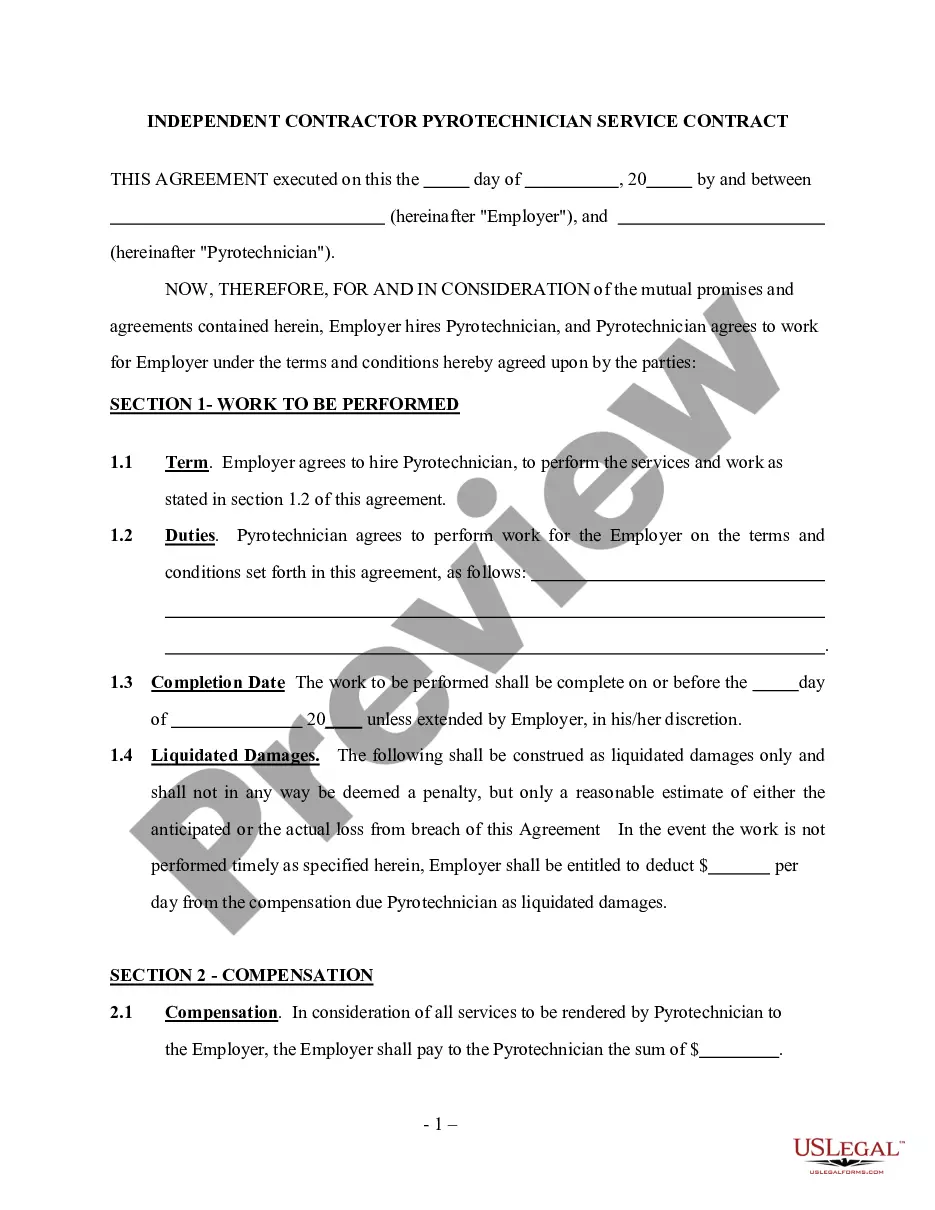

Mississippi Fire Protection Service Contract - Self-Employed

Description

How to fill out Fire Protection Service Contract - Self-Employed?

You may devote several hours online searching for the appropriate legal format that fulfills the state and federal requirements you will need.

US Legal Forms provides a vast array of legal documents that are reviewed by professionals.

You can easily download or print the Mississippi Fire Protection Service Contract - Self-Employed from their service.

- If you already possess a US Legal Forms account, you can Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Mississippi Fire Protection Service Contract - Self-Employed.

- Each legal format you purchase is yours indefinitely.

- To obtain another copy of a purchased document, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the right format for your state/city that you choose.

