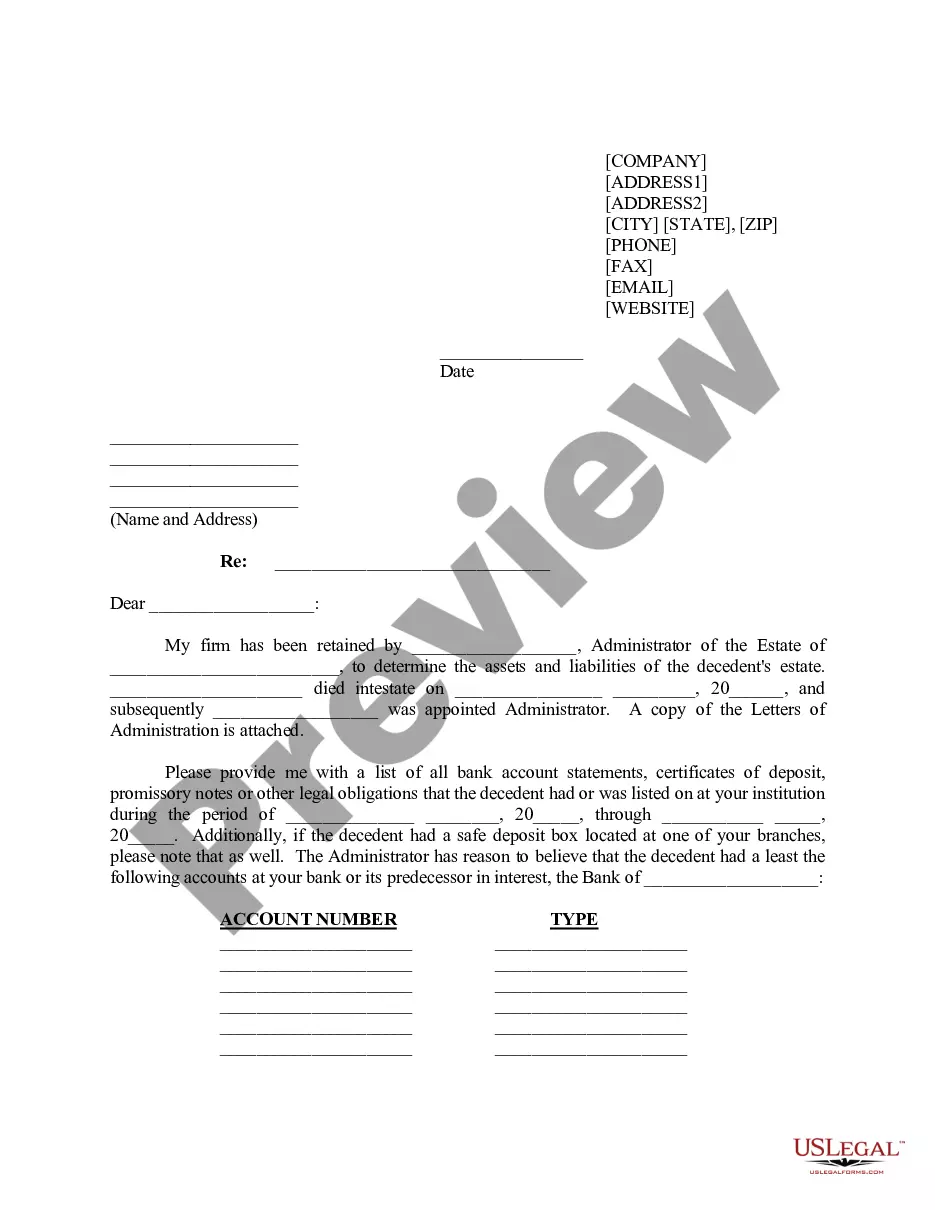

This form anticipates that a decedent left a will directing that all assets in a certain investment account be transferred to a trust. This form is a sample request to the investment firm from the trustee/executor for the assets.

Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent

Description

How to fill out Letter Of Instruction To Investment Firm Regarding Account Of Decedent From Executor / Trustee For Transfer Of Assets In Account To Trustee Of Trust For The Benefit Of Decedent?

