Mississippi Sample Letter regarding Revolving Note and Loan Agreement

Description

How to fill out Sample Letter Regarding Revolving Note And Loan Agreement?

Selecting the appropriate valid document template can be rather challenging.

Clearly, there is an assortment of templates accessible online, but how can you obtain the valid document you seek.

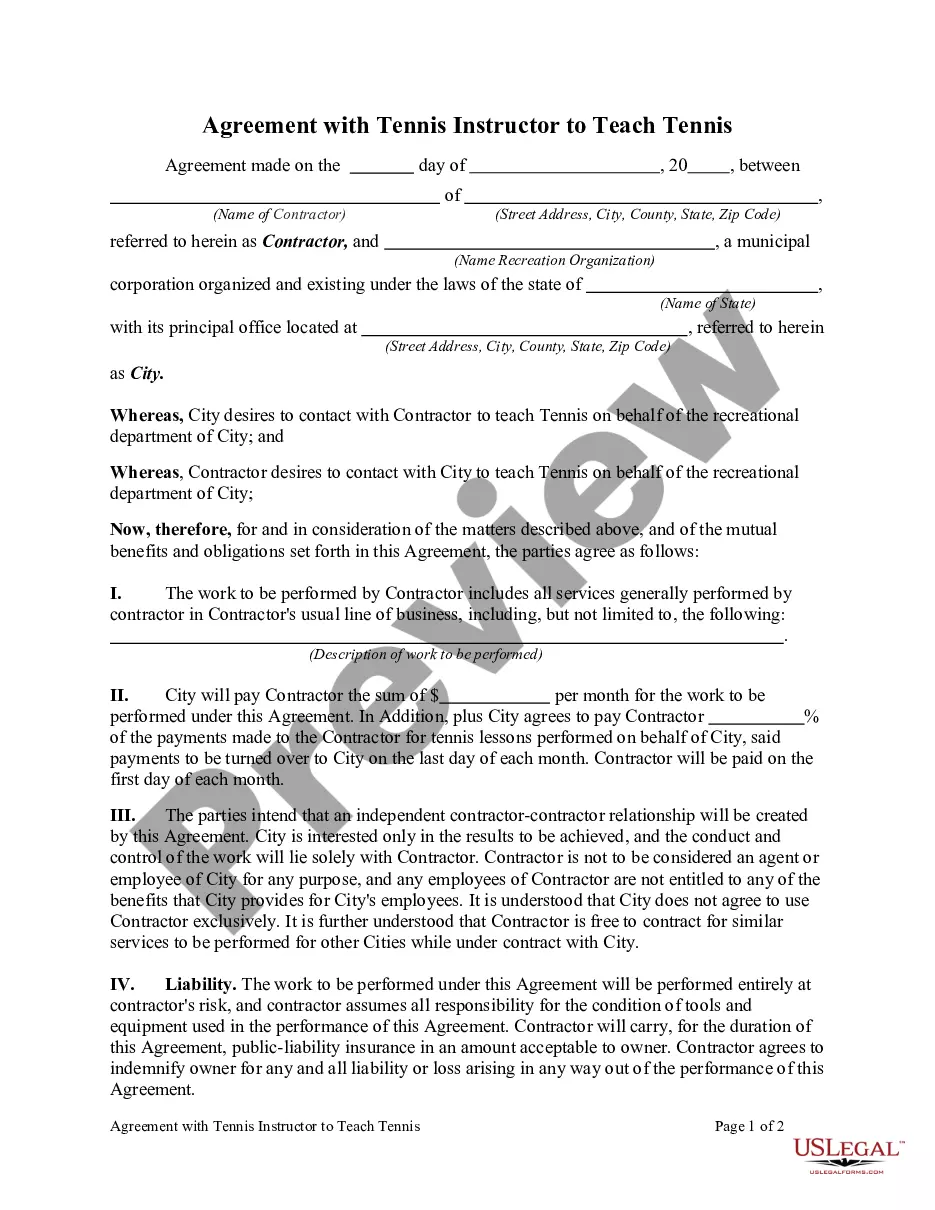

Utilize the US Legal Forms platform. This service offers a vast array of templates, including the Mississippi Sample Letter concerning Revolving Note and Loan Agreement, suitable for business and personal purposes.

You can preview the form using the Preview button and read the form description to ensure it suits your needs.

- All forms are reviewed by experts and comply with federal and state requirements.

- If you are currently registered, Log Into your account and click on the Acquire button to locate the Mississippi Sample Letter concerning Revolving Note and Loan Agreement.

- Use your account to access the valid forms you have previously purchased.

- Navigate to the My documents tab in your account to download another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward instructions for you.

- First, ensure you have selected the correct document for your location/county.

Form popularity

FAQ

There are 10 basic provisions that should be in a loan agreement.Identity of the Parties. The names of the lender and borrower need to be stated.Date of the Agreement.Interest Rate.Repayment Terms.Default provisions.Signatures.Choice of Law.Severability.

A loan agreement is a document, signed by both the lender and the borrower, that spells out the terms of the loan. These agreements are binding and can be simple or complex. The loan agreement lays out the repayment schedule, the costs to the borrower, and other rules or requirements.

A Loan Agreement is a document between a borrower and lender that details a loan repayment schedule. You can use our Loan Agreement template for a variety of purposes, including: Personal lending between friends or family. Business transactions, such as securing capital for a startup.

A loan note is a type of promissory agreement that outlines the legal obligations of the lender and the borrower. A loan note is a legally binding agreement that includes all the terms of the loan, such as the payment schedule, due date, principal amount, interest rate, and any prepayment penalties.

A Loan agreement is a standard type of document that sets out the terms of a loan and its repayment. It should be used whenever a substantial amount of money is involved, particularly if the lender and borrower are not very closely linked or wish to keep things on a more formal footing.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid. Default terms should be clearly detailed to avoid confusion or potential legal court action.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

What Are Loan Terms? Loan terms refers to the terms and conditions involved when borrowing money. This can include the loan's repayment period, the interest rate and fees associated with the loan, penalty fees borrowers might be charged, and any other special conditions that may apply.

To draft a Loan Agreement, you should include the following:The addresses and contact information of all parties involved.The conditions of use of the loan (what the money can be used for)Any repayment options.The payment schedule.The interest rates.The length of the term.Any collateral.The cancellation policy.More items...

The purpose of a loan agreement is to detail what is being loaned and when the borrower has to pay it back as well as how. The loan agreement has specific terms that detail exactly what is given and what is expected in return.