A nonprofit corporation is one that is organized for charitable or benevolent purposes. These corporations include certain hospitals, universities, churches, and other religious organizations. A nonprofit entity does not have to be a nonprofit corporation, however. Nonprofit corporations do not have shareholders, but have members or a perpetual board of directors or board of trustees.

Mississippi Articles of Incorporation for Church Corporation

Description

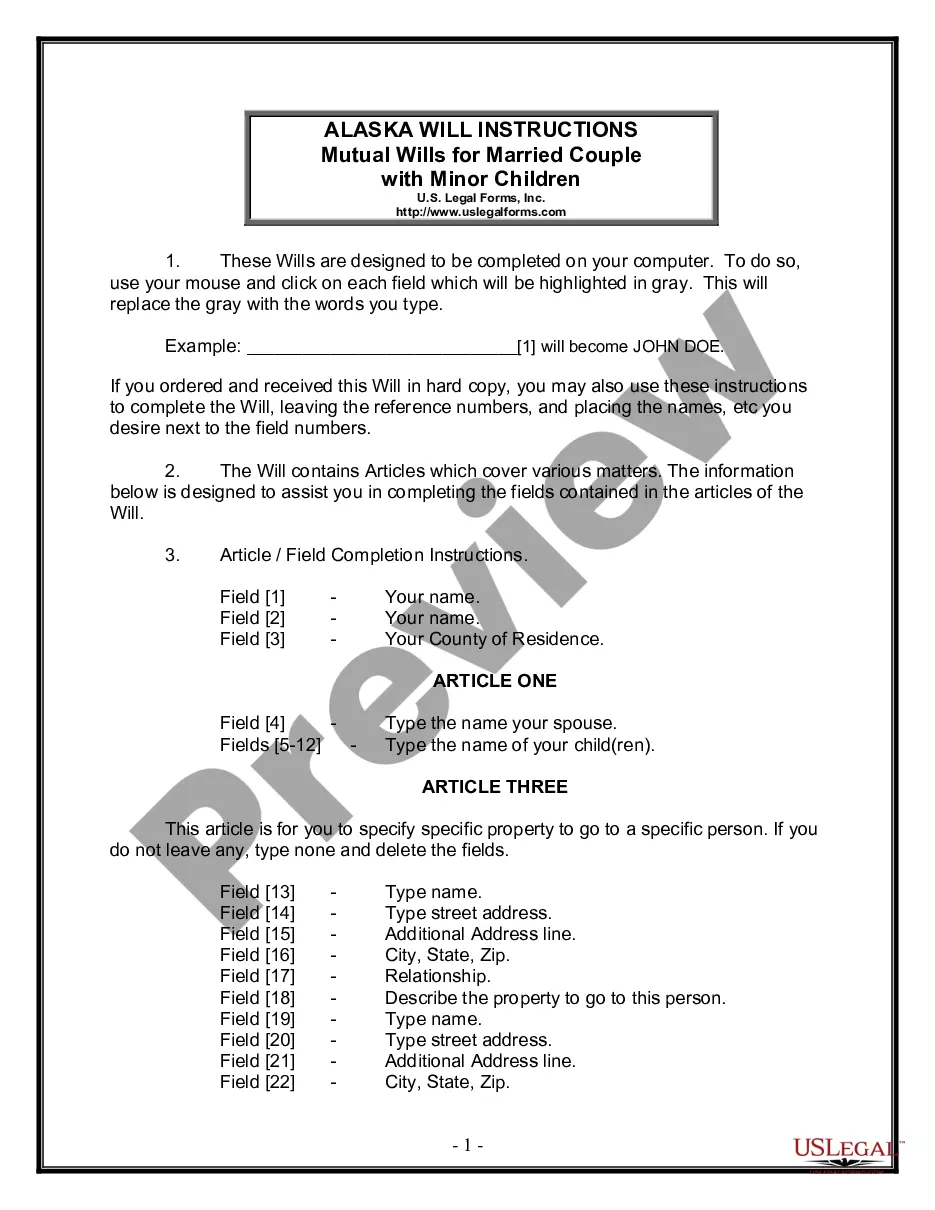

How to fill out Articles Of Incorporation For Church Corporation?

