Mississippi Cease and Desist for Debt Collectors

Description

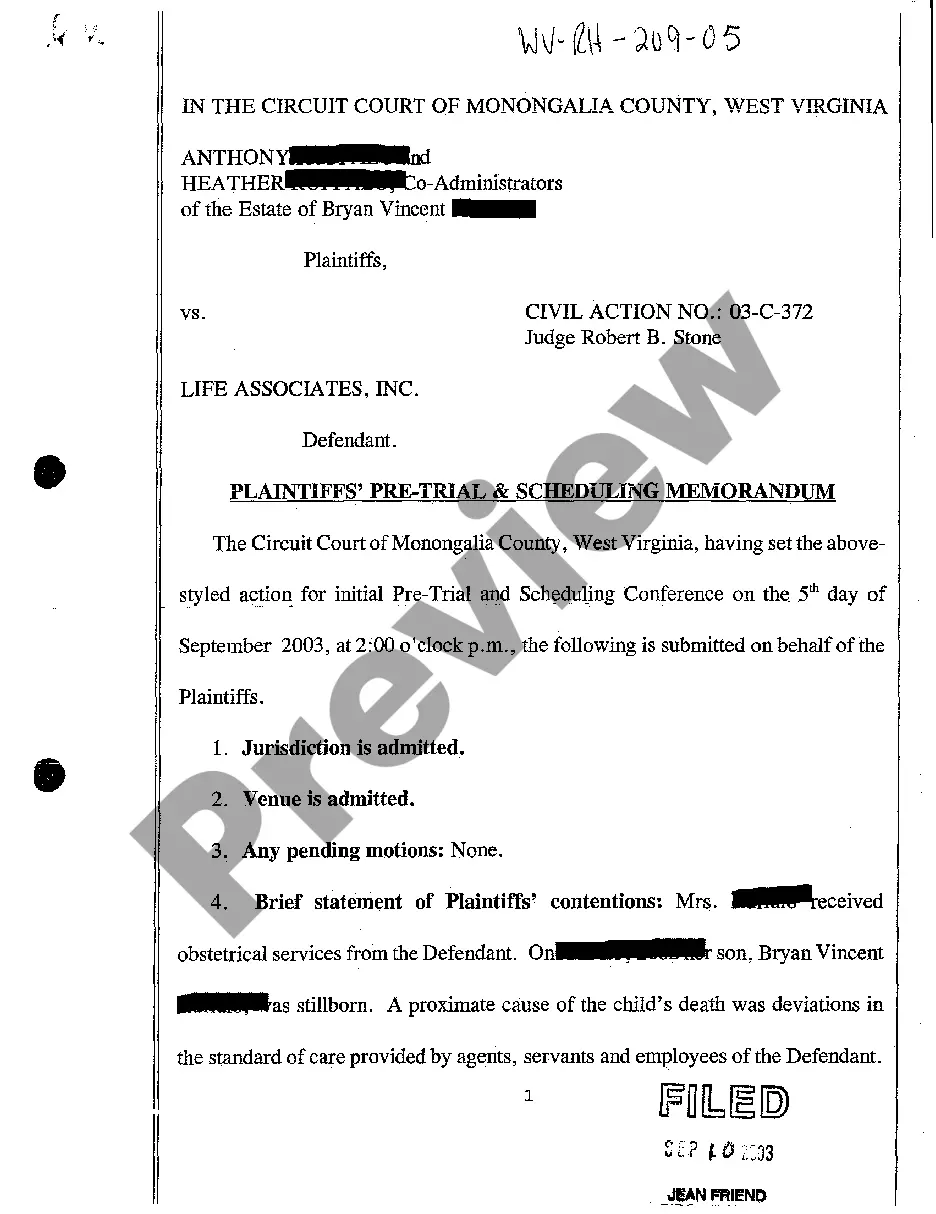

How to fill out Cease And Desist For Debt Collectors?

If you need to thorough, obtain, or print legal document templates, utilize US Legal Forms, the largest selection of legal forms, which are accessible online.

Make use of the site’s straightforward and user-friendly search to find the documents you require.

Various templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your credentials to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to acquire the Mississippi Cease and Desist for Debt Collectors in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to receive the Mississippi Cease and Desist for Debt Collectors.

- You can also access forms you previously acquired in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Utilize the Review option to verify the form’s details. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Yes, you can send a cease and desist letter to a debt collector. This letter serves as your official request to stop all communications regarding the debt. It is your right to do so, and it can provide you with peace of mind. Using a service like uslegalforms can help you create a personalized Mississippi Cease and Desist for Debt Collectors letter that meets your needs.

The 11-word phrase often used to stop debt collectors is: 'I do not wish to be contacted by you any further.' This statement communicates your desire for the debt collector to stop reaching out to you. It is important to deliver this message clearly and formally. You can enhance your position by following up with a Mississippi Cease and Desist for Debt Collectors letter.

Yes, you can instruct a debt collector to cease and desist from contacting you. By sending a cease and desist letter, you formally request that they stop all communication regarding the debt. This action is part of your rights under the Fair Debt Collection Practices Act. Utilizing a Mississippi Cease and Desist for Debt Collectors template can simplify this process and ensure you include all necessary information.

In Mississippi, a debt becomes uncollectible after a period of six years. This timeframe is known as the statute of limitations, which begins when the debt is due. Once this period expires, creditors can no longer take legal action to collect the debt. Understanding this timeline can help you make informed decisions regarding your debts and your rights in the context of Mississippi Cease and Desist for Debt Collectors.

Yes, cease and desist letters can be effective for stopping debt collectors. When you formally request them to cease communication, they are legally obligated to comply. If they continue contacting you, you may have grounds for a legal complaint. Using US Legal Forms to create a well-structured Mississippi Cease and Desist for Debt Collectors letter can enhance your chances of success.

Writing a cease and desist letter involves clearly stating your request for the debt collector to stop all contact. Begin with your personal information, then detail the debt collector's information, followed by your request. It's essential to include any relevant account numbers and a statement of your rights. US Legal Forms provides templates to simplify this process and ensure your Mississippi Cease and Desist for Debt Collectors letter is effective.

The phrase 'I do not wish to be contacted anymore' can be effective in stopping debt collectors. By stating this clearly, you assert your right to limit communication. It's crucial to document this request, as it serves as a formal notice. Consider using US Legal Forms to create a formal Mississippi Cease and Desist for Debt Collectors letter that includes this phrase.

To effectively issue a cease and desist to debt collectors, you should gather any relevant documentation that supports your claim. This may include account statements, correspondence, or any evidence showing the debt is invalid or not yours. By providing substantial proof, you strengthen your position and encourage compliance. US Legal Forms can assist you in drafting precise documents for your Mississippi Cease and Desist for Debt Collectors.

A 609 letter is a request you send to a debt collector asking them to verify a debt under the Fair Credit Reporting Act. This letter references Section 609, which gives you the right to ask for proof of the debt. If the debt collector cannot provide adequate verification, they must cease collection efforts. You can use resources like US Legal Forms to create a customized 609 letter, enhancing your Mississippi Cease and Desist for Debt Collectors strategy.

When you send a cease and desist letter to a debt collector, they are legally obligated to stop contacting you. This action can provide immediate relief from unwanted calls and letters. However, keep in mind that it does not eliminate the debt; it merely halts communication. For assistance in drafting an effective Mississippi Cease and Desist for Debt Collectors, consider using the resources available on USLegalForms.