Form popularity

FAQ

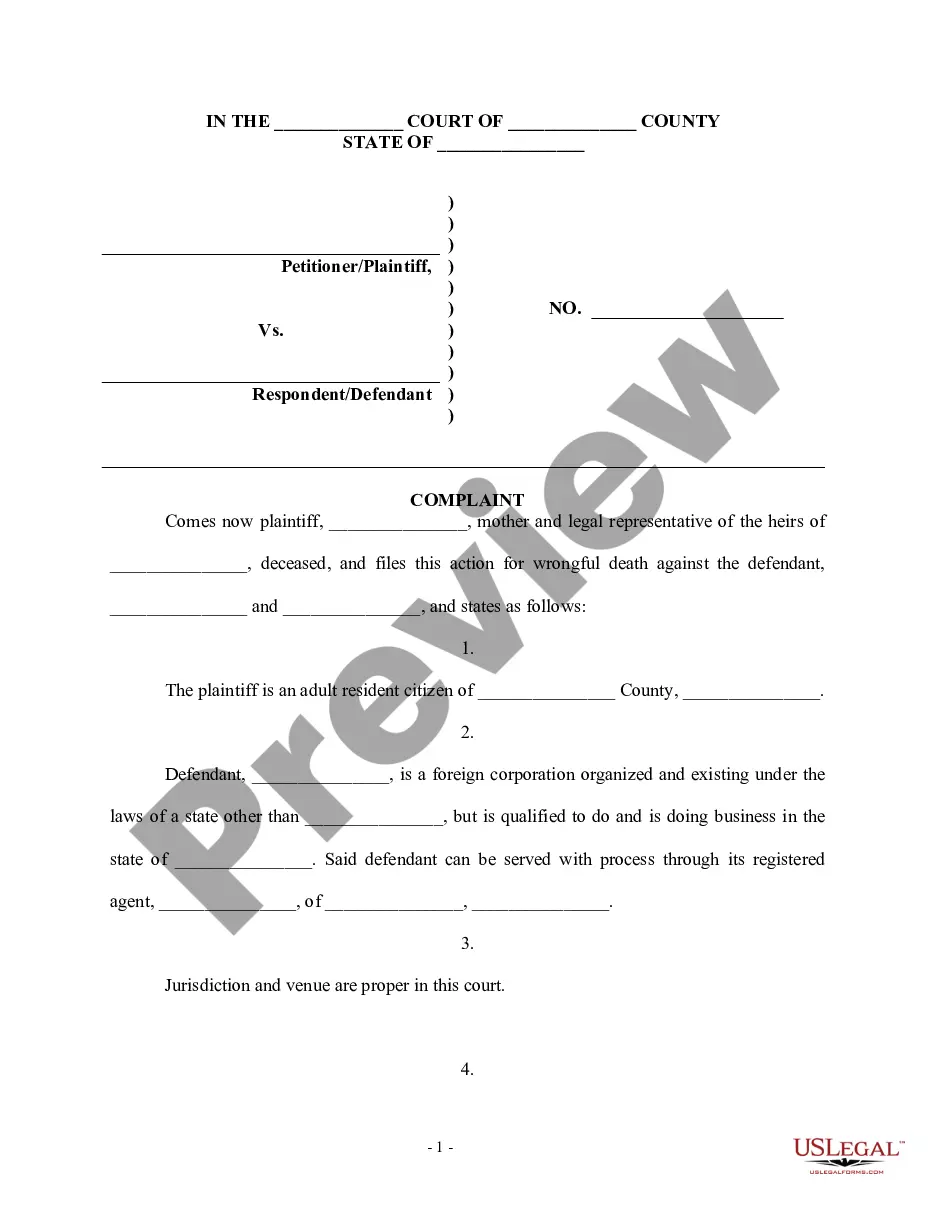

In Mississippi, for a contract to be legally binding, it must include mutual consent, a lawful object, and consideration. Both parties should clearly understand the terms and intentions outlined in the Mississippi Fire Protection Service Contract - Self-Employed. Additionally, the contract needs to be signed by all involved parties. With USLegalForms, you can ensure your contract meets all legal requirements, helping you avoid potential disputes.

Yes, a sole proprietor in Mississippi needs to obtain a business license to operate legally. This requirement ensures compliance with state regulations and protects your business under the Mississippi Fire Protection Service Contract - Self-Employed. Additionally, having a business license can strengthen your credibility with clients, allowing you to attract more customers. To simplify this process, consider using platforms like US Legal Forms, which can guide you in acquiring the necessary documents efficiently.

