This form is a notice of a failure to make a required payment when due pursuant to a promissory note. The form also contains a warning to the breaching party that legal action will be taken unless the breach is remedied on or before a certain date. This form is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a notice in a particular jurisdiction.

Mississippi Notice of Default in Payment Due on Promissory Note

Description

How to fill out Notice Of Default In Payment Due On Promissory Note?

Selecting the appropriate legal document template can be a challenge.

Clearly, there are numerous templates accessible online, but how can you find the legal type you need.

Utilize the US Legal Forms website. The service provides a vast array of templates, including the Mississippi Notice of Default in Payment Due on Promissory Note, which you can utilize for business and personal purposes.

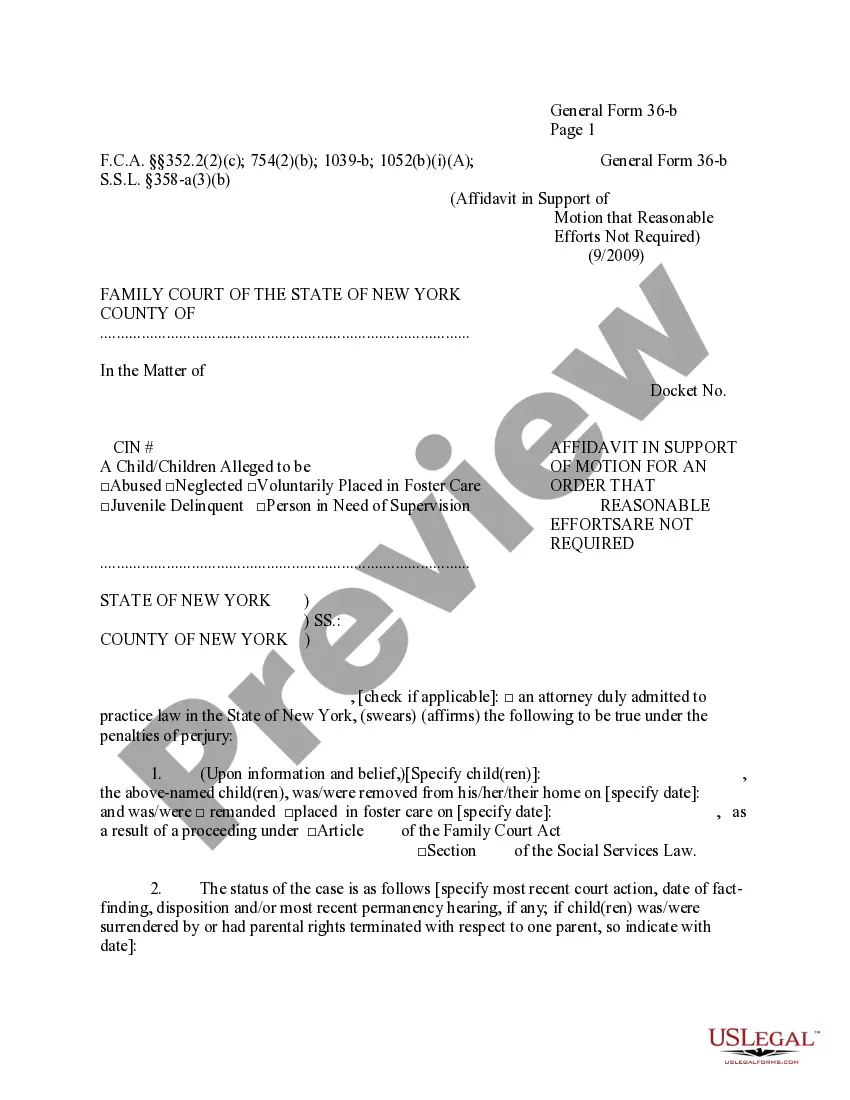

First, ensure you have selected the correct form for your city/state. You can review the document using the Review button and read the form details to confirm it is suitable for you.

- All of the forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Mississippi Notice of Default in Payment Due on Promissory Note.

- Use your account to browse through the legal forms you have acquired previously.

- Visit the My documents tab of your account and obtain another copy of the documents you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

Form popularity

FAQ

A house can be foreclosed relatively quickly in Mississippi, typically within 3 to 6 months after missing a payment. The issuance of a Mississippi Notice of Default in Payment Due on Promissory Note initiates this timeline. Therefore, it is crucial to address any payment issues as soon as possible to avoid this outcome.

Closing on a house in Mississippi usually takes about 30 to 45 days after the offer is accepted. However, this timeframe can vary based on several factors such as financing and inspections. It's essential to stay in communication with your real estate agent and lender to ensure a smooth process.

Foreclosure on a house in Mississippi can take approximately 3 to 6 months, depending on several factors. Receiving a Mississippi Notice of Default in Payment Due on Promissory Note is a key event in this process. Hence, it’s important to act promptly if you receive such a notice to explore your options.

The duration of a foreclosure in Mississippi can vary, but it typically takes about 3 to 6 months. This timeframe begins after the Mississippi Notice of Default in Payment Due on Promissory Note is sent to the borrower. Factors such as court schedules and the borrower's response may affect the length of the process.

Yes, you can foreclose on a promissory note if the borrower fails to make payments. In Mississippi, once you receive a Mississippi Notice of Default in Payment Due on Promissory Note, you can initiate foreclosure proceedings. This process allows the lender to reclaim the property in order to recover the outstanding debt.

To write a default notice, include key details such as the borrower's name, the date of the original promissory note, and a summary of the default situation. Clearly state the amount owed and reference the Mississippi Notice of Default in Payment Due on Promissory Note as part of the process. This notice should be concise yet detailed, outlining any necessary actions the borrower should take to remedy the situation.

If someone defaults on a promissory note, start by contacting them to discuss the situation and explore possible solutions. If informal communication is ineffective, send a Mississippi Notice of Default in Payment Due on Promissory Note to legally document the default. Should the borrower still fail to respond, consider seeking legal counsel to determine the best course of action moving forward.

A notice of default on a promissory note is a formal announcement that the borrower has failed to meet the payment obligations outlined in the agreement. This document serves as a trigger for potential legal actions by the lender. By issuing a Mississippi Notice of Default in Payment Due on Promissory Note, the lender notifies the borrower of the default and provides them with information on the next steps.

Yes, a promissory note can hold up in court, provided it meets specific legal requirements. It should clearly outline the terms, including the amount, interest rate, and repayment schedule. If you need to enforce the note, having a valid Mississippi Notice of Default in Payment Due on Promissory Note can strengthen your case in legal proceedings.

When someone defaults on a promissory note, first review the terms of the agreement to understand your rights. Next, attempt to communicate with the borrower to find a resolution, as they may be willing to negotiate a new repayment schedule. If these steps do not yield results, consider issuing a Mississippi Notice of Default in Payment Due on Promissory Note to formally document the default and outline the next steps.