Mississippi Non-Disclosure Agreement for Potential Investors

Description

How to fill out Non-Disclosure Agreement For Potential Investors?

If you want to be thorough, obtain, or create legal document templates, utilize US Legal Forms, the largest repository of legal documents accessible online.

Take advantage of the site's simple and user-friendly search feature to obtain the forms you need.

Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click the Buy Now option.

Select the payment plan you prefer and enter your details to register for an account.

- Use US Legal Forms to download the Mississippi Non-Disclosure Agreement for Potential Investors with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and select the Download option to locate the Mississippi Non-Disclosure Agreement for Potential Investors.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

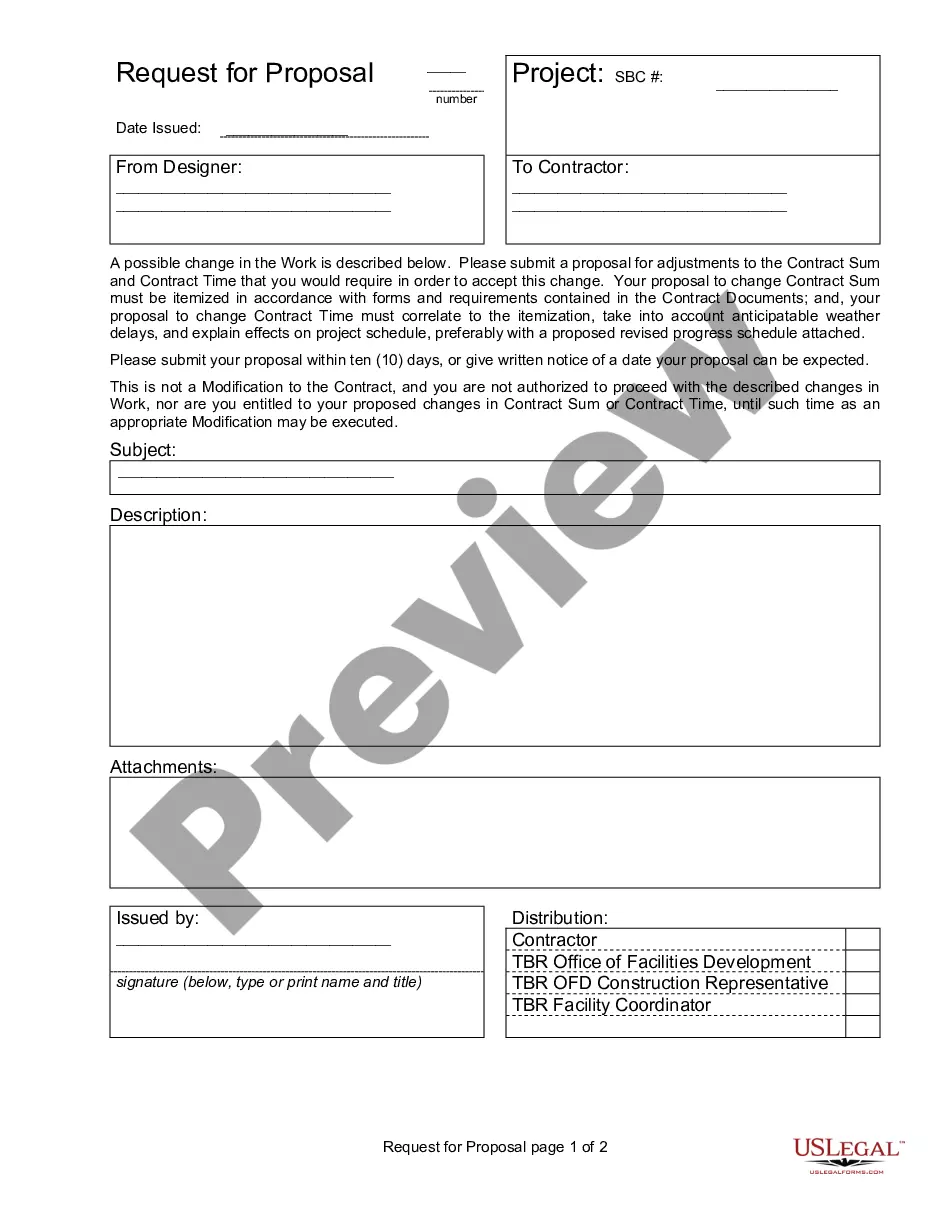

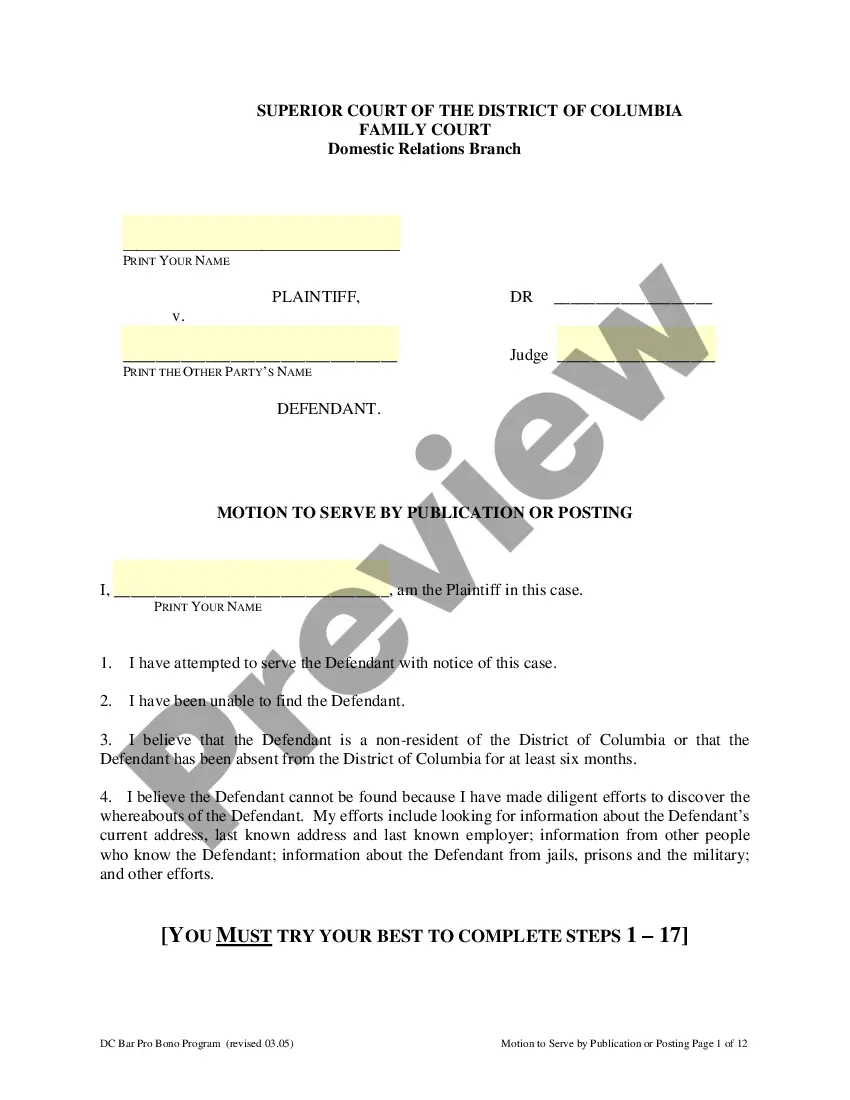

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Certainly, you can write your own Mississippi Non-Disclosure Agreement for Potential Investors using straightforward language and a clear structure. It’s essential to cover all relevant aspects, such as confidentiality duration and obligations. For convenience, consider using platforms like US Legal Forms, which offer templates to help guide you through the process.

Filling out a Mississippi Non-Disclosure Agreement for Potential Investors involves providing relevant information such as the names of the parties involved, specifics about the confidential information, and agreeing on the terms. Carefully read each section to ensure accuracy and clarity. Once completed, ensure all parties sign the form for it to be legally effective.

A good Mississippi Non-Disclosure Agreement for Potential Investors is clear, concise, and tailored to your specific needs. It includes well-defined terms, the scope of confidential information, and clear obligations for each party. Additionally, it is structured logically, making it easy for all parties to understand their commitments and responsibilities.

Yes, you can write your own Mississippi Non-Disclosure Agreement for Potential Investors. However, it’s important to include all necessary elements and ensure clarity throughout the document. Utilizing an online platform like US Legal Forms can streamline this process by providing templates and guidance to help you create a comprehensive agreement.

