Mississippi Notice of Default on Promissory Note Installment

Description

Form popularity

FAQ

If someone defaults on a promissory note, first, review the terms to determine your options. Reach out to the borrower to discuss the situation and explore solutions, such as a payment plan. If these discussions do not yield results, issue a Mississippi Notice of Default on Promissory Note Installment to formally document the default. Utilizing the resources from USLegalForms can facilitate the entire process.

When facing default on a promissory note, options include contacting the borrower for payment or renegotiating terms. If these efforts fail, you can pursue legal action to recover the owed amount. Additionally, a Mississippi Notice of Default on Promissory Note Installment can be a powerful tool to initiate this process. Access templates on USLegalForms to streamline your approach.

Issuing a Mississippi Notice of Default on Promissory Note Installment requires notifying the borrower in writing. Make sure to deliver the notice via certified mail for proper documentation. It’s also wise to keep a copy for your records, as this may be crucial if legal action is necessary. USLegalForms provides resources to ensure your communication meets legal requirements.

To write a Mississippi Notice of Default on Promissory Note Installment, begin by identifying the parties involved and the date of the agreement. Clearly state the nature of the default, including the specific payment missed and the total amount due. Include a demand for payment and a timeframe within which the borrower must respond. Templates and forms available on USLegalForms can simplify this process.

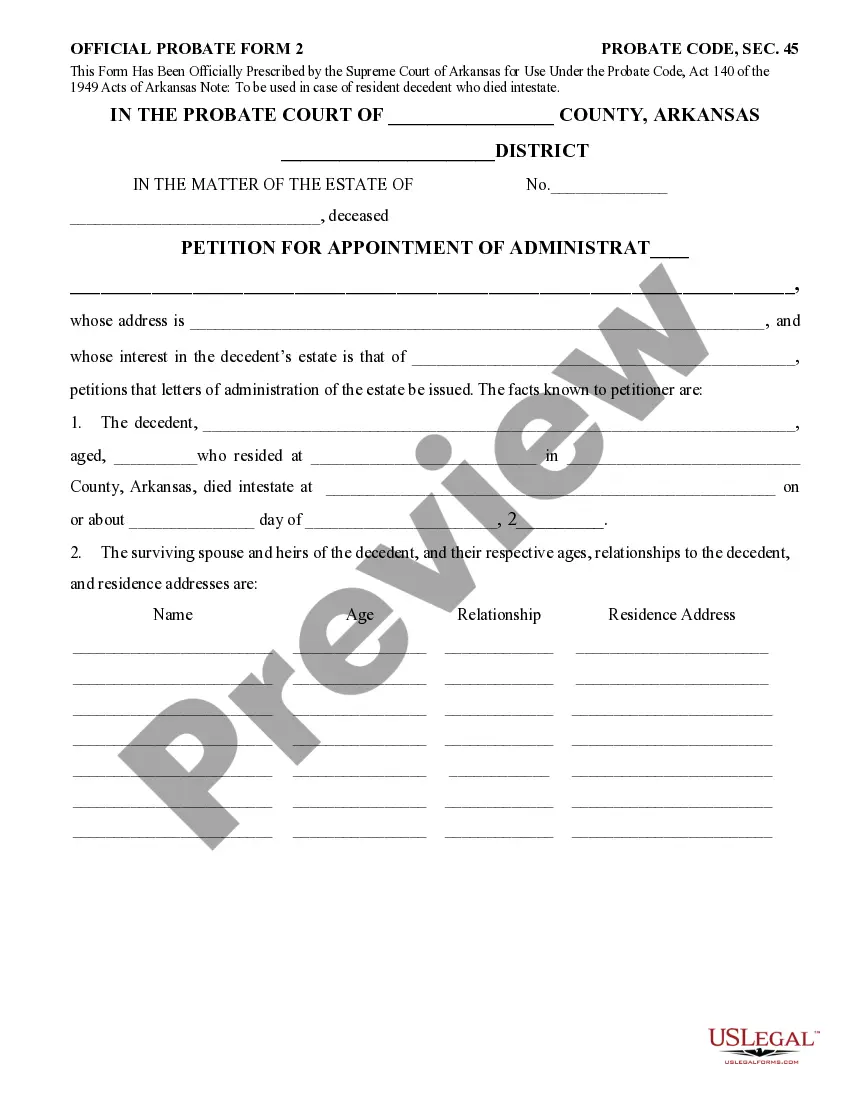

A notice of default typically has a formal formatting style and includes the borrower's name, the details of the promissory note, and a clear statement of default. The document is concise and contains essential information, such as missed payment dates and the total amount due, in line with the Mississippi Notice of Default on Promissory Note Installment. It may also include guidance on how the borrower can remedy the default situation.

To issue a default notice, gather all relevant details about the promissory note, including payment history and terms. Draft the notice, being sure to include specifics regarding the default, such as missed payments and total outstanding amounts under the Mississippi Notice of Default on Promissory Note Installment. Finally, deliver the notice to the borrower through a method that provides proof of receipt, ensuring that you keep a copy for your records.

A notice of default on a promissory note is a formal declaration that the borrower has failed to meet their repayment terms. This legal document is essential for protecting the lender's rights under the Mississippi Notice of Default on Promissory Note Installment. It provides the borrower with a clear indication of their outstanding obligations and the consequences if they do not act.

If someone defaults on a promissory note, the first step is to issue a formal Mississippi Notice of Default on Promissory Note Installment. This notice informs the borrower of their default status and encourages them to take corrective action. After sending the notice, consider negotiating a payment plan or pursuing legal action if necessary, while keeping communication open and constructive.

Writing a default notice begins with clearly stating the reason for the notice, such as a missed payment on the Mississippi Notice of Default on Promissory Note Installment. Include details like the amount due, the due date, and any applicable penalties. Conclude with instructions for the borrower on how to remedy the default, ensuring clarity and professionalism throughout the document.

A default notice typically outlines the specific terms under which a borrower has failed to meet their obligations. For instance, if a borrower misses a payment on their Mississippi Notice of Default on Promissory Note Installment, the notice would detail the missed payment amount and the total due. It serves to formally inform the borrower of their default status and provides a clear path for resolution.