Mississippi Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005

Description

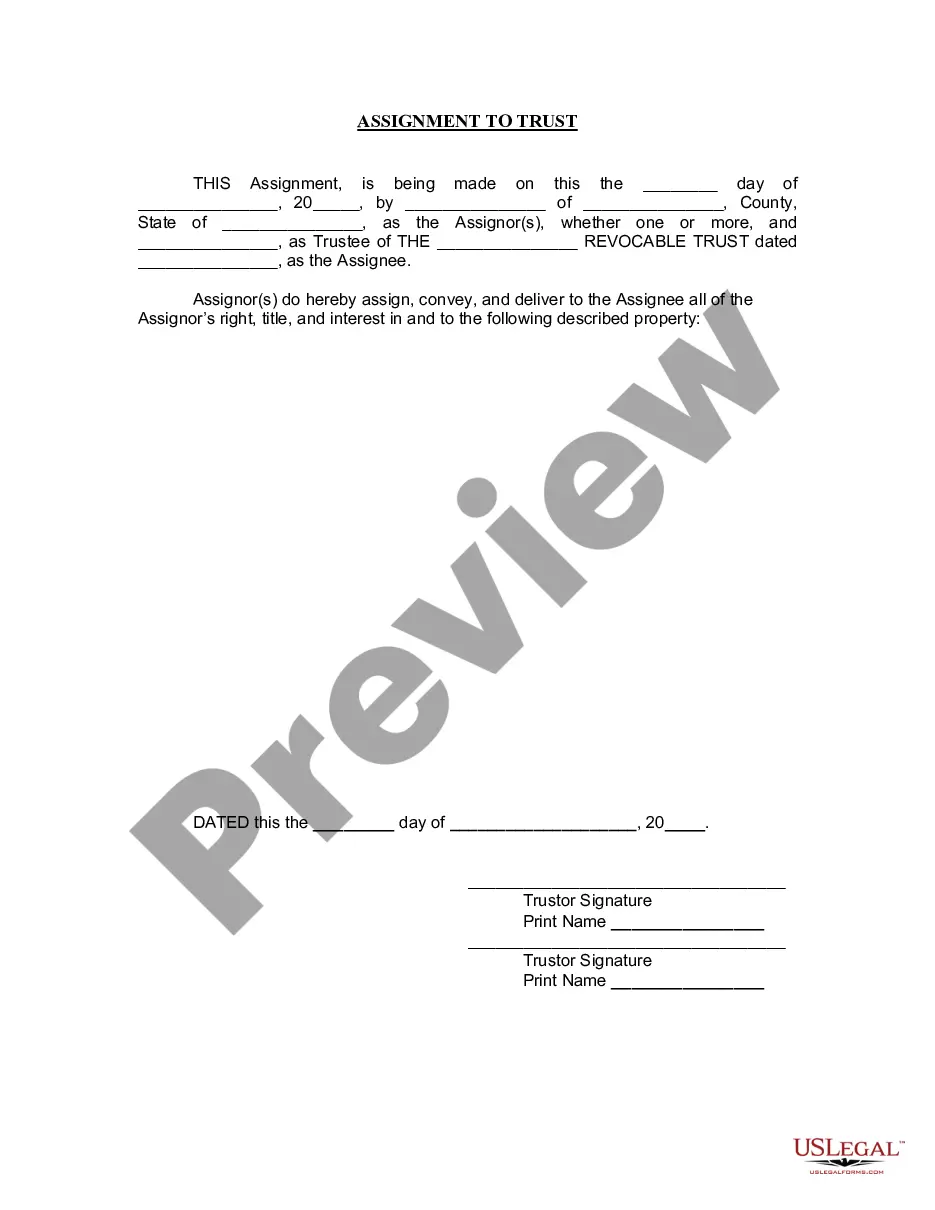

How to fill out Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005?

If you wish to complete, acquire, or printing legitimate document themes, use US Legal Forms, the biggest variety of legitimate types, that can be found on the web. Take advantage of the site`s easy and handy research to find the papers you need. Different themes for enterprise and personal functions are categorized by classes and suggests, or key phrases. Use US Legal Forms to find the Mississippi Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 in a few click throughs.

Should you be presently a US Legal Forms customer, log in to the profile and click on the Down load button to obtain the Mississippi Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005. You can also access types you formerly acquired inside the My Forms tab of your respective profile.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Be sure you have selected the shape for that proper town/land.

- Step 2. Use the Review option to examine the form`s information. Never overlook to read through the description.

- Step 3. Should you be unhappy with all the type, use the Search industry near the top of the screen to get other models from the legitimate type template.

- Step 4. Once you have found the shape you need, select the Get now button. Opt for the rates strategy you like and put your accreditations to register for the profile.

- Step 5. Method the financial transaction. You should use your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Select the format from the legitimate type and acquire it on your device.

- Step 7. Full, revise and printing or indication the Mississippi Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005.

Each legitimate document template you buy is your own property permanently. You have acces to every type you acquired inside your acccount. Click on the My Forms area and choose a type to printing or acquire once more.

Remain competitive and acquire, and printing the Mississippi Creditors Holding Unsecured Priority Claims - Schedule E - Form 6E - Post 2005 with US Legal Forms. There are thousands of specialist and condition-specific types you can use for the enterprise or personal demands.

Form popularity

FAQ

Priority Unsecured Debts Examples of bankruptcy priority claims include most taxes, alimony, child support, restitution, and administrative claims. In a Chapter 7 asset case, priority claims receive payment in full before any payments to general unsecured creditors. Priority debts are nondischargeable.

Unsecured claims are the opposite of secured claims: There is no property to seize, repossess, or foreclose upon. Examples of unsecured claims are child support debt, alimony debt, credit card debt, tax debts, and personal loans.

Under Chapter 11 procedures, Secured Creditors will receive payment before the next class of Creditors?those with unsecured claims. Secured claims can be oversecured, meaning the collateral is worth more than the debt, or undersecured, meaning the debt is worth more than the value of the collateral.

Unsecured creditors are generally placed into two categories: priority unsecured creditors and general unsecured creditors. As their name suggests, unsecured priority creditors are higher in the pecking order than general unsecured creditors when it comes to claims over any assets in a bankruptcy filing.

Creditors are ranked as follows: Secured creditors with a fixed charge. Administrator/Liquidator fees. Preferential creditors. Secondary preferential creditors (expanded to include HMRC for certain taxes) Secured creditors with a floating charge. Unsecured creditors (including all other HMRC debt) Shareholders.

Who gets paid first when a company is liquidated? Secured creditors with a fixed charge. Preferential creditors (including secondary preferential) Secured floating charge creditors and the 'prescribed part' Unsecured creditors. Connected unsecured creditors. Shareholders.

PRIORITIES - - WHO GETS THE COLLATERAL (First)? Secured vs. Unsecured Interests: Secured creditors generally prevail against unsecured creditors and judgment creditors who have not begun legal process to collect on their judgment.

In general, secured creditors have the highest priority followed by priority unsecured creditors. The remaining creditors are often paid prior to equity shareholders.