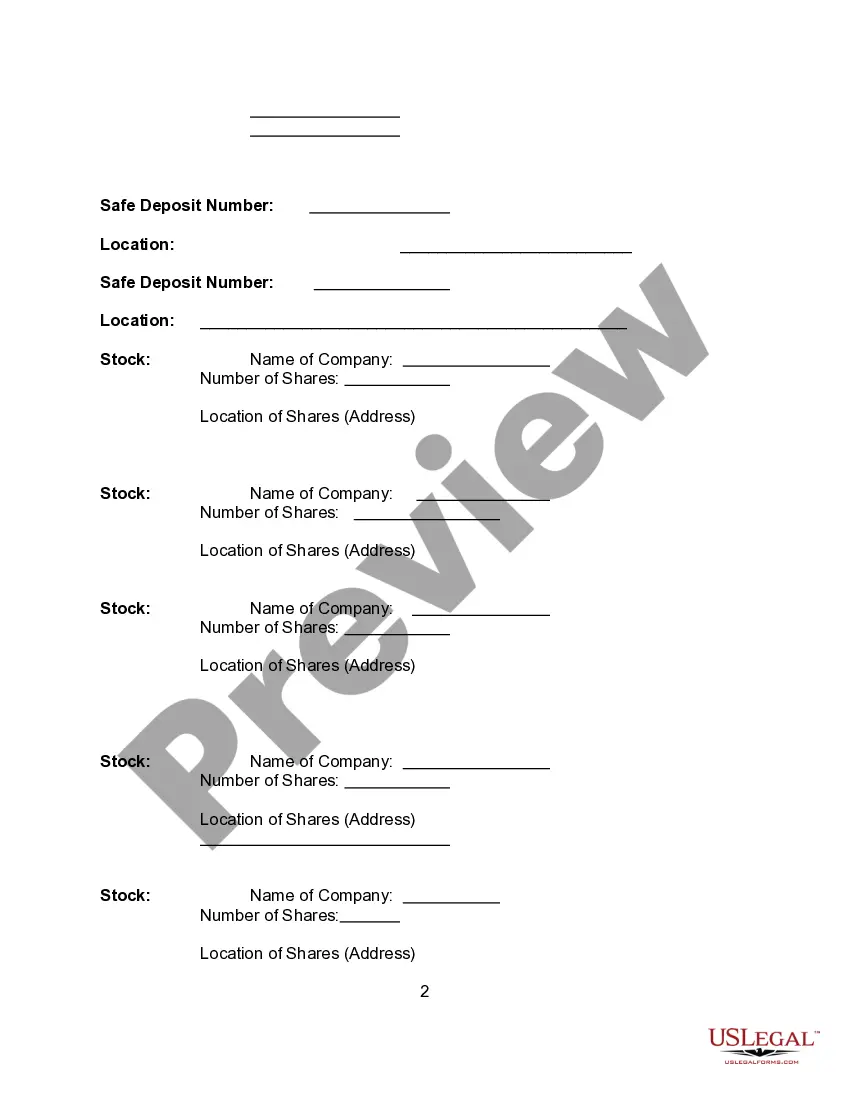

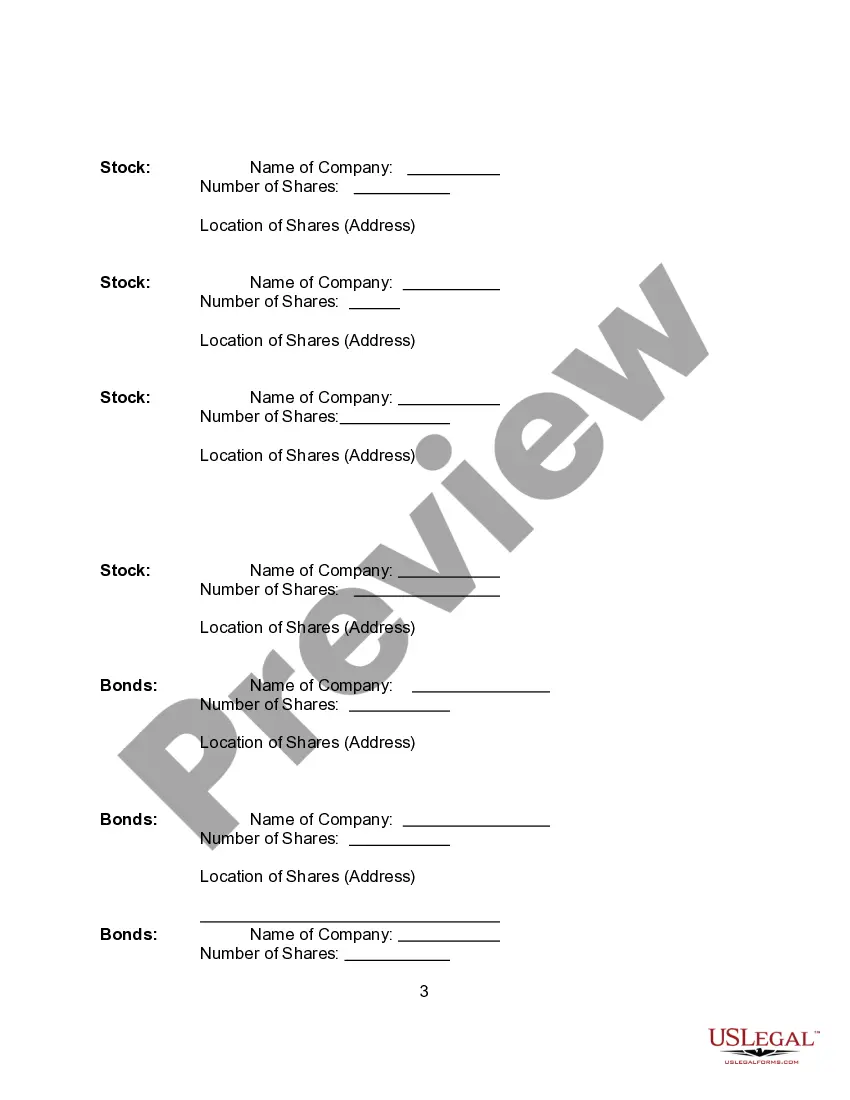

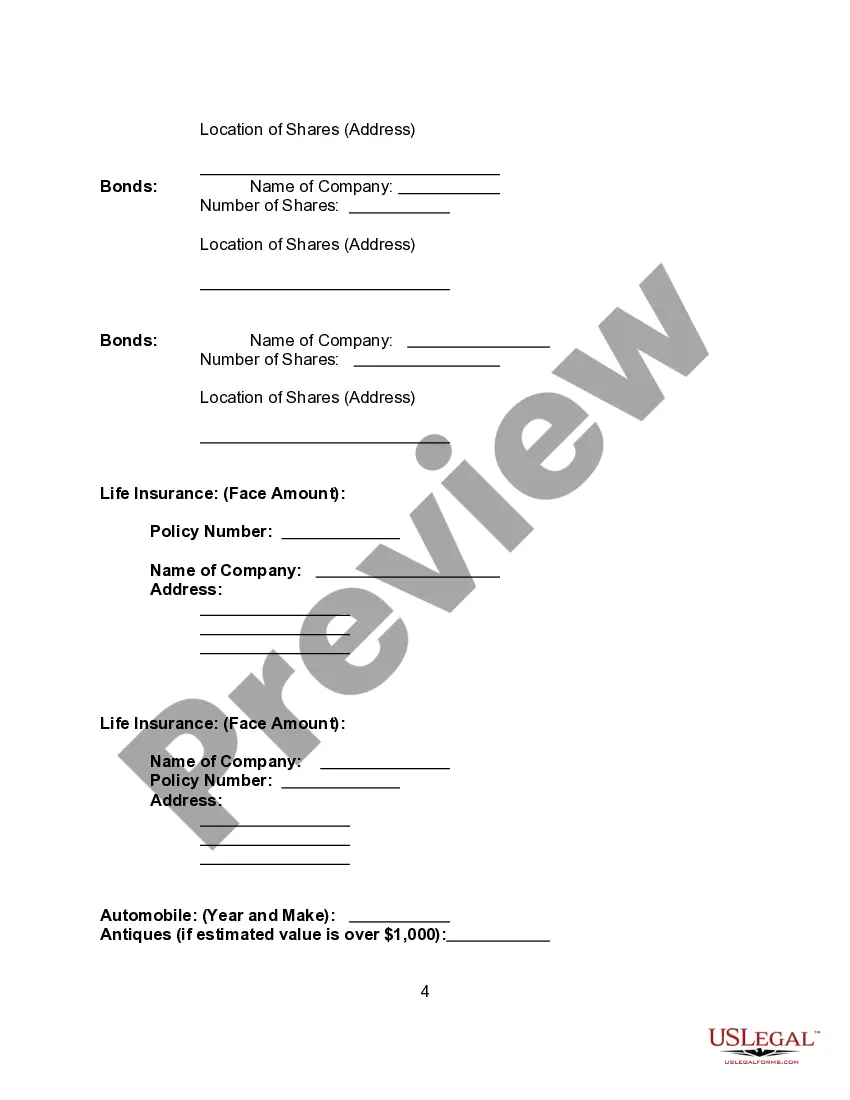

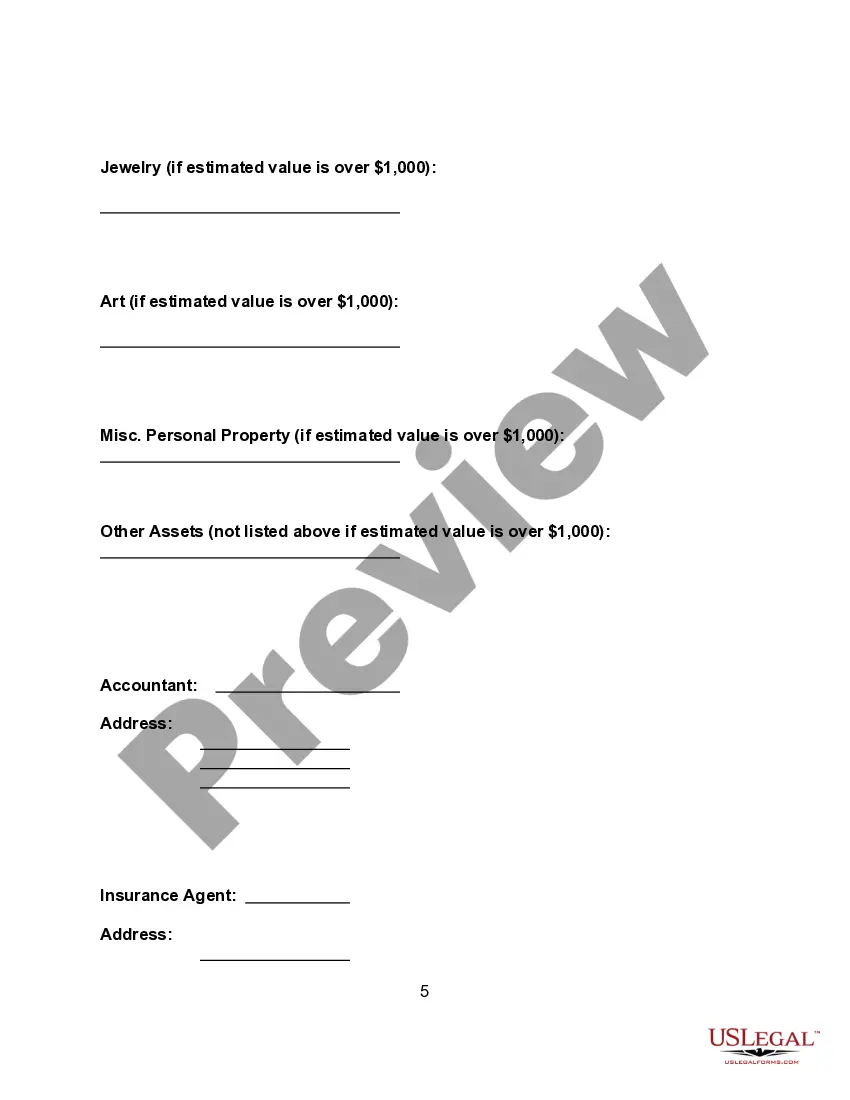

Mississippi Asset Information Sheet

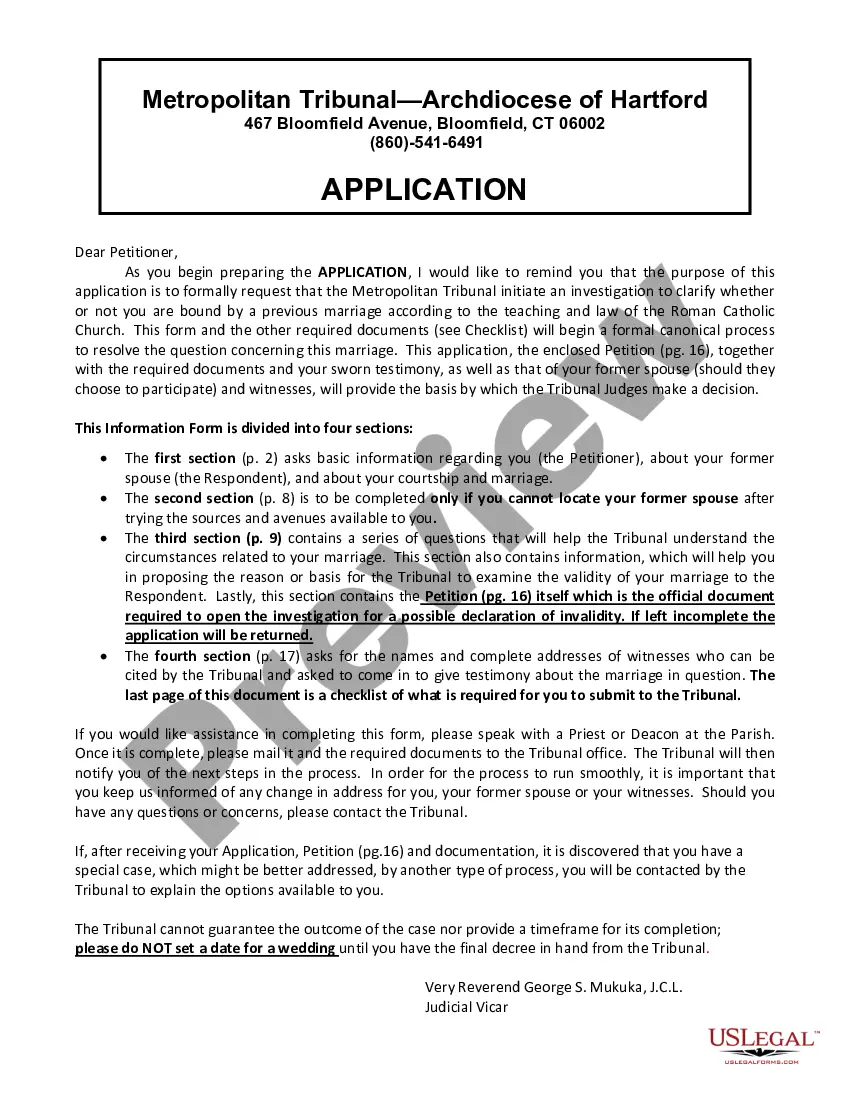

Description

How to fill out Asset Information Sheet?

You can spend hours online searching for the legal document model that complies with the federal and state criteria you need.

US Legal Forms offers thousands of legal documents that are reviewed by professionals.

It is easy to download or print the Mississippi Asset Information Sheet from my service.

If available, utilize the Review button to peruse the document template as well.

- If you already possess a US Legal Forms account, you may Log In and click on the Download button.

- Then, you may complete, modify, print, or sign the Mississippi Asset Information Sheet.

- Each legal document template you acquire is yours for an extended period.

- To obtain another copy of the received form, visit the My documents section and click the appropriate button.

