Mississippi Contract with Independent Contractor for Systems Programming and Related Services

Description

How to fill out Contract With Independent Contractor For Systems Programming And Related Services?

It is feasible to spend countless hours online attempting to locate the legal document template that meets the federal and state criteria you require.

US Legal Forms offers an extensive selection of legal forms that have been reviewed by experts.

You can easily download or print the Mississippi Contract with Independent Contractor for Systems Programming and Related Services from their service.

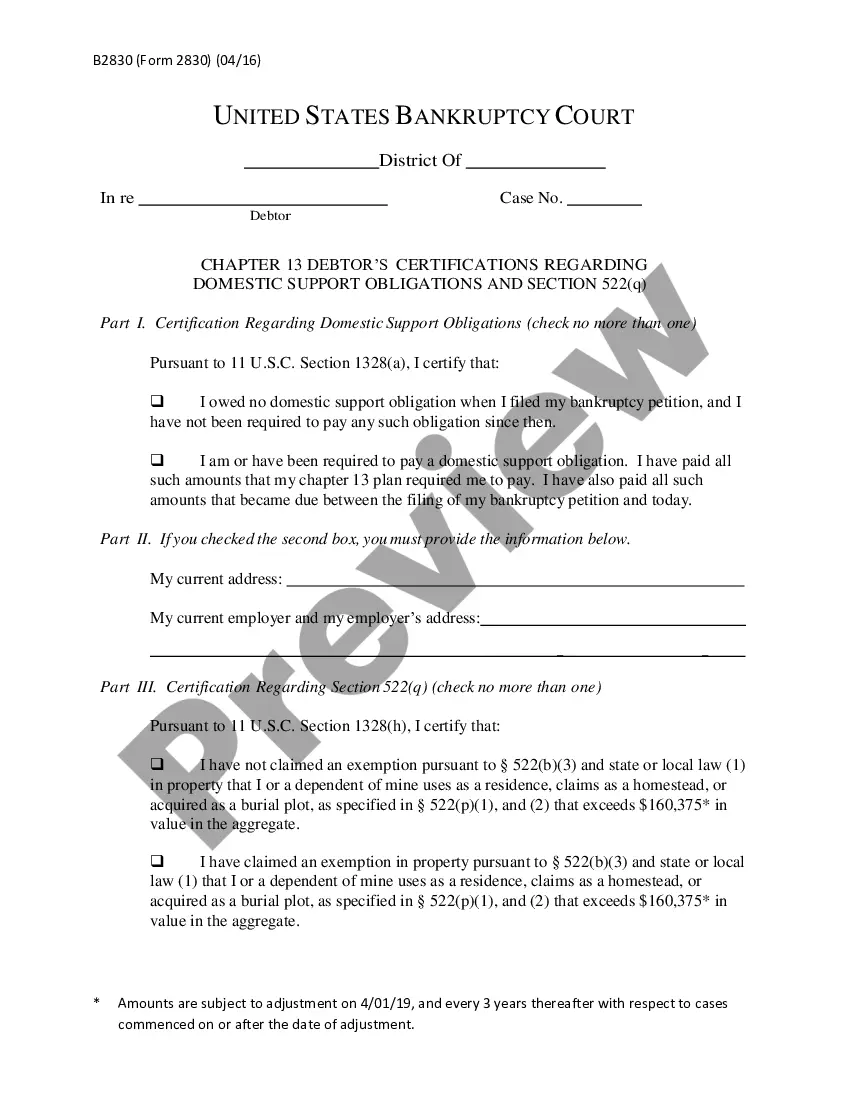

If available, utilize the Preview option to view the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- After that, you can fill out, modify, print, or sign the Mississippi Contract with Independent Contractor for Systems Programming and Related Services.

- Every legal document template you obtain is yours indefinitely.

- To receive another copy of any purchased form, go to the My documents section and select the corresponding option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city you choose.

- Review the form description to confirm you have selected the appropriate document.

Form popularity

FAQ

An attorney or accountant who has his or her own office, advertises in the yellow pages of the phone book under Attorneys or Accountants, bills clients by the hour, is engaged by the job or paid an annual retainer, and can hire a substitute to do the work is an example of an independent contractor.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

An independent contractor agreement is a contract between a freelancer and a company or client outlining the specifics of their work together. This legal contract usually includes information regarding the scope of the work, payment, and deadlines.

An independent contractor agreement is a legally binding document signed by a 1099 employee and the company that hires them. It outlines the scope of work and the terms under which that work will be completed, which goes a long way to making sure both parties are on the same page about the project from the start.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

While the occasional family member/friend helping out as a server on a busy day, or an attorney who comes in once or twice a year to update corporate documents or assist with legal matters are typically classified as independent contractors, regular servers, bartenders, and even cooks usually fall under the employee

There are a few subtle distinctions between the two definitions. The definition of a contractor seems to be broader; it is anyone to whom a business makes available consumers' personal information for a business purpose, as opposed to a service provider who must "process information" for a business.

A service provider is an individual or entity that provides services to another party. The provision of services between a service provider and a company is typically governed by a service agreement.

There are a few subtle distinctions between the two definitions. The definition of a contractor seems to be broader; it is anyone to whom a business makes available consumers' personal information for a business purpose, as opposed to a service provider who must "process information" for a business.