Mississippi Carpentry Services Contract - Self-Employed Independent Contractor

Description

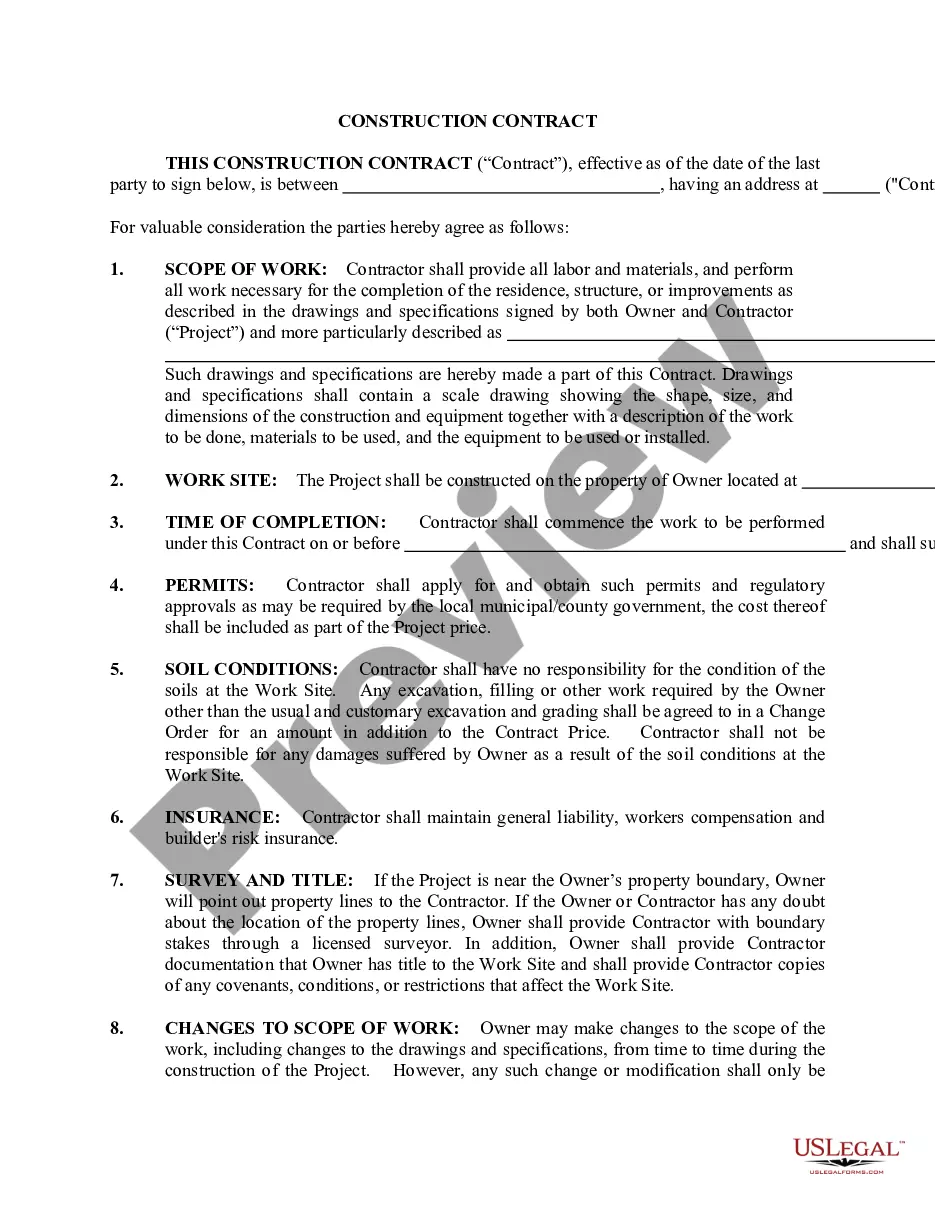

How to fill out Carpentry Services Contract - Self-Employed Independent Contractor?

You are capable of dedicating hours online attempting to locate the legal document template that satisfies the local and federal requirements you desire.

US Legal Forms offers a vast array of legal documents that have been assessed by experts.

