Mississippi Statutory Notices Required for California Foreclosure Consultants

Description

How to fill out Statutory Notices Required For California Foreclosure Consultants?

Selecting the optimal authorized document format can be challenging.

Naturally, there are numerous templates available online, but how can you locate the authorized form you need.

Utilize the US Legal Forms website.

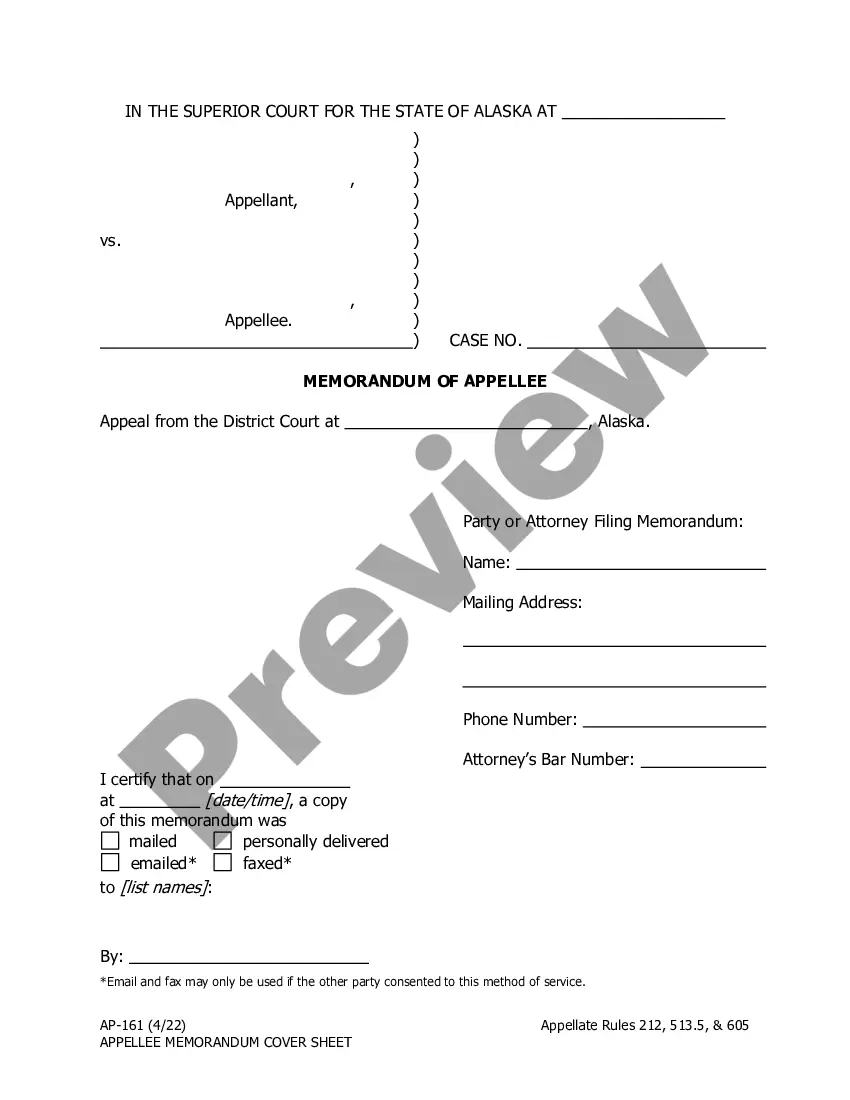

If you are a new user of US Legal Forms, here are simple steps you should follow: First, ensure you have chosen the correct form for your city/region. You can preview the document using the Review button and read the form description to confirm it is suitable for you.

- The service provides thousands of templates, including the Mississippi Statutory Notices Required for California Foreclosure Consultants, which can be utilized for business and personal needs.

- All of the forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to obtain the Mississippi Statutory Notices Required for California Foreclosure Consultants.

- Use your account to reference the legal forms you might have bought previously.

- Access the My documents section of your account and download another copy of the document you need.

Form popularity

FAQ

California's new foreclosure laws focus on enhancing homeowner protections and increasing lender accountability. These laws call for improved communication and clearer timelines for foreclosure proceedings. Understanding the Mississippi Statutory Notices Required for California Foreclosure Consultants is essential for compliance, helping consultants and homeowners alike navigate these evolving regulations with confidence.

Yes, Mississippi is a redemption state, allowing homeowners to reclaim their property after a foreclosure sale under specific conditions. Homeowners have a limited time frame to exercise this right, which highlights the importance of understanding the Mississippi Statutory Notices Required for California Foreclosure Consultants. This knowledge empowers homeowners and consultants to navigate the complexity of foreclosure and redemption effectively.

In 2025, California's foreclosure law aims to improve transparency and protect homeowners from sudden evictions. Key regulations will require lenders to provide detailed disclosures about the foreclosure process and resources available for assistance. These changes emphasize the importance of following the Mississippi Statutory Notices Required for California Foreclosure Consultants, ensuring that all parties comply with notification requirements to prevent unfair practices.

The new law for foreclosure in California emphasizes the need for compliance with various statutory requirements, including the Mississippi Statutory Notices Required for California Foreclosure Consultants. This legislation aims to protect homeowners by ensuring they receive adequate notice and information about the foreclosure process. It's important for consultants to familiarize themselves with these requirements to effectively assist their clients. You can rely on uslegalforms to provide comprehensive resources and forms that help you navigate these legal obligations seamlessly.

Yes, Mississippi is classified as a non-judicial foreclosure state. In most cases, lenders can initiate foreclosure without court involvement, making the process quicker and less burdensome for both parties. Borrowers benefit from certain statutory protections during this process. By staying informed about Mississippi statutory notices required for California foreclosure consultants, you can better assist clients facing foreclosure.

Various states allow non-judicial foreclosures, including California, Texas, and Nevada, among others. In these states, the mortgage includes a provision that authorizes the lender to foreclose without court intervention. This process is typically faster than judicial foreclosures, allowing for rapid resolution. If you are a California foreclosure consultant, understanding the different state laws and Mississippi statutory notices is vital for efficient client service.

The 37 day foreclosure rule in Mississippi refers to the statutory waiting period before a foreclosure sale can occur. After the notice of default is issued, lenders must wait a minimum of 37 days before proceeding with the sale. This period provides borrowers a chance to catch up on their payments or pursue alternatives. Knowledge of Mississippi statutory notices required for California foreclosure consultants is essential to navigate this timeline effectively.

Mississippi is primarily a non-judicial foreclosure state, which means that lenders do not need to go through the court system to foreclose on a property. Instead, lenders can use a power of sale clause included in the mortgage agreement. This process allows for a more efficient timeline, enabling quicker resolutions. For California foreclosure consultants, it's crucial to recognize the statutory requirements relevant to Mississippi.

Foreclosure in Mississippi initiates when a borrower defaults on their mortgage payments. The lender files a notice of default, typically after the borrower misses several payments. Once the notice is filed, the borrower has the right to cure the default or negotiate alternative solutions. Understanding Mississippi statutory notices required for California foreclosure consultants can help streamline the process.

Yes, foreclosure laws do indeed vary by state, including specific regulations and procedures. In Mississippi, for example, the statutory notices play a crucial role in foreclosures, and these requirements differ greatly from those in California. Understanding the Mississippi Statutory Notices Required for California Foreclosure Consultants is essential for compliance and effective client representation. Utilizing resources like USLegalForms can provide clarity and help navigate these complex legal frameworks.