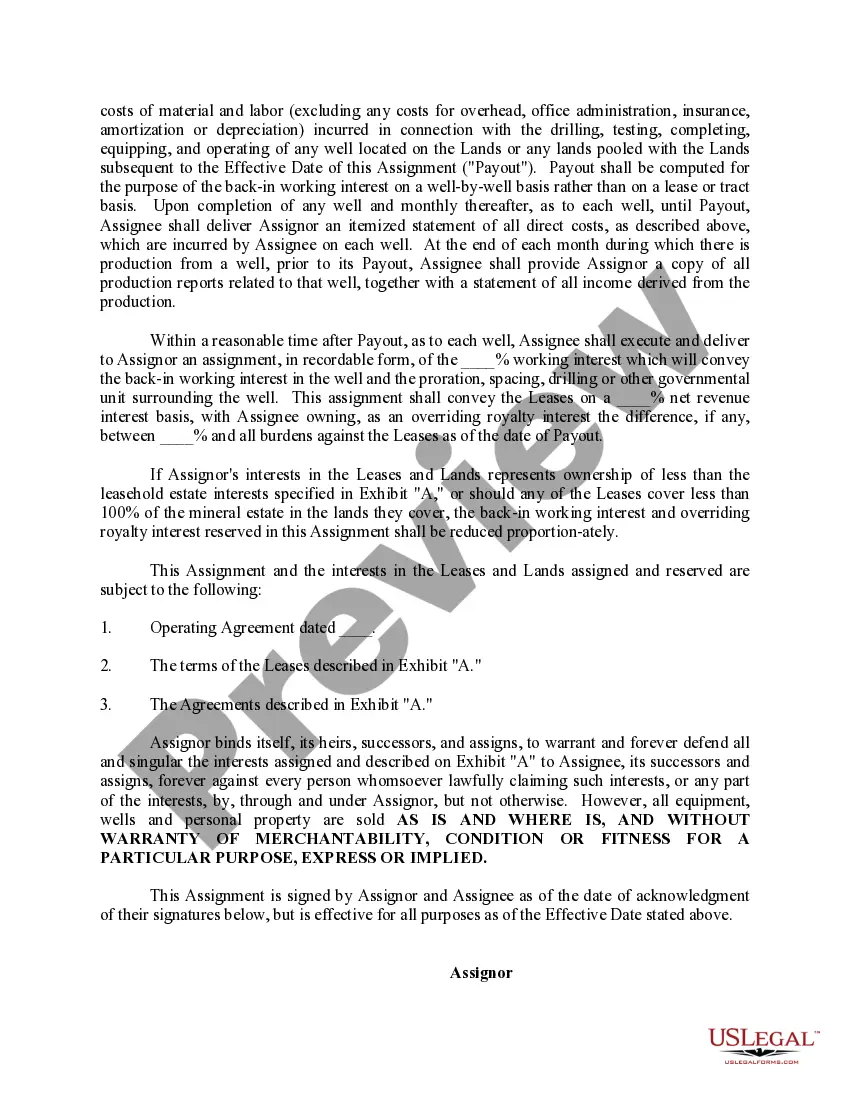

Mississippi Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout

Description

How to fill out Assignment Of Oil And Gas Leases With Reservation Of Overriding Royalty Interest Before Payout, And A Back-In Working Interest After Payout?

US Legal Forms - one of many biggest libraries of authorized kinds in the States - provides a wide array of authorized file web templates it is possible to download or print out. Making use of the web site, you will get 1000s of kinds for company and individual functions, categorized by types, states, or search phrases.You will discover the newest versions of kinds just like the Mississippi Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout within minutes.

If you currently have a registration, log in and download Mississippi Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout from your US Legal Forms catalogue. The Acquire option will appear on every kind you perspective. You gain access to all formerly downloaded kinds within the My Forms tab of the bank account.

If you would like use US Legal Forms initially, listed below are simple guidelines to get you started:

- Make sure you have selected the best kind for the city/county. Click on the Review option to check the form`s content. Look at the kind description to ensure that you have selected the correct kind.

- When the kind does not match your specifications, take advantage of the Lookup field near the top of the monitor to discover the the one that does.

- In case you are satisfied with the form, confirm your option by visiting the Buy now option. Then, select the prices plan you favor and offer your qualifications to register for the bank account.

- Procedure the deal. Use your credit card or PayPal bank account to accomplish the deal.

