Mississippi Time Adjustment Report

Description

How to fill out Time Adjustment Report?

If you want to finalize, retrieve, or generate official document templates, utilize US Legal Forms, the most extensive collection of official forms available online.

Take advantage of the website's user-friendly and convenient search feature to find the documents you need.

Various templates for business and personal uses are organized by categories and states, or by keywords. Use US Legal Forms to access the Mississippi Time Adjustment Report in just a few clicks.

Step 4. Once you have identified the form you need, click the Get Now button. Choose the pricing plan you wish and enter your details to register for an account.

Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- If you are an existing US Legal Forms user, Log In to your account and press the Download button to locate the Mississippi Time Adjustment Report.

- You can also find forms you previously acquired in the My documents section of your account.

- If you are a new user of US Legal Forms, follow the guidelines below.

- Step 1. Ensure you have chosen the form for your specific city/state.

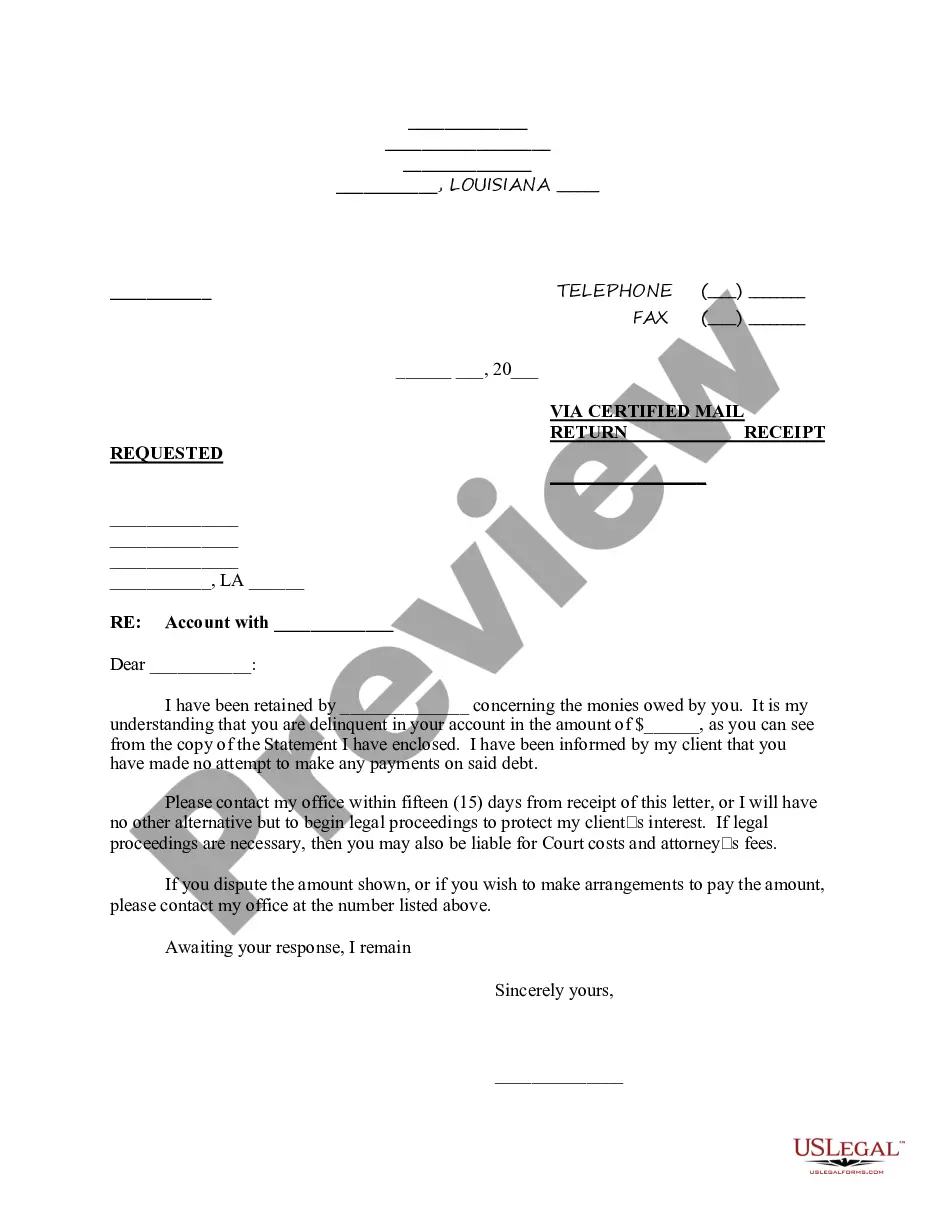

- Step 2. Utilize the Review option to examine the form's details. Don't forget to read through the overview.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the official form template.

Form popularity

FAQ

Use one of the following options to find another business's federal tax ID number:Ask the company. Someone in the payroll or accounting department should know the company's tax ID.Search SEC filings. Source: SEC.gov.Inquire with a credit bureau.Use a paid EIN database.Use Melissa Database for nonprofits.

You may request to close your account online. The request will be reviewed by MDES staff before authorizing the closure of your account. You may also notify your local tax field representative.

Which states are not changing their clocks? The only parts of the US that do not have Daylight Saving Time are Hawaii, most of Arizona, Puerto Rico, the US Virgin Islands, Northern Mariana Islands, Guam, and American Samoa.

The state has legislated the 2014 Workforce Enhancement Training contribution and State Workforce Investment contribution to be a rate of 0.19%. This is a change from the 0.15% training tax that was in effect when the tax rate notices were issued last month. For subsequent years the rate will be 0.16%.

Step-by-Step Guide to Running Payroll in MississippiStep 1: Set up your business as an employer.Step 2: Register your business with the State of Mississippi.Step 3: Create your payroll process.Step 4: Have employees fill out relevant forms.Step 5: Review and approve time sheets.More items...?

Because federal law does not currently allow full-time DST, Congress would have to act before states could adopt changes. The 18 states are Alabama, Georgia, Minnesota, Mississippi and Montana (2021).

Mississippi Payroll Tax and Registration GuideApply online at the MDES Employer Registration portal to receive the Employer Account Number immediately after completing the registration.Find an existing Employer Account Number. on Form UI-2, Employer's Quarterly Wage Report. by contacting the MDES.

On Tuesday, the U.S. Senate voted unanimously to make daylight saving time permanent from 2023getting rid of the biannual ritual of Americans changing their clocks back or forth by an hour.

State unemployment You can find your MDES EAN on notices received from the Mississippi Department of Employment Security such as the Registration Notification Letter or Quarterly Contribution Report (Form UI-2). You should also call the agency at (601) 321-6000 if you need to inquire about your number.