Mississippi Amendment of common stock par value

Description

How to fill out Amendment Of Common Stock Par Value?

Choosing the best legitimate file template could be a have difficulties. Naturally, there are a lot of themes accessible on the Internet, but how do you obtain the legitimate develop you will need? Utilize the US Legal Forms web site. The service gives 1000s of themes, like the Mississippi Amendment of common stock par value, that can be used for enterprise and personal requires. Each of the varieties are checked by experts and meet up with state and federal requirements.

In case you are presently signed up, log in to your accounts and then click the Download button to obtain the Mississippi Amendment of common stock par value. Make use of accounts to look with the legitimate varieties you might have bought previously. Visit the My Forms tab of your respective accounts and get yet another version in the file you will need.

In case you are a new customer of US Legal Forms, listed here are straightforward guidelines so that you can stick to:

- Very first, make sure you have chosen the proper develop to your area/area. It is possible to examine the form utilizing the Preview button and read the form outline to ensure it will be the right one for you.

- If the develop does not meet up with your preferences, make use of the Seach field to obtain the appropriate develop.

- Once you are sure that the form is suitable, go through the Purchase now button to obtain the develop.

- Opt for the rates program you desire and enter in the required info. Build your accounts and pay for an order using your PayPal accounts or Visa or Mastercard.

- Opt for the data file structure and down load the legitimate file template to your device.

- Complete, change and produce and sign the acquired Mississippi Amendment of common stock par value.

US Legal Forms is definitely the largest local library of legitimate varieties in which you can see various file themes. Utilize the company to down load skillfully-created documents that stick to state requirements.

Form popularity

FAQ

The document required to form a corporation in Mississippi is called the Articles of Incorporation. The information required in the formation document varies by state. Mississippi's requirements include: Officers. Officer names and addresses are not required to be listed in the Articles of Incorporation.

Step 1: Name Your Mississippi LLC. ... Step 2: Choose a Registered Agent. ... Step 3: File the Mississippi LLC Certificate of Formation. ... Step 4: Create an Operating Agreement. ... Step 5: File Form 2553 to Elect Mississippi S Corp Tax Designation.

