Mississippi Separation Notice for 1099 Employee

Description

How to fill out Separation Notice For 1099 Employee?

Finding the correct legal document template can be quite challenging.

Of course, there is a multitude of templates accessible online, but how do you obtain the legal form you need.

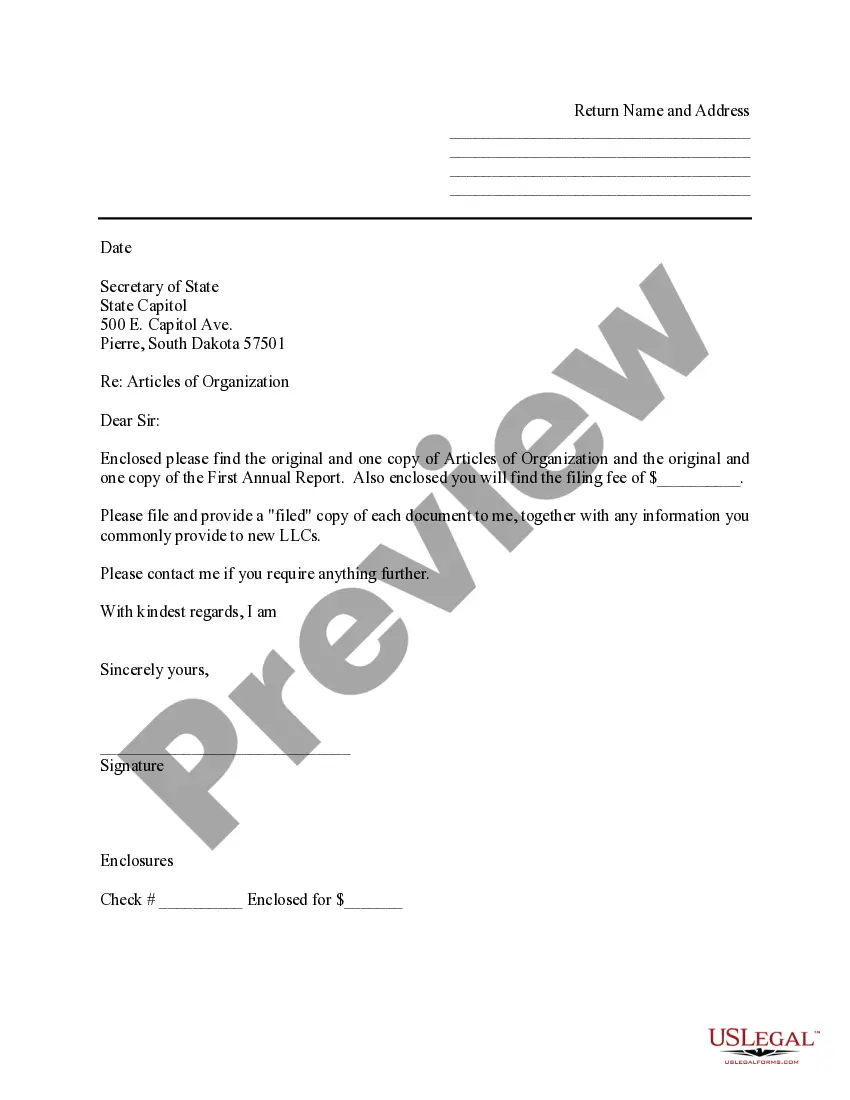

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Mississippi Separation Notice for 1099 Employee, which can be utilized for business and personal purposes.

If the form does not meet your requirements, utilize the Search field to locate the appropriate form. Once you are confident that the form is right, select the Purchase now button to acquire the form. Choose the payment plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, modify, print, and sign the received Mississippi Separation Notice for 1099 Employee. US Legal Forms is the largest database of legal forms where you can find a variety of document templates. Take advantage of the service to download professionally crafted documents that comply with state regulations.

- All of the forms are reviewed by experts and meet federal and state regulations.

- If you are already registered, Log In to your account and click on the Download button to get the Mississippi Separation Notice for 1099 Employee.

- Use your account to search through the legal forms you have previously obtained.

- Go to the My documents section of your account to access another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple guidelines for you to follow.

- First, ensure you have selected the correct form for your city/region. You can view the form with the Preview option and read the form details to confirm it is suitable for you.

Form popularity

FAQ

You can access your Form 1099-G through your Reemployment Assistance account inbox. The fastest way to receive your 1099-G Form is by selecting electronic as your preferred method for correspondence. Go to My 1099-G in the main menu to view Form 1099-G from the last five years.

To submit documentation online, login to the ReEmployMS unemployment system and select the 'Provide PUA Proof of Employment/Earnings' tab and follow the instructions to upload your proof.

Claims are processed Monday through Friday. Depending on when you submit your claim, whether it is online or by using the 2File UI app, you should receive your payment within 5 days from the date you filed your weekly certification.

If you did not receive your 1099-G form via mail, you can log in to your account to obtain a copy. If you believe a fraudulent claim was filed by a person using your information, please send an email to safe@mdes.ms.gov and provide all available details regarding the situation.

If you did not receive your 1099-G form via mail, you can log in to your account to obtain a copy. If you believe a fraudulent claim was filed by a person using your information, please send an email to safe@mdes.ms.gov and provide all available details regarding the situation.

Although Benefit Regulation 321.00 states the employer has fourteen (14) days from the date of mailing to respond to this request, a five day response time is requested so that immediate action may be taken if it is determined an issue that needs additional investigation exists.

A: You will find the 1099-G in Uplink on your Correspondence page. You may need Adobe Acrobat Reader software to open the 1099-G, and that can be downloaded for free at . NOTE: if you were a phone filer, it will be mailed to you. No other 1099-Gs will be mailed.

A. To file an Unemployment Claim, visit the MDES website at or call the MDES Contact Center at 601-493-9427. Online filing is encouraged! A claim may be filed on-line at twenty-four (24) hours a day, seven (7) days a week.

Steps to verify your identity:Select the green Verify with ID.me button to begin the identity verification process.Sign in to your existing ID.me account, or create a new one.Confirm your email address.Select a multi-factor authentication option (MFA).Verify your identity.More items...

OnlineLog in to Benefit Programs Online and select UI Online.Select Payments.Select Form 1099G.Select View next to the desired year.Select Print to print your Form 1099G information.Select Request Duplicate to request an official paper copy.