You can acquire or print the Mississippi Carpentry Services Contract - Self-Employed Independent Contractor from our service.

- If you already have a US Legal Forms account, you may sign in and then click the Download option.

- After that, you can complete, modify, print, or sign the Mississippi Carpentry Services Contract - Self-Employed Independent Contractor.

- Each legal document template you purchase is yours for years.

- To get another version of the purchased form, navigate to the My documents section and then click the corresponding option.

- If you are visiting the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure you have selected the correct document template for the area/city of your preference.

- Read the form description to confirm you have chosen the right form.

- If available, use the Preview option to view the document template as well.

- If you wish to obtain another variation of the form, use the Search box to find the template that meets your needs and requirements.

- Once you have found the template you need, click Get now to proceed.

Form popularity

FAQ

As an independent contractor, you possess several rights, including the right to negotiate your rates, choose where and how you work, and retain ownership of your work products unless stated otherwise. It's crucial to know these rights, as they empower you to establish a fair working relationship. Documenting these rights in your Mississippi Carpentry Services Contract - Self-Employed Independent Contractor can provide additional protection.

Legal requirements for independent contractors encompass various aspects, including obtaining the necessary licenses, adhering to tax guidelines, and ensuring compliance with safety regulations. Understanding these requirements is vital for operating as a self-employed individual in Mississippi's carpentry sector. A well-formulated Mississippi Carpentry Services Contract - Self-Employed Independent Contractor can aid in meeting these legalities effectively.

A basic independent contractor agreement is a legal document outlining the terms of a working relationship between the contractor and the client. This agreement includes vital details such as the projects to be completed, payment terms, and timelines. Utilizing a Mississippi Carpentry Services Contract - Self-Employed Independent Contractor can simplify this process and ensure both parties are aligned on expectations.

The standard independent contractor clause outlines the relationship between the contractor and the client, emphasizing that the contractor operates independently. This clause typically includes terms regarding payment, project scope, and ownership of work produced. Including this clause in your Mississippi Carpentry Services Contract - Self-Employed Independent Contractor helps to clarify expectations and avoid potential disputes.

An independent contractor carpenter operates their business under a self-employed status, providing carpentry services without being tied to a single employer. This allows for greater flexibility to choose projects and manage working hours. Crafting a solid Mississippi Carpentry Services Contract - Self-Employed Independent Contractor is crucial for protecting your interests and ensuring clarity in job expectations.

The new contractor law in Mississippi aims to enhance the regulations surrounding construction works, including carpentry. This law provides clear guidelines for contractor licensing and ensures that contractors comply with state standards. As a self-employed independent contractor, understanding these regulations is essential when drafting a Mississippi Carpentry Services Contract - Self-Employed Independent Contractor.

Yes, having a contract is essential for independent contractors in Mississippi. A contract, such as a Mississippi Carpentry Services Contract - Self-Employed Independent Contractor, outlines expectations, payment terms, and project details. This document serves as a safeguard for both you and your client, ensuring mutual understanding and reducing misunderstandings. It is a vital tool for operating your independent carpentry business successfully.

Yes, an independent contractor is classified as self-employed in Mississippi. This status means you manage your own business operations and are responsible for your taxes. Becoming self-employed enables you to take control of your carpentry services, allowing for flexibility in how you work. A Mississippi Carpentry Services Contract - Self-Employed Independent Contractor can clarify your responsibilities and tasks.

In Mississippi, a contractor license is generally required for jobs that exceed $10,000 in total costs. If you plan to perform carpentry services as a self-employed independent contractor, you can undertake smaller projects without a license. However, it's essential to maintain compliance with local laws and regulations. Utilizing a Mississippi Carpentry Services Contract - Self-Employed Independent Contractor can help you outline the scope of your work and protect your interests.

Yes, independent contractors file taxes as self-employed individuals. This distinction allows you to report income and expenses related to your Mississippi Carpentry Services Contract - Self-Employed Independent Contractor status on your tax forms. Understanding how to file correctly is crucial for managing your tax obligations. Tools and resources provided by USLegalForms can simplify the paperwork involved in this process, ensuring you stay compliant.