Mississippi Sample Letter for Deed of Trust

Description

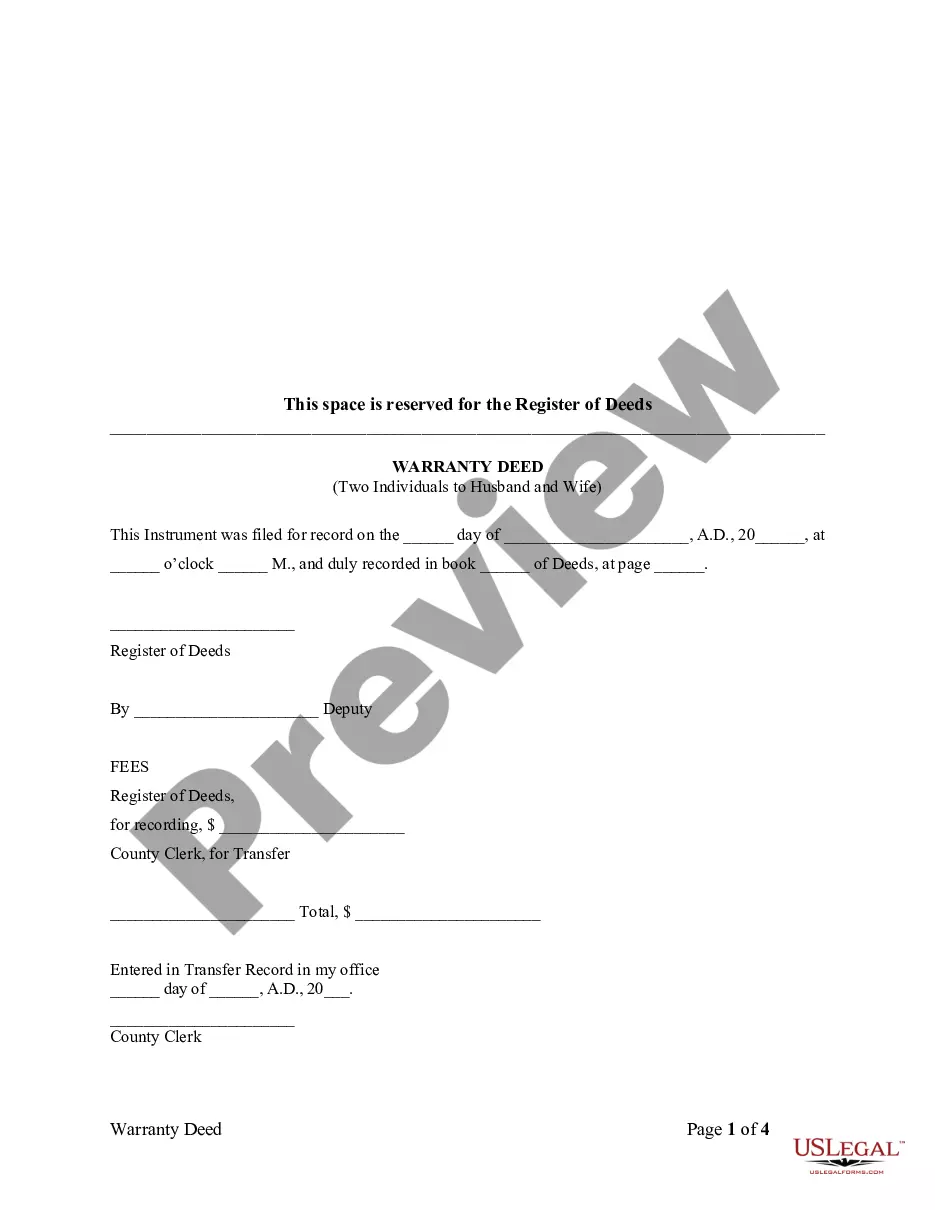

How to fill out Sample Letter For Deed Of Trust?

If you wish to full, obtain, or printing legal document templates, use US Legal Forms, the greatest collection of legal forms, that can be found on-line. Use the site`s simple and easy practical lookup to obtain the documents you want. Different templates for company and person functions are categorized by classes and says, or keywords. Use US Legal Forms to obtain the Mississippi Sample Letter for Deed of Trust in just a few clicks.

If you are already a US Legal Forms consumer, log in in your accounts and then click the Obtain switch to find the Mississippi Sample Letter for Deed of Trust. You can even entry forms you earlier downloaded within the My Forms tab of your accounts.

If you are using US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have chosen the shape for the appropriate town/nation.

- Step 2. Take advantage of the Preview choice to look through the form`s content material. Do not forget about to read the explanation.

- Step 3. If you are unhappy with the form, utilize the Lookup area towards the top of the screen to get other types of the legal form template.

- Step 4. Upon having identified the shape you want, select the Acquire now switch. Select the rates strategy you favor and include your accreditations to sign up on an accounts.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal accounts to complete the transaction.

- Step 6. Choose the formatting of the legal form and obtain it on your device.

- Step 7. Total, revise and printing or indication the Mississippi Sample Letter for Deed of Trust.

Every single legal document template you purchase is yours forever. You have acces to each and every form you downloaded in your acccount. Go through the My Forms segment and pick a form to printing or obtain once more.

Remain competitive and obtain, and printing the Mississippi Sample Letter for Deed of Trust with US Legal Forms. There are millions of expert and condition-distinct forms you can utilize to your company or person requires.

Form popularity

FAQ

A deed must identify the current owner, new owner, and any other parties to the deed. The parties must be identified by name, mailing address, and telephone number. The identifying information must be on the first page below the 3-inch top margin. Property description or indexing information.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.

A deed of trust involves three parties: (1) the trustor, who is the person who received the loan, (2) the beneficiary, who is the person who loaned the money to the trustor, and (3) the trustee, who is the person that released the loan once it has been paid off.

A simple example would be the situation in which one member of a family advances money to another and asks the second member to hold the money or to invest it for him. A more complicated example of an implied trust would be the situation in which one party provides money to another for the purchase of property.

Ing to the term of a trust instrument, it can be defined into different types. For example: Inter Vivo trust is created when the settlor is alive. Testamentary trust is usually created through the terms of a settlor's will and goes into effect after the death of the settlor.

Over to the Trustees mentioned hereunder, is hereby acknowledged by the Trustees, who hereby accept the appointment as such Trustees of the said Trust, under the terms and conditions, set out hereunder for the fulfillment of the objects of the Trust, more fully and particularly described and set out hereunder.

A Mississippi deed of trust is a document by which an owner's property title transfers to a neutral party (trustee) to serve as security for a real estate loan granted by a lender (beneficiary). The trustee holds onto the property title until the land owner (borrower) pays back the loan in full to the lender.

With a deed of trust, the lender gives the borrower the funds to make the home purchase. In exchange, the borrower provides the lender with a promissory note. The promissory note outlines the terms of the loan and the borrower's promise (hence the name) to pay.