It is feasible to devote time online attempting to locate the authentic document format that aligns with the state and federal requirements you will need.

US Legal Forms offers a vast array of authentic forms that can be reviewed by experts.

You can conveniently obtain or print the Mississippi Articles of Incorporation for Church Corporation from our platform.

If available, use the Preview option to view the document format as well.

- If you possess a US Legal Forms account, you can Log In and select the Obtain option.

- Subsequently, you can complete, modify, print, or sign the Mississippi Articles of Incorporation for Church Corporation.

- Every authentic document format you acquire is yours indefinitely.

- To obtain another copy of any purchased form, navigate to the My documents tab and click the relevant option.

- If you're using the US Legal Forms site for the first time, follow the straightforward guidelines provided below.

- Firstly, ensure you have chosen the correct document format for the state/city of your preference.

- Review the form details to confirm you have selected the right form.

Form popularity

FAQ

Typically, a church is classified as a nonprofit corporation rather than an S or C corporation. This classification is important because it aligns with the IRS rules for tax-exempt status. The Mississippi Articles of Incorporation for Church Corporation serve to establish this nonprofit status, protecting the church's assets while allowing it to fulfill its mission. For detailed assistance in the incorporation process, US Legal Forms provides valuable tools to simplify the journey.

Understanding the distinction between a nonprofit and a 501c3 organization is essential for churches. All 501c3 organizations are nonprofits, but not all nonprofits qualify for 501c3 status. The 501c3 designation specifically grants tax-exempt status under federal law, allowing donations to be tax-deductible for donors. To navigate the complexities of incorporation and tax exemption, refer to the Mississippi Articles of Incorporation for Church Corporation and consider using US Legal Forms for guidance.

When deciding whether to incorporate a church or form an LLC, it is often advantageous to choose incorporation. The Mississippi Articles of Incorporation for Church Corporation provide a structured legal framework, offering protection for personal assets and ensuring compliance with state laws. Incorporating as a church also supports tax-exempt status, which is critical for many religious organizations. If you need assistance with this process, US Legal Forms offers resources to help you navigate the requirements.

Mississippi does not legally require an operating agreement for LLCs, but it is highly recommended to have one in place. An operating agreement outlines the ownership and management structure of your LLC, helping prevent future disputes. If you plan to establish a church corporation, Mississippi Articles of Incorporation for Church Corporation will take precedence, but having clear policies can greatly support your mission. Resources like USLegalForms can help you draft necessary documents effectively.

Most U.S. states require articles of organization when forming an LLC. This document establishes the business as a legal entity and outlines its management structure. While Mississippi Articles of Incorporation for Church Corporation differ in focus, many businesses nationwide benefit from understanding these requirements. Each state has its own rules, so be sure to check local regulations when forming your organization.

Yes, Mississippi does have articles of organization, which are required for forming a limited liability company (LLC). However, if you are focusing on establishing a church corporation, you will need to look into the specific requirements for Mississippi Articles of Incorporation for Church Corporation. This process differs slightly in structure and intent from articles of organization for LLCs. Ensuring compliance with these specific documents can save you time and resources.

No, Articles of Incorporation and 501(c)(3) status are not the same thing, although they are related. The Articles of Incorporation are the initial documents filed to establish a nonprofit corporation, while 501(c)(3) designation is a federal tax-exempt status granted by the IRS. To obtain 501(c)(3) status, organizations must first incorporate and then apply for this designation, which can provide significant tax advantages.

In Mississippi, a nonprofit must have at least three board members. These individuals play a crucial role in governing the organization and making decisions that align with its mission. It’s essential that board members are not related to each other, as this fosters unbiased decision-making and enhances the nonprofit's credibility.

To create Articles of Incorporation for a nonprofit in Mississippi, start by gathering necessary information about your organization. This includes the name, purpose, and details about your board members. You can then draft the Articles using a template or seek assistance from platforms like USLegalForms, which can guide you through the process and ensure compliance with state requirements.

While it is not legally required for a nonprofit to incorporate, doing so offers several benefits. Incorporating provides limited liability protection for board members and ensures the organization can enter into contracts, own property, and apply for grants. For many, these advantages make incorporating, particularly as a Mississippi Articles of Incorporation for Church Corporation, a strategic choice.