This type of form may be used in connection with a credit counseling seminar which also includes individual credit counseling. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Mississippi Agreement for Credit Counseling Services

Description

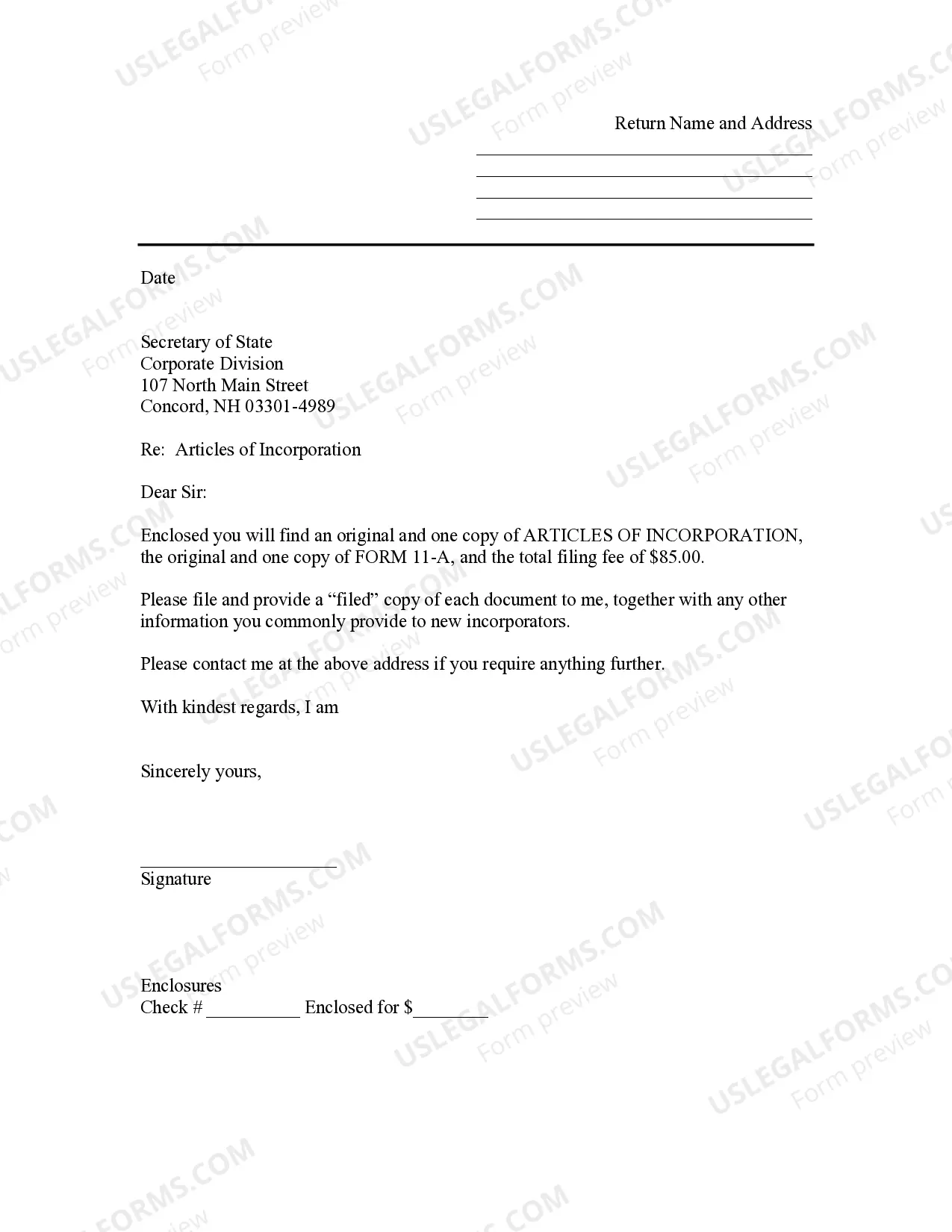

How to fill out Agreement For Credit Counseling Services?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a diverse selection of legal document templates that you can download or print.

By using the website, you can access numerous forms for both business and personal purposes, organized by categories, states, or keywords.

You can obtain the latest versions of forms such as the Mississippi Agreement for Credit Counseling Services in moments.

If the form does not meet your needs, use the Search box at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your choice by clicking the Buy Now button. Afterward, select your preferred pricing plan and provide your details to register for an account.

- If you currently hold a monthly subscription, Log In to download the Mississippi Agreement for Credit Counseling Services from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to examine the form's details. Review the form summary to confirm that you have selected the appropriate one.

Form popularity

FAQ

To become certified as a credit counselor, you typically need to complete a training program and pass a certification exam. Many accredited organizations offer programs that equip you with the necessary skills and knowledge. Engaging with the Mississippi Agreement for Credit Counseling Services through a reputable platform, like uslegalforms, can connect you with the right resources to achieve your certification smoothly.

A certificate of credit counseling is an official document that confirms you have completed a required credit counseling session. This certificate is essential if you are filing for bankruptcy in Mississippi, as it meets legal requirements. Understanding the Mississippi Agreement for Credit Counseling Services can help you ensure you receive this crucial paperwork in a timely manner.

The time it takes to receive your credit counseling certificate can vary, but generally, it takes about one to two days after completing your session. Once you finish the counseling, you typically receive your certificate electronically. The Mississippi Agreement for Credit Counseling Services helps you navigate this process seamlessly, making it easier to obtain your necessary documentation.

To obtain a credit counseling certificate, you typically need to complete a counseling session with an accredited agency. After successfully finishing the session and creating a personalized financial action plan, you will receive your certificate, confirming your participation under the Mississippi Agreement for Credit Counseling Services. This certificate can also be beneficial if you need to present proof of counseling for debt management or bankruptcy proceedings.

The credit counseling process typically begins with an initial consultation where you discuss your financial situation with a certified counselor. Following that, the counselor creates a personalized action plan that may involve budgeting, debt management strategies, and possibly enrolling you in a debt management program under the Mississippi Agreement for Credit Counseling Services. This step-by-step guidance helps you regain control of your finances and work toward your goals.

While debt counselors provide valuable guidance, disadvantages may include fees for their services and the potential need for you to share sensitive financial information. Additionally, some may focus solely on their process without truly understanding your individual needs. However, counselors offering the Mississippi Agreement for Credit Counseling Services prioritize your financial well-being, ensuring a tailored experience.

Choosing between credit counseling and debt settlement depends on your specific financial circumstances. Credit counseling offers education and a structured plan under the Mississippi Agreement for Credit Counseling Services, while debt settlement may risk your credit score by negotiating reduced amounts owed. Evaluating your situation with a credit counselor can help you make an informed decision that aligns with your financial goals.

The best person to talk to about debt is a certified credit counselor who operates under the Mississippi Agreement for Credit Counseling Services. These professionals are trained to help you assess your financial situation and develop strategies for managing your debt effectively. By reaching out to a credit counselor, you gain access to resources and insights that can empower you to regain control over your finances.

A credit counselor provides advice and guidance on managing your finances and improving your credit score, while a debt settlement company focuses on negotiating your debts to reduce what you owe. With the Mississippi Agreement for Credit Counseling Services, you can receive personalized assistance to create a manageable repayment plan. This distinction is crucial for understanding which option best suits your financial needs.

Credit counseling is legitimate, especially when conducted by accredited agencies that follow recognized standards. These counselors help individuals understand their financial situation and develop personalized plans. By utilizing the Mississippi Agreement for Credit Counseling Services, many have successfully alleviated their financial stress and achieved stability.