Mississippi Notice of Violation of Fair Debt Act - Notice to Stop Contact

Description

How to fill out Notice Of Violation Of Fair Debt Act - Notice To Stop Contact?

Locating the appropriate official document template can be a challenge.

Clearly, there are numerous templates accessible online, but how can you find the official form you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are straightforward steps for you to follow: First, ensure you have selected the correct form for your area.

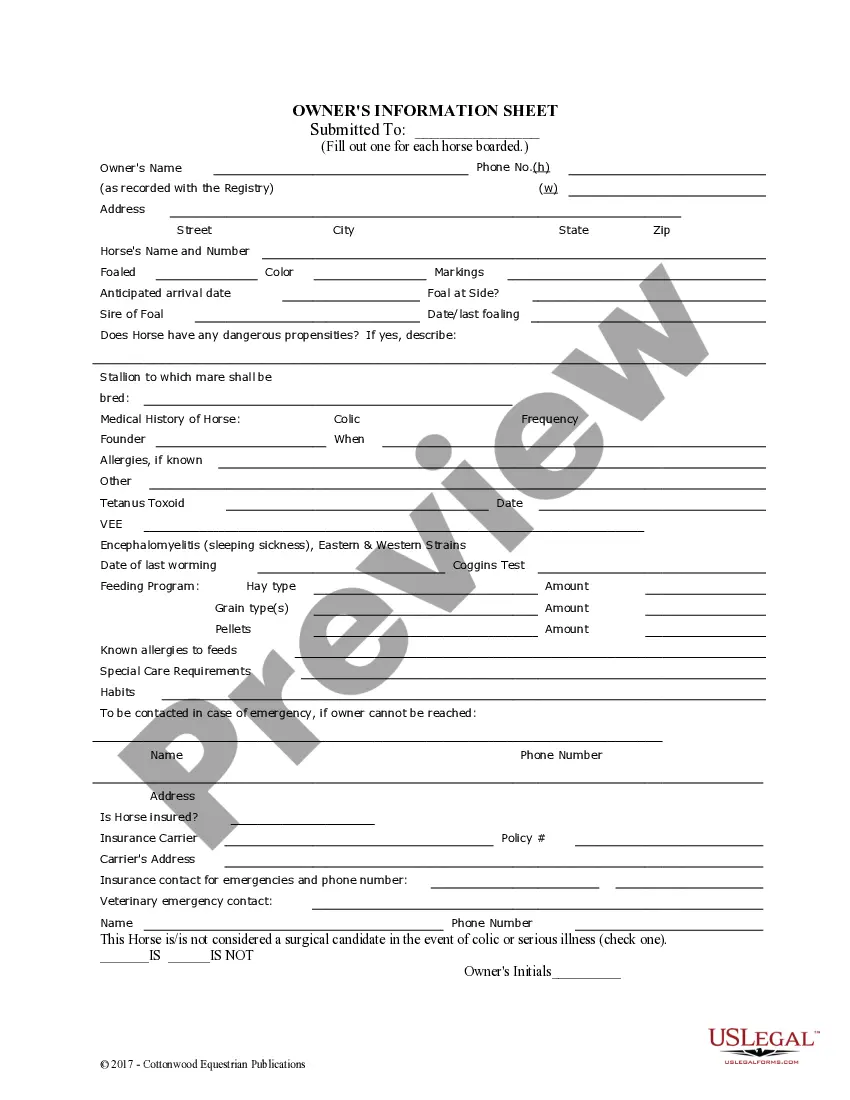

You can browse the form using the Preview button and review the form details to confirm it is suitable for you.

If the form does not meet your specifications, use the Search field to find the correct form.

Once you are confident the form is accurate, click the Get Now button to obtain the form.

Select the payment plan you prefer and enter the necessary information. Create your account and complete the order using your PayPal account or credit card.

Choose the file format and download the legal document template to your device.

Complete, modify, print, and sign the received Mississippi Notice of Violation of Fair Debt Act - Notice to Stop Contact.

US Legal Forms is the top resource for legal forms where you can find a variety of document templates.

Utilize the service to download properly crafted documents that adhere to state requirements.

- The service provides a vast array of templates, including the Mississippi Notice of Violation of Fair Debt Act - Notice to Stop Contact, suitable for both business and personal purposes.

- All forms are verified by experts and comply with state and federal regulations.

- If you are already registered, sign in to your account and click the Download button to access the Mississippi Notice of Violation of Fair Debt Act - Notice to Stop Contact.

- Use your account to review the legal forms you may have purchased previously.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

Form popularity

FAQ

According to the FDCPA, a debt collector can only contact you, your attorney, or a consumer reporting agency. According to the FDCPA, a debt collector can not: Contact you before am or after pm in your time zone or at an inconvenient time. Contact you at your place of employment.

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

A cease and desist letter is a formal request that you send a debt collector to stop contacting you about a debt. This contact includes collection calls and demand letters. If you make this request over the phone, it won't be official or binding.

You have 30 days to dispute the validity of the debt. if you don't dispute the debt's validity, the collector will assume it is valid. if you do dispute the debt's validity within the 30 days, the agency will send you verification of it, and.

Dear debt collector, I am responding to your contact about collecting a debt. You contacted me by phone/mail, on date and identified the debt as any information they gave you about the debt. I do not have any responsibility for the debt you're trying to collect.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

A cease and desist letter is a way to formally request that a debt collector stop contacting you about a debt. The Fair Debt Collection Practices Act (FDCPA) states that if you formally request that you no longer wish to be contacted by a collector, they must cease all further contact.

The Fair Debt Collection Practices Act (FDCPA) is a federal law that provides a mechanism for you to stop debt collectors from contacting you. You can do this by sending a Cease and Desist Letter. Federal law allows you to communicate with debt collectors to tell them that you want them to stop contacting you.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

There are a few circumstances when using a Cease and Desist Letter is a good idea.The debt collector is harassing you and it is causing significant stress.The legal time limit for the creditor to collect on a debt has expired.The debt they are trying to collect is not your debt.