An accounting by a fiduciary usually involves an inventory of assets, debts, income, expenditures, and other items, which is submitted to a court. Such an accounting is used in various contexts, such as administration of a trust, estate, guardianship or conservatorship. Generally, a prior demand by an appropriate party for an accounting, and a refusal by the fiduciary to account, are conditions precedent to the bringing of an action for an accounting.

Mississippi Petition to Require Accounting from Testamentary Trustee

Description

How to fill out Petition To Require Accounting From Testamentary Trustee?

Are you in the situation where you require documents for both company or person uses just about every day? There are a lot of legitimate file themes available on the net, but getting ones you can trust isn`t simple. US Legal Forms provides 1000s of develop themes, such as the Mississippi Petition to Require Accounting from Testamentary Trustee, which are written in order to meet federal and state specifications.

If you are presently knowledgeable about US Legal Forms website and have your account, simply log in. After that, you are able to download the Mississippi Petition to Require Accounting from Testamentary Trustee design.

Unless you offer an profile and would like to begin to use US Legal Forms, follow these steps:

- Obtain the develop you need and make sure it is for your appropriate area/region.

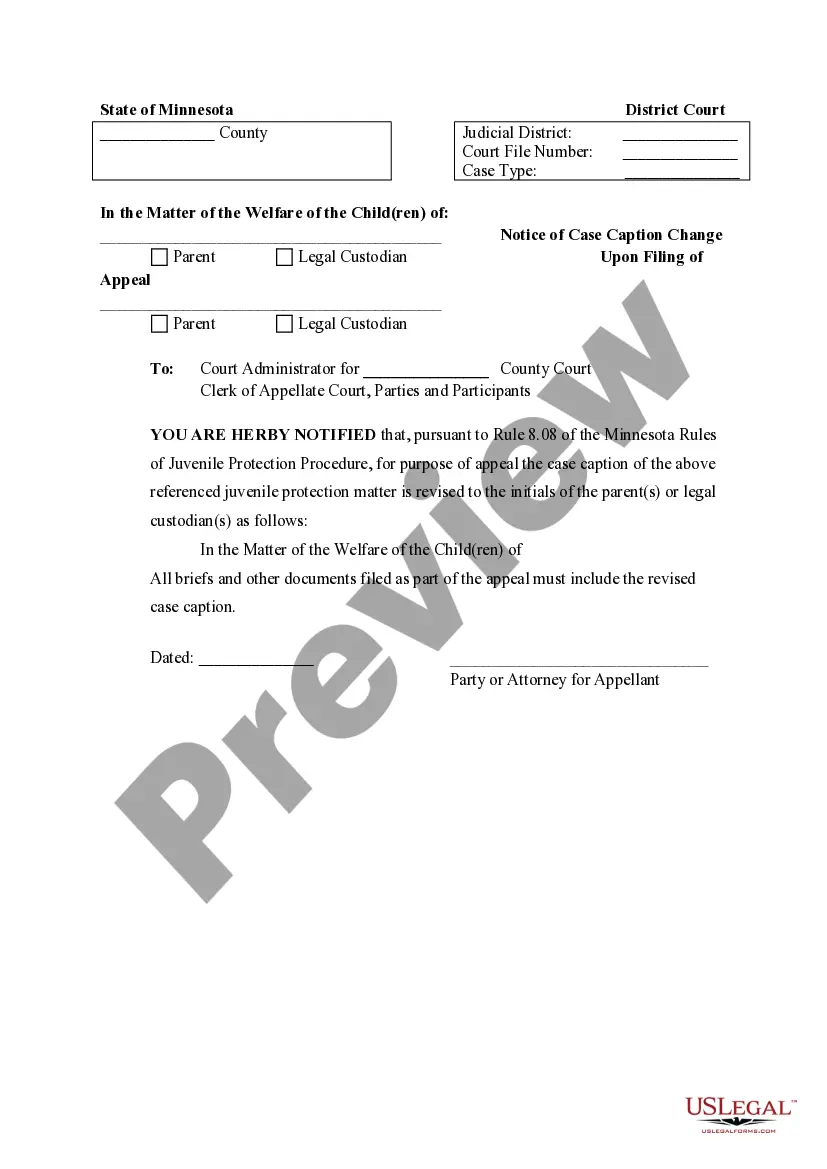

- Make use of the Review switch to analyze the form.

- Browse the explanation to actually have selected the right develop.

- When the develop isn`t what you are trying to find, take advantage of the Look for industry to discover the develop that meets your needs and specifications.

- If you find the appropriate develop, click Get now.

- Opt for the costs plan you need, complete the necessary information and facts to produce your bank account, and pay for your order using your PayPal or bank card.

- Pick a convenient document file format and download your copy.

Find every one of the file themes you possess purchased in the My Forms menu. You can aquire a more copy of Mississippi Petition to Require Accounting from Testamentary Trustee at any time, if necessary. Just select the needed develop to download or produce the file design.

Use US Legal Forms, probably the most extensive assortment of legitimate varieties, to conserve time and steer clear of mistakes. The support provides professionally manufactured legitimate file themes which can be used for a range of uses. Produce your account on US Legal Forms and begin generating your lifestyle easier.

Form popularity

FAQ

If you die with children but no spouse, your children will inherit everything. If you die with one child, your spouse gets half of the intestate property and your child gets the other half. If you die with two or more children, your surviving spouse and children each get an equal share of your intestate property.

Section 91-5-35 - Will devising real property admitted to probate as muniment of title only; petition signature; rights of interested parties unaffected (1) When a person dies testate owning at the time of death real property in the State of Mississippi and his will purports to devise such realty, then said will may be ...

In Mississippi, the executor typically has 90 days from the date of their appointment to submit this inventory to the court. Communicating with Creditors: Once the estate has been inventoried, the executor must then notify all known creditors of the deceased's passing.

Profanity in Public Title 97, Chap. 29 §47 It is illegal in Mississippi for anyone to ?profanely swear or curse, or use vulgar and indecent language, or be drunk in any public place, in the presence of two or more persons.?

Ing to Miss. Code Annotated 97-29-47, it is unlawful to be drunk or use profanity in a public place in the presence of two or more people. As crimes go, public drunkenness may not seem serious. It is a misdemeanor and not a felony.

Section 91-29-1 - Will provisions made before dissolution of marriage (a) In this section: (1) "Irrevocable trust" means a trust: (A) For which the trust instrument was executed before the dissolution of a testator's marriage; and (B) That the testator was not solely empowered by law or by the trust instrument to ...

If any man and woman shall unlawfully cohabit, whether in adultery or fornication, they shall be fined in any sum not more than five hundred dollars each, and imprisoned in the county jail not more than six months; and it shall not be necessary, to constitute the offense, that the parties shall dwell together publicly ...

Next Steps If a Trustee Refuses Accounting Duties Your trust and probate attorney files a petition to compel the trustee to carry out their accounting duties. The court issues a citation to your trustee mandating them to appear in court on a specified hearing date.