- If this is your first time using the US Legal Forms website, follow the simple instructions below.

- First, ensure that you've chosen the correct document template for your area/city.

- Check the form description to confirm you have selected the suitable form.

Form popularity

FAQ

How to create a personal balance sheetStep 1: Make a list of your ASSETS and where to get the most current values.Step 2: Make a list of your DEBTS and where to get the most current values.Step 3: Compile the information.Step 4: Categorize your total assets.Step 5: Categorize your total liabilities / debts.More items...?

In other words, assets are items that benefit a company economically, such as inventory, buildings, equipment and cash. They help a business manufacture goods or provide services, now and in the future. Liabilities are a company's obligationseither money owed or services not yet performed.

How to Prepare a Personal Financial StatementCreate a spreadsheet that has a section for assets and one for liabilities.List your assets and their worth.List every liability as well as its worth.Determine the total of both assets and liabilities.Determine your net worth.

7 Common Items Missing from Your Financial Net Worth StatementCars and other motor vehicles. Understandably, most people exclude these depreciating assets from their net worth, unless they are collectibles.Collectibles.Jewelry.Cash value on life insurance.Taxes and liens.Hospital bills.Student loans.

Assets include the value of securities and funds held in checking or savings accounts, retirement account balances, trading accounts, and real estate. Liabilities include any debts the individual may have including personal loans, credit cards, student loans, unpaid taxes, and mortgages.

Total liabilities: Add up the total amount of your liabilities. Net worth: Subtract your total liabilities from your total assets to determine your net worth. Total: Add your Total Liabilities and your Net Worth. This value should be equal to your total assets.

Usually, liabilities are divided into two major categories current liabilities and long-term liabilities. On a balance sheet, liabilities are typically listed in order of shortest term to longest term, which at a glance, can help you understand what is due and when.

The balance sheet displays the company's total assets and how the assets are financed, either through either debt or equity. It can also be referred to as a statement of net worth or a statement of financial position. The balance sheet is based on the fundamental equation: Assets = Liabilities + Equity.

For example, if your assets total $208,000 and you currently owe $8,000 on credit card balances, loans, and other debts, your net worth today would be $200,000.

How to set up a personal net worth statement.List your assets (what you own), estimate the value of each, and add up the total. Include items such as:List your liabilities (what you owe) and add up the outstanding balances.Subtract your liabilities from your assets to determine your personal net worth.