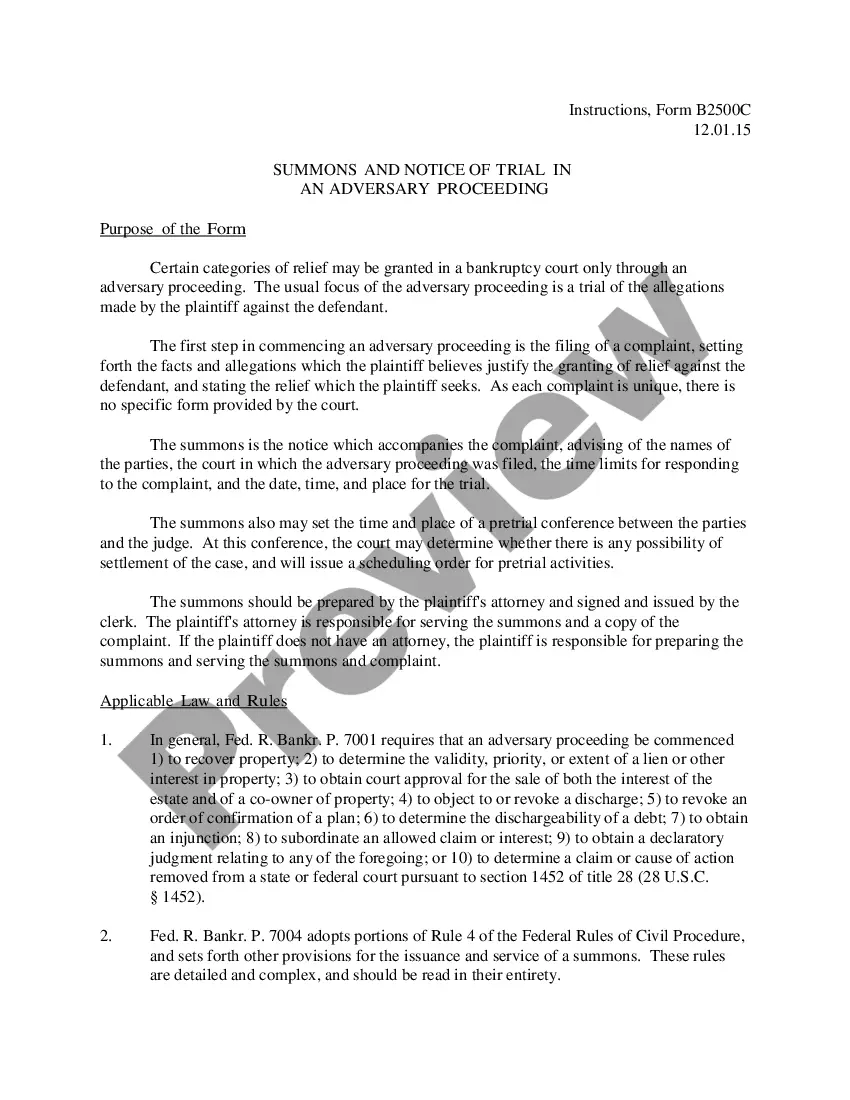

The independent contractor law in Mississippi defines the legal framework that governs the rights and responsibilities of self-employed individuals. It clarifies the classification of independent contractors versus employees, offering key protections, such as ensuring proper payment practices. Understanding this law can help you navigate contracts like the Mississippi Fire Protection Service Contract - Self-Employed effectively.

The standard independent contractor clause outlines the relationship between a contractor and a client, specifying that the contractor is self-employed, not an employee. This clause should clearly define payments, responsibilities, and rights, making it an essential component of any agreement, such as a Mississippi Fire Protection Service Contract - Self-Employed. Including a well-drafted clause protects both parties' interests.

Independent contractors in Mississippi must adhere to legal requirements that include having the appropriate licenses, understanding tax implications, and managing their business operations correctly. It's essential to maintain clear documentation and contracts, such as the Mississippi Fire Protection Service Contract - Self-Employed, to clarify the relationship between you and your client. Compliance with these regulations helps mitigate risks and enhances professionalism.

In Mississippi, individuals must be at least 18 years old to enter into legally binding contracts for personal property. This means that a minor under 18 cannot legally sign contracts unless they are for necessities. Therefore, if you are considering a Mississippi Fire Protection Service Contract - Self-Employed, ensure you meet the age requirement to validate the agreement.

A verbal contract can be binding in Mississippi, but it is often hard to enforce compared to written agreements. It's advisable to have a formal written contract, like a Mississippi Fire Protection Service Contract - Self-Employed, to avoid misunderstandings. Writing down the terms provides clarity and serves as evidence of the agreement in case disputes arise.

As an independent contractor in Mississippi, you possess certain rights that safeguard your work and compensation. You have the right to negotiate contract terms, such as the Mississippi Fire Protection Service Contract - Self-Employed, and you are entitled to receive agreed payments upon completion of your services. Additionally, you can choose your work hours and methods, providing flexibility in how you operate your business.

The new contractor law in Mississippi introduces regulations that affect how independent contractors operate, specifically in construction and related sectors. It emphasizes the importance of contracts, like the Mississippi Fire Protection Service Contract - Self-Employed, ensuring clear terms between parties. This law aims to protect both contractors and clients by establishing defined responsibilities and rights.

Yes, you can be your own contractor in Mississippi, particularly in the realm of fire protection services. Being self-employed allows you to manage your own contracts and client relationships. However, ensure you adhere to all state and local regulations, including securing any required certifications. Platforms like uslegalforms can assist in ensuring that you have the correct documentation when setting up your own contracts.