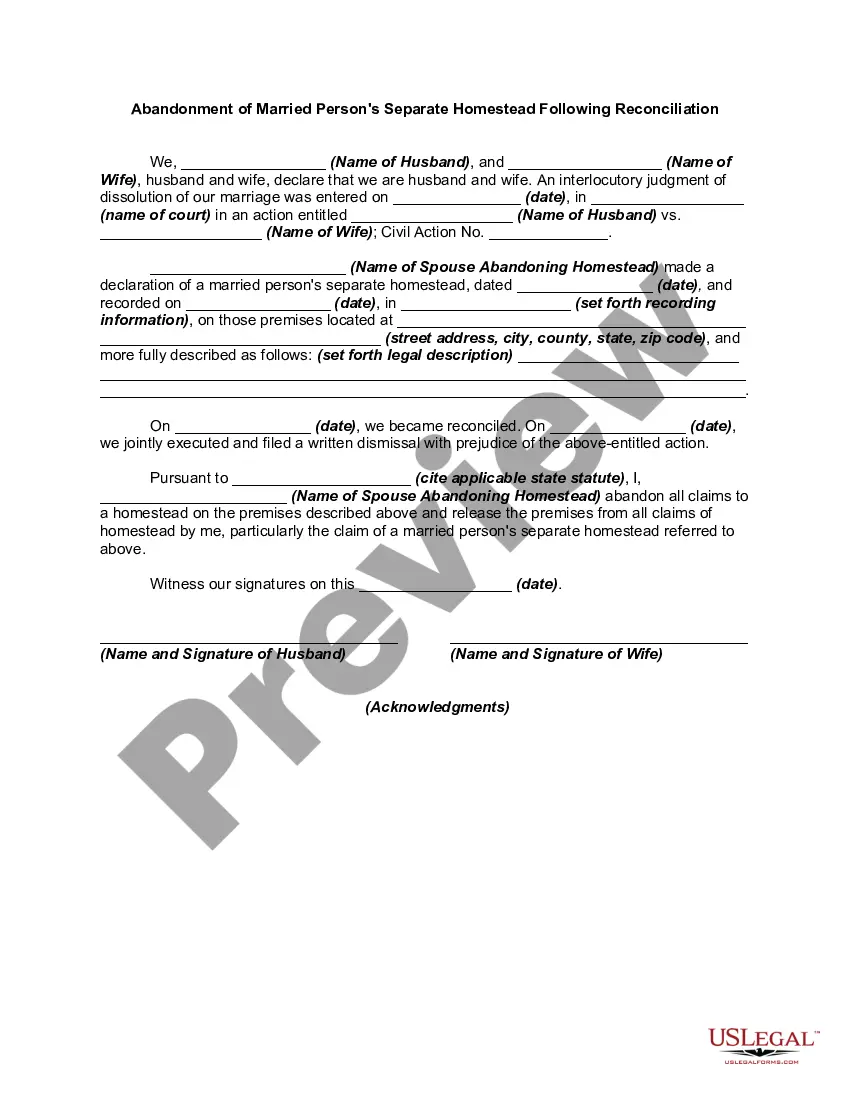

Are you currently within a place where you need to have files for either business or person reasons almost every working day? There are plenty of authorized record templates available on the Internet, but locating versions you can trust isn`t straightforward. US Legal Forms delivers thousands of type templates, much like the Mississippi Homestead Declaration following Decree of Legal Separation or Divorce, that happen to be composed to meet state and federal needs.

When you are presently informed about US Legal Forms internet site and get a merchant account, merely log in. After that, you are able to acquire the Mississippi Homestead Declaration following Decree of Legal Separation or Divorce web template.

Unless you offer an profile and need to begin to use US Legal Forms, follow these steps:

- Obtain the type you require and make sure it is for that proper town/state.

- Take advantage of the Preview key to check the form.

- Look at the explanation to ensure that you have chosen the appropriate type.

- In case the type isn`t what you are trying to find, utilize the Search discipline to discover the type that fits your needs and needs.

- When you get the proper type, click on Get now.

- Opt for the rates strategy you would like, complete the necessary info to make your money, and pay for the transaction utilizing your PayPal or credit card.

- Decide on a practical document formatting and acquire your version.

Locate all of the record templates you might have bought in the My Forms menu. You can obtain a extra version of Mississippi Homestead Declaration following Decree of Legal Separation or Divorce whenever, if necessary. Just go through the required type to acquire or produce the record web template.

Use US Legal Forms, the most substantial assortment of authorized forms, to conserve time and stay away from errors. The assistance delivers skillfully produced authorized record templates which can be used for a selection of reasons. Make a merchant account on US Legal Forms and commence generating your way of life easier.