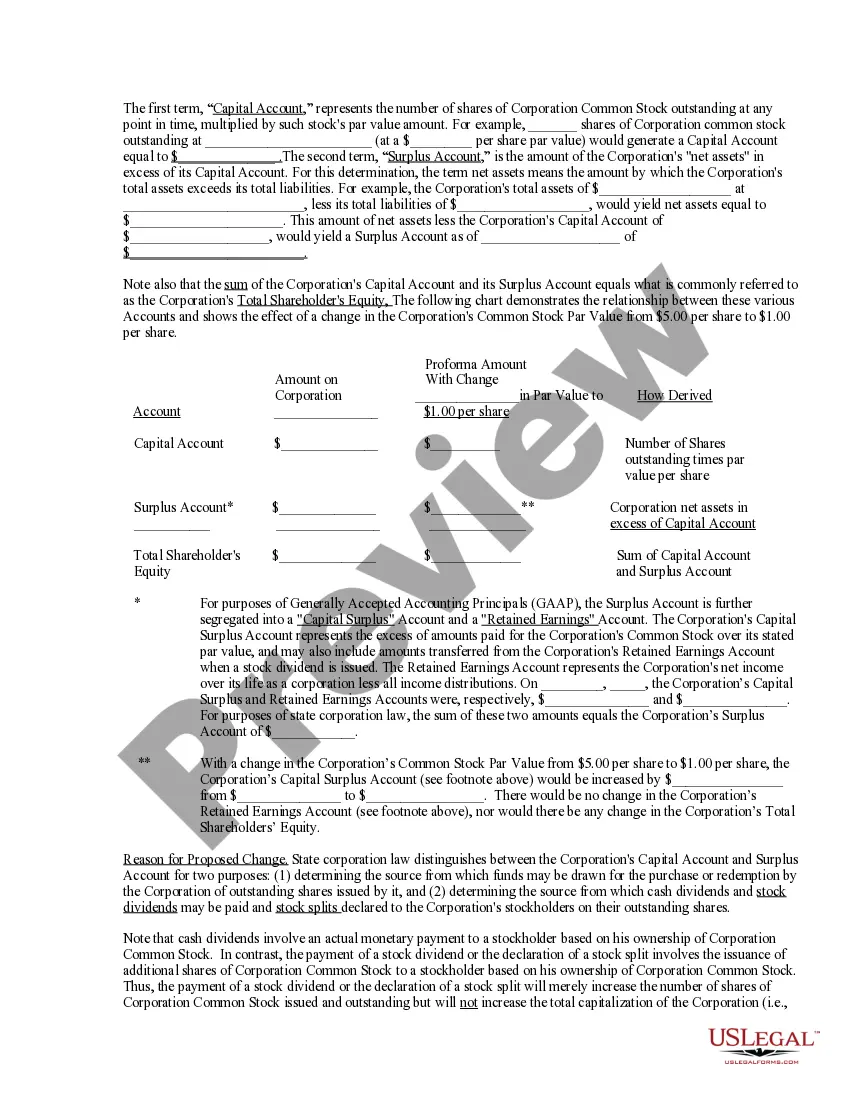

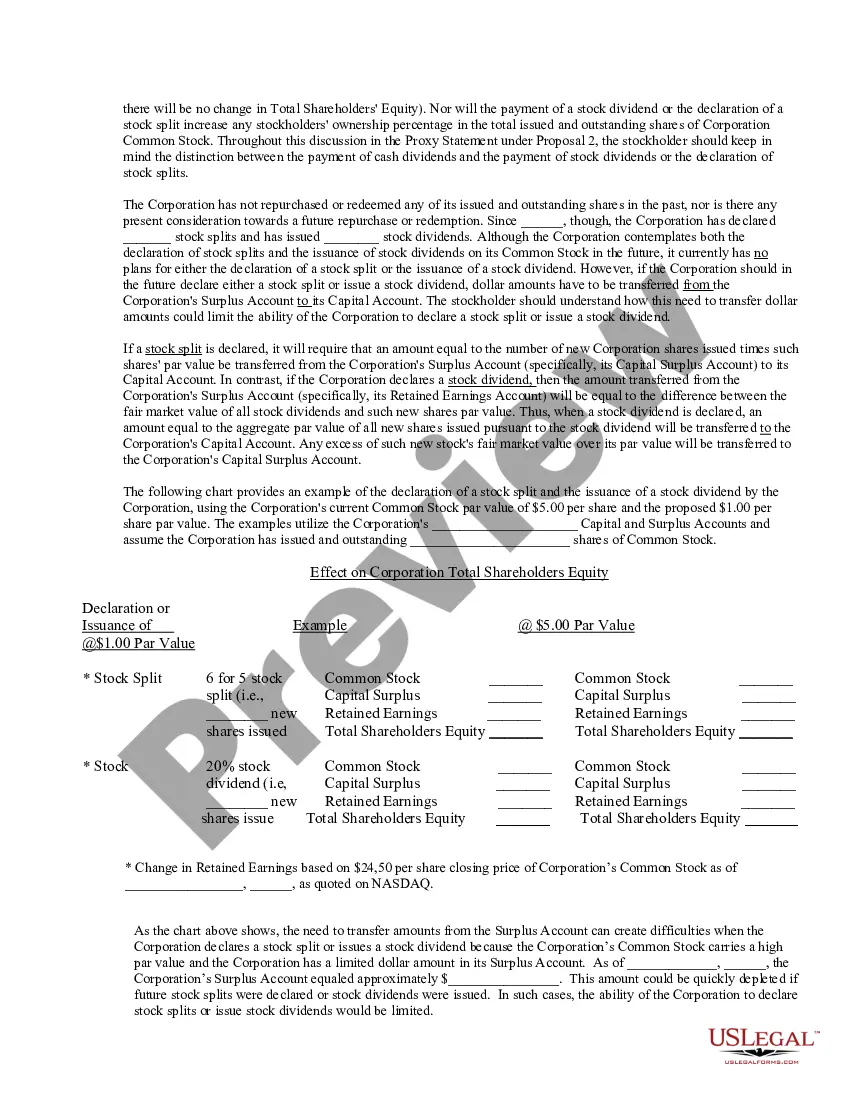

A change in par value usually occurs when a company's stock is split. The par value is typically listed on stock certificates and usually does not represent the stock's actual value.

If you already have par value and you want to raise or lower it, things are a bit more complicated. Typically, you can't just make an amendment saying you now have a new par value. Instead, the most common way that corporations change their par value is with a stock split (or reverse stock split).

If the value of the stocks ever drop below the par value, the corporation becomes liable to the shareholders for the price drop. No-par stocks completely avoid this whole process by having no minimum price or par value at all for the stocks.

A corporation's business and affairs are managed by or under the direction of its board of directors. Although the board has the power to make all decisions on behalf of its corporation, many business decisions are actually made by the corporation's officers.

A reverse split raises your stock's par value and reduces the number of shares at the same time. The reverse split doesn't change the value of the retained earnings, paid-in capital or cash accounts. When the reverse split is completed, the total value of your stock is unchanged.

A par value for a stock is its per-share value assigned by the company that issues it and is often set at a very low amount such as one cent. A no-par stock is issued without any designated minimum value.