Mississippi Term Loan Agreement between Business or Corporate Borrower and Bank

Description

The Federal Truth in Lending Act and the regulations promulgated under the Act apply to certain credit transactions, primarily those involving loans made to a natural person and intended for personal, family, or household purposes and for which a finance charge is made, or loans that are payable in more than four installments. However, said Act and regulations do not apply to a business loan of this type.

How to fill out Term Loan Agreement Between Business Or Corporate Borrower And Bank?

If you need to full, obtain, or printing legitimate papers web templates, use US Legal Forms, the most important assortment of legitimate varieties, which can be found online. Take advantage of the site`s basic and convenient look for to find the paperwork you require. Various web templates for organization and individual uses are sorted by classes and suggests, or search phrases. Use US Legal Forms to find the Mississippi Term Loan Agreement between Business or Corporate Borrower and Bank within a couple of clicks.

In case you are currently a US Legal Forms buyer, log in for your bank account and click the Obtain switch to find the Mississippi Term Loan Agreement between Business or Corporate Borrower and Bank. You may also entry varieties you previously acquired inside the My Forms tab of your respective bank account.

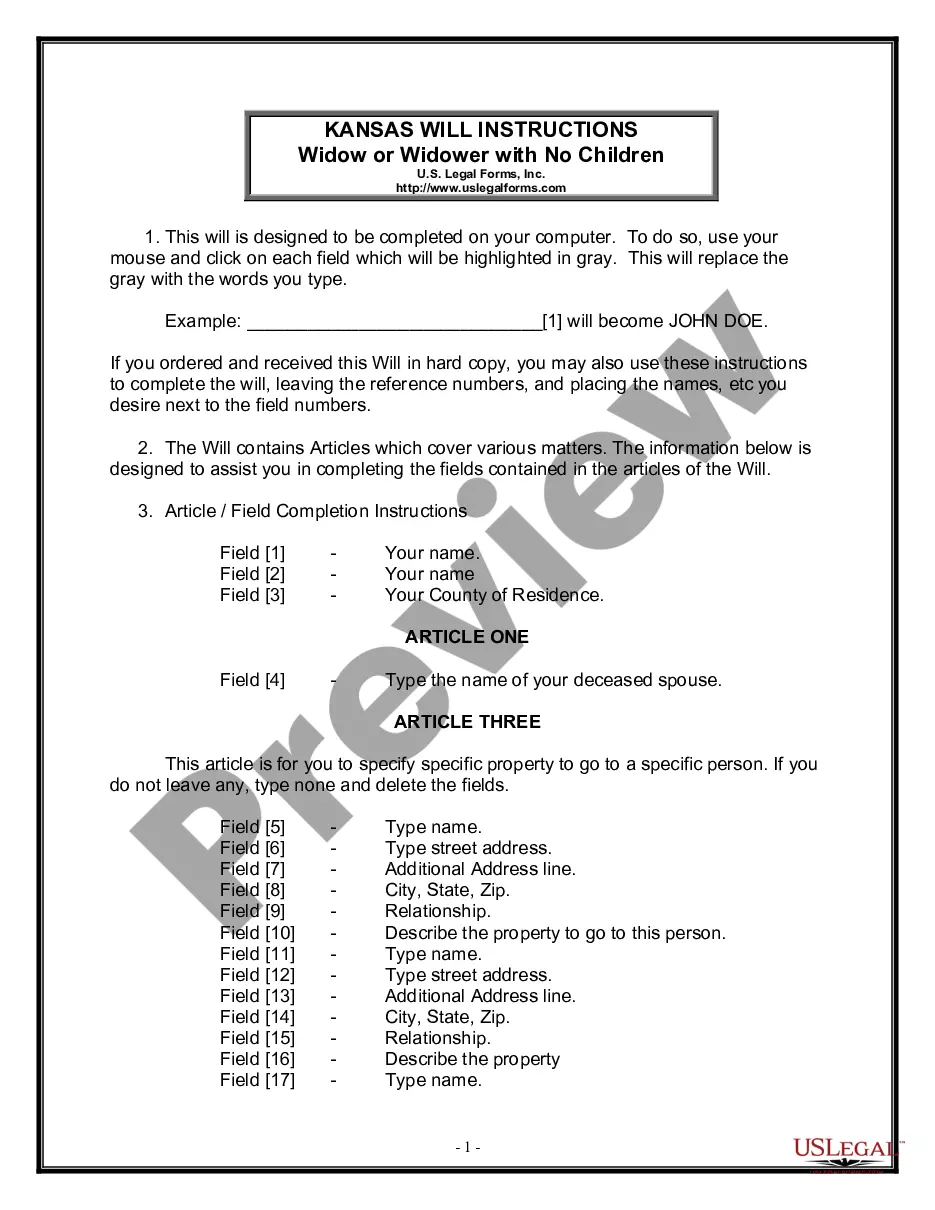

If you use US Legal Forms initially, follow the instructions listed below:

- Step 1. Make sure you have chosen the shape for that appropriate town/country.

- Step 2. Utilize the Preview option to look over the form`s content material. Never forget to read through the outline.

- Step 3. In case you are not satisfied together with the develop, take advantage of the Search discipline towards the top of the screen to get other types of the legitimate develop design.

- Step 4. When you have discovered the shape you require, click the Buy now switch. Pick the prices strategy you favor and put your accreditations to sign up for an bank account.

- Step 5. Approach the purchase. You should use your bank card or PayPal bank account to perform the purchase.

- Step 6. Select the format of the legitimate develop and obtain it on your own system.

- Step 7. Total, change and printing or signal the Mississippi Term Loan Agreement between Business or Corporate Borrower and Bank.

Each and every legitimate papers design you acquire is your own property forever. You may have acces to every single develop you acquired in your acccount. Click on the My Forms portion and decide on a develop to printing or obtain once more.

Remain competitive and obtain, and printing the Mississippi Term Loan Agreement between Business or Corporate Borrower and Bank with US Legal Forms. There are thousands of professional and state-particular varieties you can utilize for the organization or individual requirements.

Form popularity

FAQ

A couple of examples could include infrastructure finance, working capital finance, term loans, letter of credit etc.

An intercompany loan agreement, also known as an intracompany loan agreement, outlines the terms and conditions of a loan between one company and another. For example, if a company has short-term financial needs, it may opt for an intercompany loan instead of an outside financing source.

A loan agreement, sometimes used interchangeably with terms like note payable, term loan, IOU, or promissory note, is a binding contract between a borrower and a lender that formalizes the loan process and details the terms and schedule associated with repayment.

A credit agreement is a legally binding contract documenting the terms of a loan, made between a borrower and a lender. A credit agreement is used with many types of credit, including home mortgages, credit cards, and auto loans. Credit agreements can sometimes be renegotiated under certain circumstances.

Meaning of corporate loan in English a loan that is given to a company, rather than to a government organization or an individual person: The bank said demand for large corporate loans was low but offset by growth in personal lending.

3 key components of a business loan Principal. Principal is a fancy name for the amount of money you have borrowed and have yet to pay back. ... Interest. Interest is the amount of money a borrower pays the lender in exchange for the privilege of using their money. ... Fees. ... Putting it all together.

A business loan agreement is a legal document between you and your lender, whether that's a bank, credit union, online lender or even a family member. It serves both parties by clarifying everything about the loan, including its repayment schedule and any collateral that secures it.

A business loan agreement is a legally binding document that outlines the details of a loan between a lender and borrower. Loan agreements typically include information like the loan amount, repayment term and due dates, interest rates and other costs.