Mississippi Private Client General Asset Management Agreement

Description

How to fill out Private Client General Asset Management Agreement?

Are you presently engaged in a position that necessitates documents for both corporate and personal purposes almost every day.

There are numerous legitimate document templates available online, but finding ones you can trust is not straightforward.

US Legal Forms offers thousands of document templates, such as the Mississippi Private Client General Asset Management Agreement, designed to satisfy federal and state requirements.

When you find the right form, just click Acquire now.

Choose the payment plan you want, fill in the necessary details to create your account, and complete the payment using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Mississippi Private Client General Asset Management Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/region.

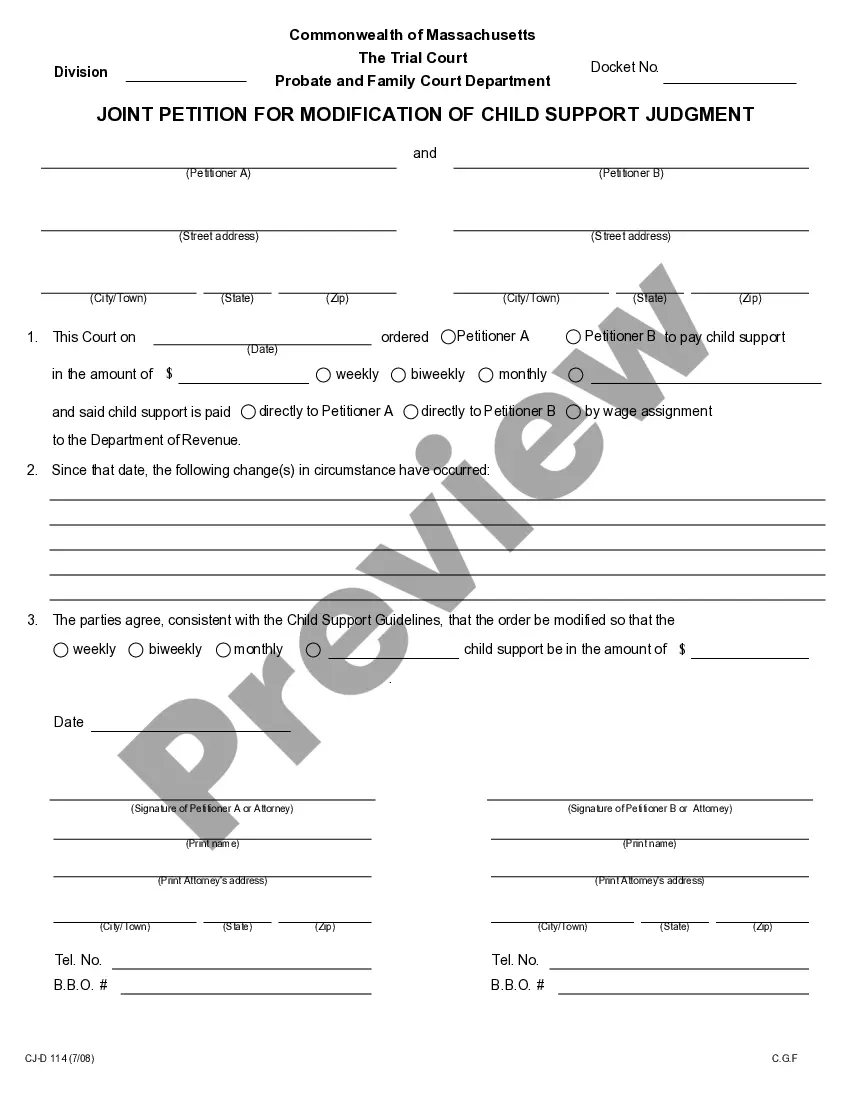

- Use the Preview option to examine the form.

- Check the summary to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

The Governor of Mississippi appoints the members of the Mississippi Real Estate Commission. These appointments are crucial because the Commission oversees licensing and regulation within the real estate sector. Therefore, understanding the appointment process helps you appreciate how these members influence the compliance landscape, especially concerning agreements like the Mississippi Private Client General Asset Management Agreement. If you need guidance through this process and its implications, US Legal Forms offers resources to assist you.

To obtain a real estate license in Mississippi, an applicant must complete 60 hours of pre-licensure education, pass a state exam, and undergo a background check. Additionally, applicants must be at least 18 years old and have a high school diploma or equivalent. Understanding these requirements is essential when considering a Mississippi Private Client General Asset Management Agreement, as it underscores the importance of working with licensed professionals in your investment decisions.

Members of the Mississippi Real Estate Commission must have at least five years of experience as licensed brokers before appointment. This requirement ensures that commission members have a robust understanding of the real estate landscape, benefiting the public they serve. Knowing such regulations can enhance your confidence in entering a Mississippi Private Client General Asset Management Agreement, as you are assured of expert oversight.

In Mississippi, a broker must file at least three copies of a cooperative agreement with the Mississippi Real Estate Commission. This ensures that all parties involved have a clear understanding of their responsibilities and obligations. Having these agreements in place aligns with the principles of a Mississippi Private Client General Asset Management Agreement, emphasizing transparency and accountability in real estate transactions.

In Mississippi, certain actions like managing properties for a friend or family member may not require an active real estate license. However, engaging in activities that involve commercial transactions does necessitate licensing. Understanding this distinction is crucial, especially when entering a Mississippi Private Client General Asset Management Agreement, as it protects you from potential legal pitfalls.

In investment management, IMA stands for Investment Management Agreement, which is a legal contract between an investor and the investment manager. This agreement specifies the authority granted to the manager to make investment decisions on behalf of the client. It includes details about fees, services, and responsibilities, ensuring clarity and protection for both parties. Familiarity with the implications of the IMA will enhance your understanding of the Mississippi Private Client General Asset Management Agreement.

The primary difference between a Private Placement Memorandum (PPM) and an Investment Management Agreement (IMA) lies in their purpose. A PPM primarily provides detailed information to potential investors about an investment opportunity, including risks and terms. On the other hand, an IMA formalizes the relationship between the investor and the asset manager, outlining how investments will be managed. Understanding this distinction is crucial when navigating the Mississippi Private Client General Asset Management Agreement.

The IMA, or Investment Management Agreement, is a formal contract that defines the terms of investment management services. This agreement specifies how the manager will act on behalf of the client, including decision-making processes and performance expectations. By utilizing a Mississippi Private Client General Asset Management Agreement, you can establish a solid foundation for effective investment management.

The purpose of a management agreement is to clarify the roles, duties, and expectations of both the client and the manager. This document acts as a roadmap for how assets will be managed, providing transparency and security for both parties. In the context of a Mississippi Private Client General Asset Management Agreement, clear terms help foster a trusting relationship.

An investment management agreement details how an investment manager will handle a client's investment portfolio. This agreement specifies the responsibilities, fees, and strategies employed to achieve the client's financial objectives. When you engage in a Mississippi Private Client General Asset Management Agreement, you ensure a structured approach to managing your wealth.