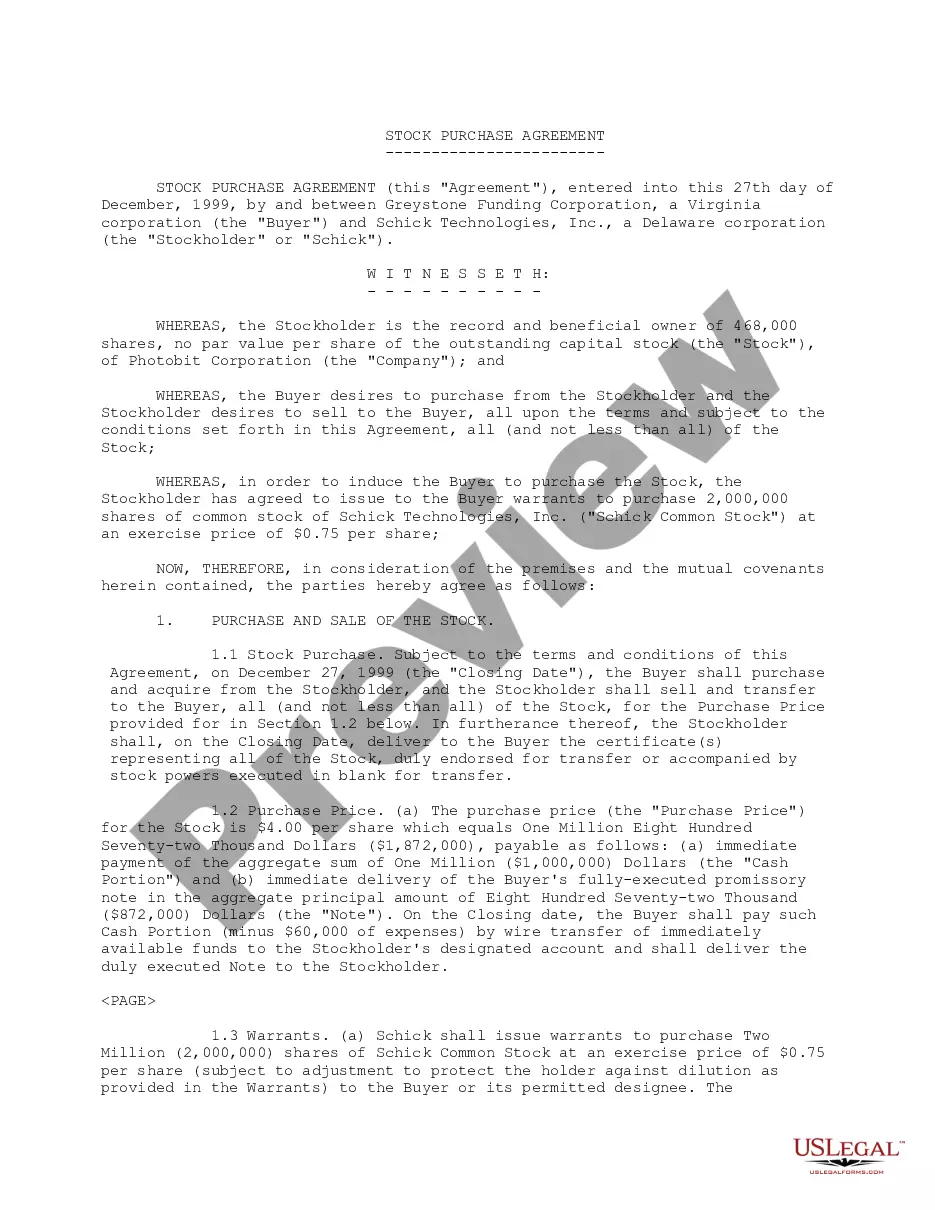

If you desire to complete, obtain, or create legitimate document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's user-friendly and convenient search feature to find the documents you need. A variety of templates for both business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to access the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent with just a few clicks.

Every legal document template you obtain is yours permanently. You have access to every form you saved in your account. Click on the My documents section and select a form to print or download again.

Compete and acquire, and produce the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal requirements.

- If you are already a US Legal Forms user, Log In to your account and click on the Download button to retrieve the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

- You can also access templates you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

- Step 2. Use the Review option to browse through the content of the form. Do not forget to review the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other options in the legal form template.

- Step 4. Once you have located the form you need, click on the Acquire now button. Choose the payment plan you prefer and provide your details to register for an account.

- Step 5. Process the payment. You can use your MasterCard, Visa, or PayPal account to complete the transaction.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Complete, review, and print or sign the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

Form popularity

FAQ

Yes, a trustee can also be the sole beneficiary of a trust. This setup can streamline management of the trust, but it is essential to follow the trust's terms and applicable laws. For clarity and compliance, refer to the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent when considering this arrangement.

The IL 1041 form must be filed with the Illinois Department of Revenue. Proper filing ensures the trust complies with state tax obligations. If your trust involves investments related to a Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent, it's advisable to consult a tax professional.

Yes, you can serve as both the trustee and a beneficiary of a trust. This arrangement can provide a level of control over the assets, but it is crucial to understand the obligations involved. Ensure you consider the implications of your dual role as outlined in the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

Typically, trustees cannot unilaterally add beneficiaries to a trust. Trust documents outline the named beneficiaries, and any changes generally require modifications to the trust itself. Relying on the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help clarify these responsibilities.

A trustee can be an individual or an institution, such as a bank or law firm. The person or entity must be trustworthy and capable of managing and distributing the trust's assets according to its terms. If you are unsure about selecting a trustee, consider seeking guidance through the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor / Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent.

Avoiding probate in Mississippi can often be achieved by placing assets in a trust or utilizing beneficiary designations. This method allows assets to pass directly to beneficiaries without undergoing the lengthy probate process. A Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can significantly aid in managing asset transfer smoothly and efficiently without the complications of probate.

Beneficiaries in a trust are individuals or entities entitled to receive distributions from the trust's assets. They can include primary beneficiaries who access assets first, as well as contingent beneficiaries who receive assets if primary beneficiaries cannot. To ensure your beneficiaries are correctly recognized and understand their entitlements, a Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can provide essential documentation.

A beneficiary can be an individual, organization, or even another trust, as defined by the trust document. Generally, beneficiaries are those who have been specifically named or designated to receive assets or benefits from the trust. If you require guidance on establishing or identifying beneficiaries, using the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can streamline the process.

A trustee is the individual or institution responsible for managing and administering the trust per its terms, while a beneficiary is the individual or entity entitled to receive benefits from the trust. The trustee acts on behalf of the trust to safeguard and distribute assets according to the trust’s guidelines. Understanding the roles outlined in the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can promote clarity in trust management.

The primary beneficiary of a trust is the person or entity designated to receive the trust's assets after the grantor's death. This beneficiary holds the most immediate interest in the trust and will benefit first from its distributions. Understanding your rights and responsibilities as a primary beneficiary can be complex, and utilizing the Mississippi Letter of Instruction to Investment Firm Regarding Account of Decedent from Executor/Trustee for Transfer of Assets in Account to Trustee of Trust for the Benefit of Decedent can help clarify these roles.