Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement

Description

How to fill out Nonqualified Defined Benefit Deferred Compensation Agreement?

If you aim to finalize, acquire, or print legitimate document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Leverage the site's user-friendly and convenient search feature to locate the documents you require.

A range of templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the form you need, click the Acquire now button. Choose your preferred pricing plan and provide your information to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finish the purchase. Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify, and print or sign the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement.

- Utilize US Legal Forms to find the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to access the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement.

- You can also access forms you previously saved from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

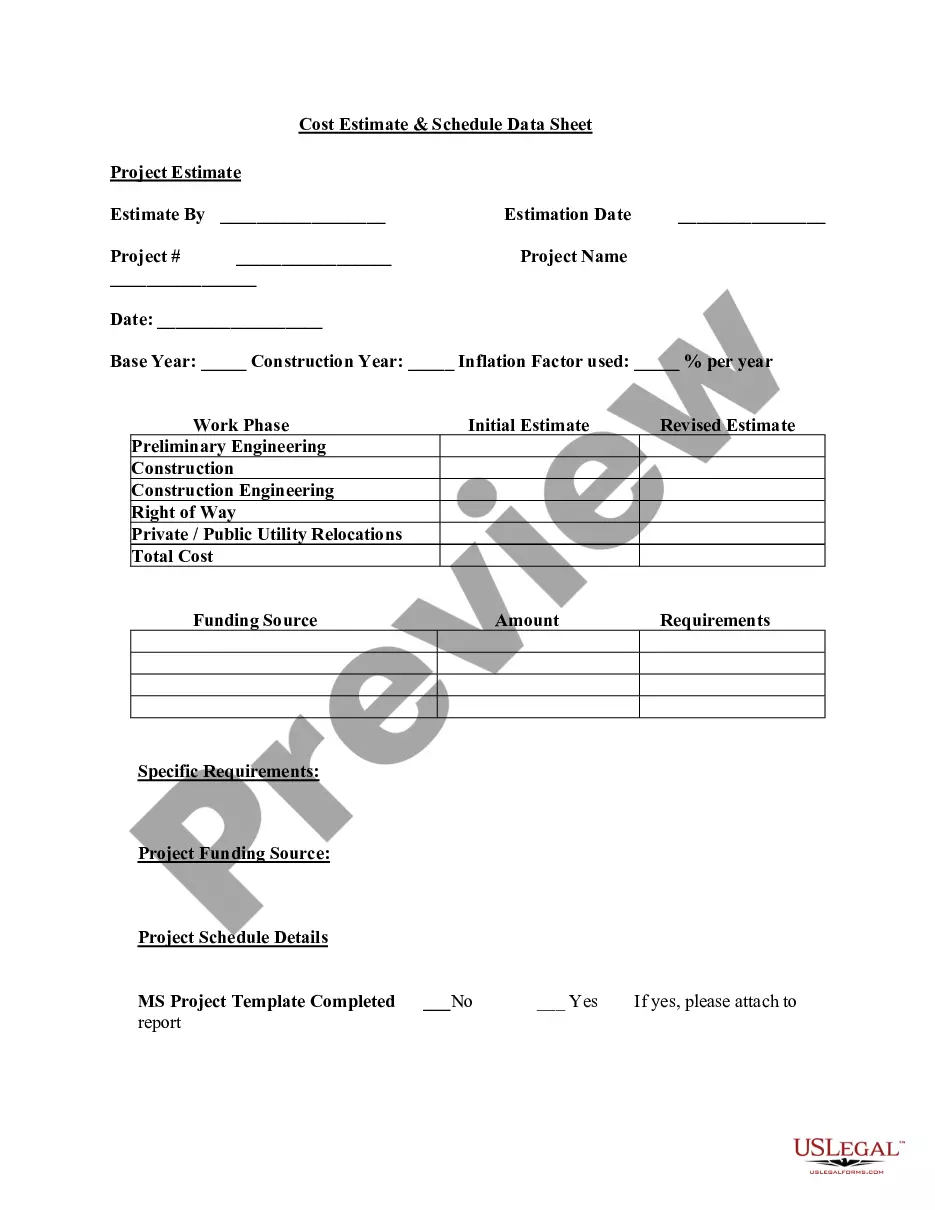

- Step 2. Utilize the Review option to verify the content of the form. Do not forget to read the description.

- Step 3. If you are not satisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

Eligibility for a nonqualified deferred compensation plan typically includes high-level executives and select employees chosen by the employer. These plans offer flexibility and can be tailored to meet the needs of specific individuals in the organization. If your employer is considering the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement, it is important to discuss eligibility criteria to ensure you can take advantage of this beneficial retirement strategy.

To determine if your retirement plan is qualified or nonqualified, review the plan’s adherence to IRS guidelines. Qualified plans must meet specific regulations, while nonqualified plans, like the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement, do not. If you have questions about your specific plan, consider consulting with a financial advisor or legal professional who can provide clarity and guidance.

A nonqualified deferred compensation plan allows employees to defer a portion of their income until a later date, often retirement. Unlike qualified plans, these do not adhere to IRS regulations, providing more flexible options for employers and employees. Specifically, the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement offers unique benefits tailored to enhance retirement savings without the restrictive guidelines of qualified plans.

Setting up a nonqualified deferred compensation plan, such as the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement, involves several key steps. First, consult with legal and financial professionals to ensure compliance with state and federal regulations. Next, outline the plan specifics, including eligibility, benefit calculations, and distribution options. Finally, draft a written agreement that clearly defines the terms of the plan to protect both the employer and employee.

A deferred compensation plan is considered nonqualified when it does not meet the criteria set by the IRS for qualified plans, like 401(k) plans. The Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement allows employers to maintain more flexibility with plan terms and funding. This means that contributions do not have to adhere to the contribution limits required for qualified plans, unlike traditional retirement options.

Mississippi deferred compensation plans, like the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement, enable employees to defer a portion of their earnings until a later date, often retirement. This deferral can provide tax advantages, as taxes on the income are postponed until withdrawal. Employees can agree on the timing and amount of these deferrals, enhancing their long-term savings strategy.

A common example of a nonqualified deferred compensation plan is a Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement, which allows employers to promise supplemental retirement benefits to select employees. This type of plan typically does not adhere to the same regulations as qualified plans, providing greater freedom for employers to customize benefits. Such arrangements can include various forms of retirement income, making them versatile and appealing.

Mississippi Nonqualified Defined Benefit Deferred Compensation Agreements can be a strategic option for high earners looking to supplement their retirement savings. These plans allow flexibility in contribution limits, which can lead to significant savings and tax benefits. By deferring income, you can manage your tax burden more effectively. Overall, they can be a smart addition to your financial planning.

Participating in a nonqualified deferred compensation plan can be beneficial, particularly if you are a high-income earner and wish to save more for retirement beyond standard limits. It can provide a unique way to manage your tax liability and plan for your financial future. By using the Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement, you can customize your participation to align with your personal financial goals.

A nonqualified deferred compensation arrangement is similar to a retirement plan but does not meet the government requirements to be officially recognized. It allows employees to receive some of their income later, often after retirement, which can enhance their financial flexibility. The Mississippi Nonqualified Defined Benefit Deferred Compensation Agreement exemplifies this type of arrangement, providing employees with tailored solutions for their retirement needs.