Mississippi Worksheet - Escrow Fees

Description

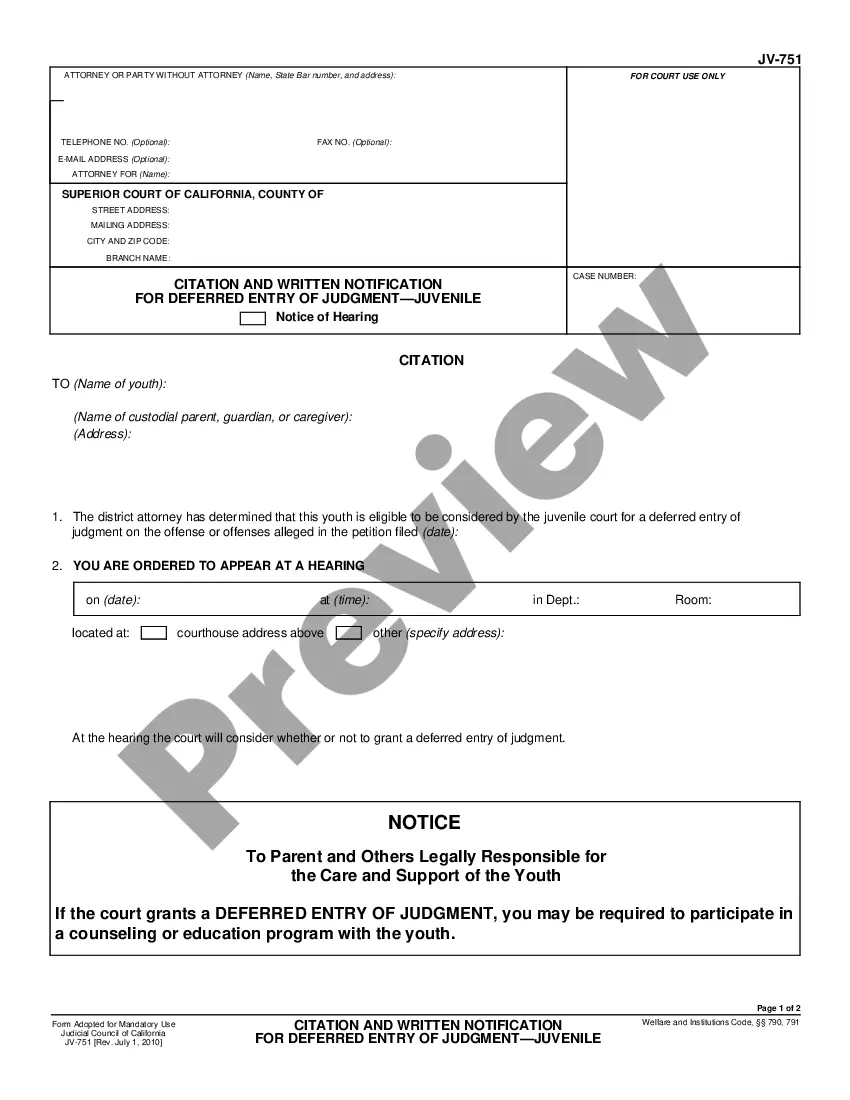

How to fill out Worksheet - Escrow Fees?

Are you currently within a position that you require paperwork for sometimes enterprise or personal functions nearly every day time? There are a lot of authorized file layouts available online, but getting versions you can depend on is not effortless. US Legal Forms delivers thousands of type layouts, much like the Mississippi Worksheet - Escrow Fees, that happen to be composed to fulfill state and federal needs.

Should you be presently informed about US Legal Forms web site and also have an account, simply log in. After that, you are able to acquire the Mississippi Worksheet - Escrow Fees template.

If you do not provide an account and wish to start using US Legal Forms, abide by these steps:

- Discover the type you want and make sure it is for the right metropolis/region.

- Utilize the Review option to check the shape.

- Look at the explanation to actually have chosen the correct type.

- In the event the type is not what you`re trying to find, use the Look for discipline to find the type that suits you and needs.

- When you get the right type, click on Purchase now.

- Select the costs program you would like, complete the desired info to make your account, and pay for the transaction using your PayPal or Visa or Mastercard.

- Pick a handy file structure and acquire your duplicate.

Discover all the file layouts you possess purchased in the My Forms menu. You can obtain a further duplicate of Mississippi Worksheet - Escrow Fees whenever, if necessary. Just click on the essential type to acquire or print out the file template.

Use US Legal Forms, the most substantial collection of authorized kinds, to save lots of some time and avoid mistakes. The service delivers professionally created authorized file layouts that you can use for a selection of functions. Make an account on US Legal Forms and initiate producing your daily life easier.

Form popularity

FAQ

The average closing cost for a buyer in Mississippi is 1.0% of the total purchase price, as per ClosingCorp. It includes the cost of financing, property-related costs, and paperwork costs. Not all Mississippi home buyers pay the same costs at closing.

How Much Are Closing Costs in Mississippi? Closing costs in Mississippi are, on average, $2,016 for a home priced at $200,423, ing to a 2021 report by ClosingCorp, which provides research on the U.S. real estate industry. That price tag makes up 1.01 percent of the home's price tag.

Owner's title insurance: 0.27% In Mississippi, it's more common for the seller to pay for owner's title insurance. If you do pay part of the bill, owner's title insurance usually costs around 0.27% of a Mississippi home's final sale price ? or $484 for a $177,536 home.

Just like owner's title insurance protects the buyer, lender's title insurance protects the bank or financial institution that issued the buyer a mortgage. In Mississippi, the buyer usually pays for lender's title insurance, so you're off the hook.

Title insurance cost They'll depend on which state you live in. Some states have fixed premiums; that means you'll have roughly the same title insurance cost no matter who you buy from. Other states let the title insurance providers set the premium cost, so you can shop around for the best price.

The Bottom Line: Escrow Is Mutually Beneficial, But Not Free These fees pay for third-party services that help you sell your home or complete the tasks required to successfully close your loan.

You could pay a large amount of money on the low chance of using the policy, so it may seem like wasted money. You don't plan to own the property for long. If you're flipping or living temporarily in a home you've bought, it may not be worth buying title insurance.

While the prevalent practice is that the seller purchases it, it is negotiable. The buyer has to purchase the lender's title policy in Mississippi to protect the mortgage broker's interests in the transaction. While applying for a refinance, the homebuyer or the lender is at liberty to choose the title company.