To draw up a Mississippi Non-Disclosure Agreement for Potential Investors, begin with a template that includes essential sections such as the introduction, purpose, and definitions. Clearly outline each party's rights and responsibilities regarding confidential information. It's wise to review the agreement with a legal expert to ensure it meets all requirements and effectively protects your interests.

A valid Mississippi Non-Disclosure Agreement for Potential Investors typically contains five key elements: the definition of confidential information, the obligations of both parties, the duration of confidentiality, permissible disclosures, and the terms for dispute resolution. Each of these components plays a vital role in protecting sensitive information during investment discussions. Understanding these elements helps you create a strong agreement.

To draft a Mississippi Non-Disclosure Agreement for Potential Investors, start by outlining the purpose of the agreement, identifying the parties involved, and defining the confidential information. Next, include the obligations of each party regarding that information, the term of the agreement, and any exclusions from confidentiality. Finally, ensure both parties sign the document to make it legally binding.

You can write your own Mississippi Non-Disclosure Agreement for Potential Investors, but it requires careful attention to detail. Make sure to include essential elements, such as definitions of confidential information and the obligations of both parties. To avoid legal pitfalls, consider using a professional template or service, like USLegalForms, which provides tailored solutions for your specific needs. This approach ensures that your NDA is both effective and compliant with state laws.

A Mississippi Non-Disclosure Agreement for Potential Investors might not be necessary in certain situations, such as when discussing publicly available information. If the information is already known or easily accessible, an NDA may create unnecessary barriers. Also, be cautious with small, informal conversations where the stakes are low. Knowing when to use an NDA can save time and improve your discussions with potential investors.

Not having a Mississippi Non-Disclosure Agreement for Potential Investors exposes you to several risks. You may experience unauthorized use of your proprietary information or strategies, which can hinder growth or lead to financial loss. Additionally, the absence of an NDA may discourage potential investors from engaging fully, as they may fear leaks of their own information. Ultimately, it can jeopardize your business relationships and opportunities.