- Select the file format and download the form on your own system.

- Make alterations. Fill up, change and print out and indication the downloaded Mississippi Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout.

Every template you added to your bank account lacks an expiration particular date which is yours permanently. So, in order to download or print out one more version, just check out the My Forms segment and then click around the kind you require.

Gain access to the Mississippi Assignment of Oil and Gas Leases with Reservation of Overriding Royalty Interest Before Payout, and A Back-In Working Interest After Payout with US Legal Forms, the most extensive catalogue of authorized file web templates. Use 1000s of professional and status-specific web templates that satisfy your organization or individual needs and specifications.

Form popularity

FAQ

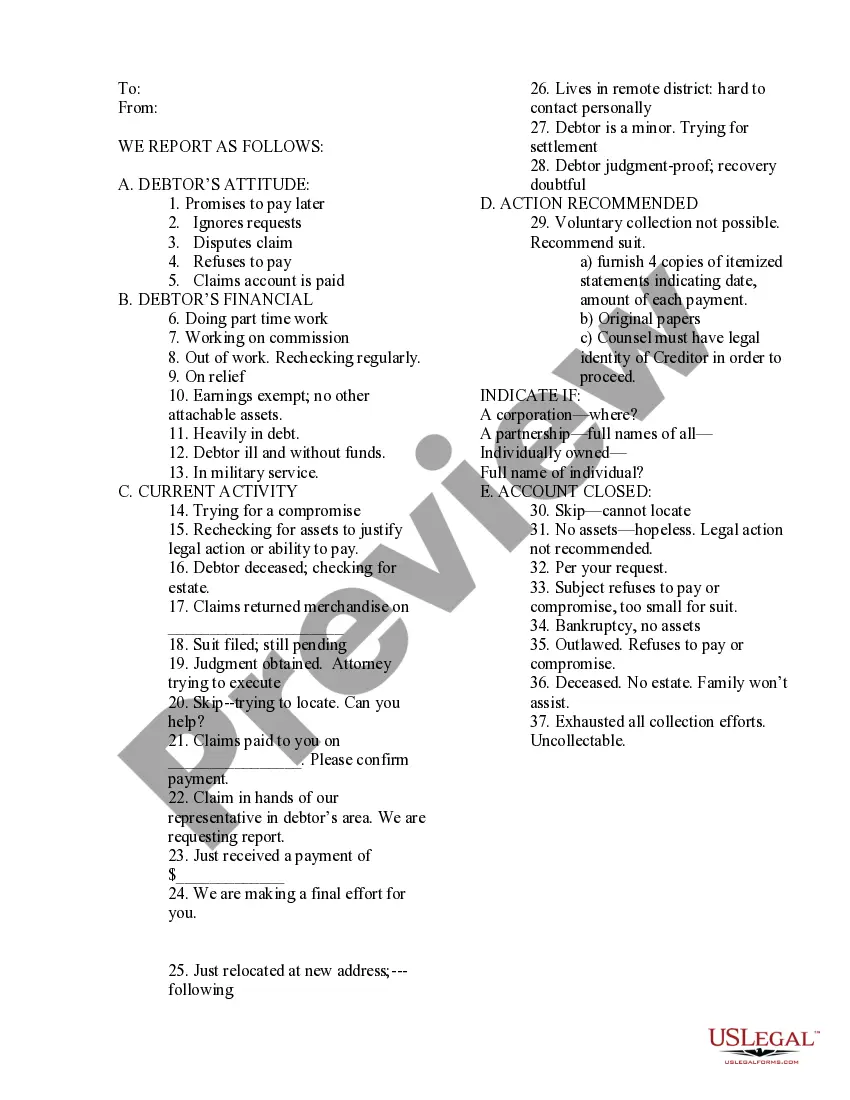

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

Overriding Royalty Interest Example The mineral estate can be severed from the surface, beginning two separate chains of title. The mineral owner has the right to explore and develop the minerals, but the vast majority do not have the finances or knowledge to drill and operate a well.

The value of a royalty interest is derived from expected future revenues generated by leasing and/or production, which are largely determined by oil and gas market prices and the current drilling environment.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How Do Overriding Royalty Interest Payments Work? The value of an overriding royalty interest is simple to calculate since it is a percent of the working interest lease. The ORRI value is based on production on the acreage leased by the working interest.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.