Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed

Description

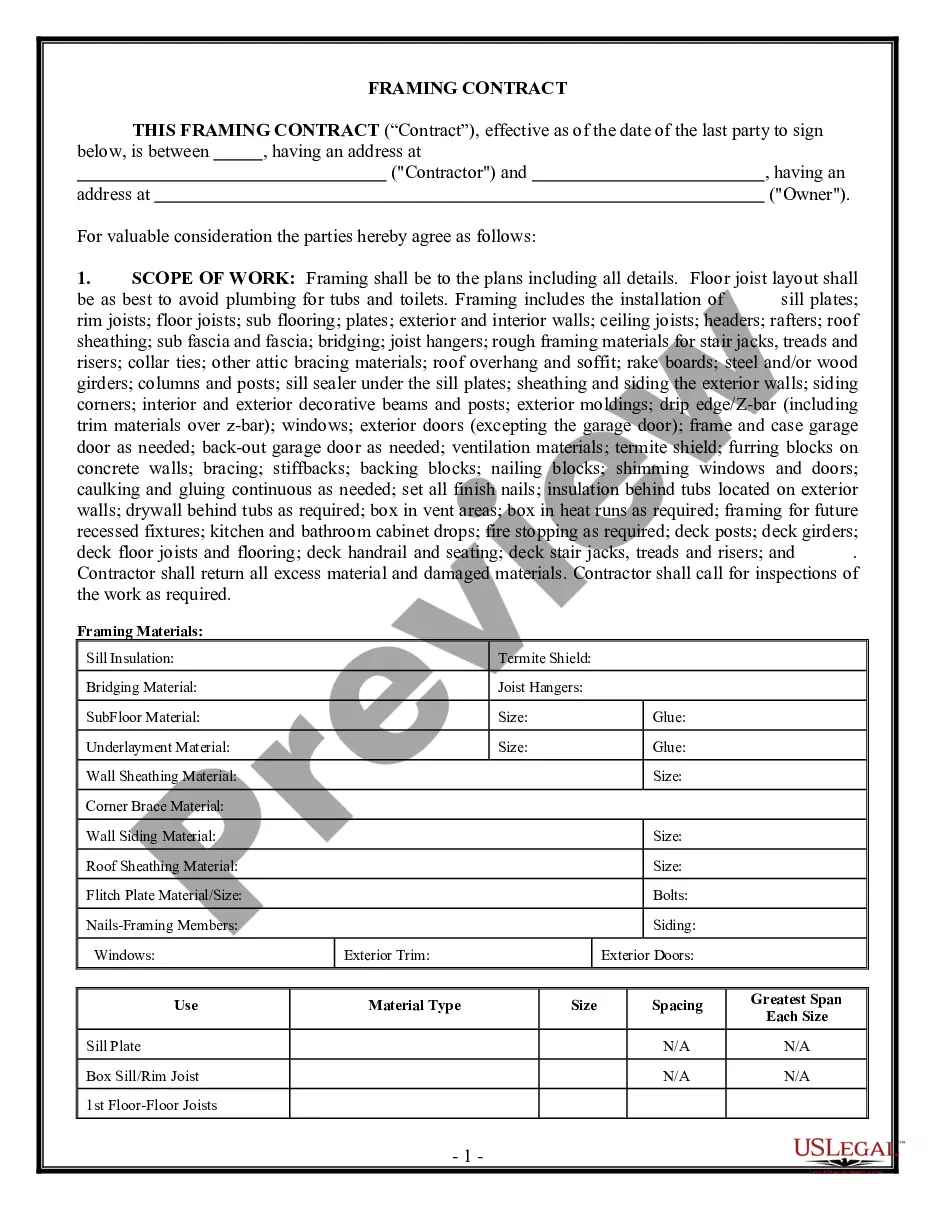

How to fill out Agreement And Release For Working At A Novelty Store - Self-Employed?

It is feasible to spend hours online attempting to locate the valid document template that satisfies the local and federal criteria you require.

US Legal Forms provides a vast array of valid forms that are evaluated by professionals.

You can download or print the Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed from our platform.

If available, utilize the Preview button to view the document template as well.

- If you already possess a US Legal Forms account, you may Log In and then click the Download button.

- Subsequently, you may fill out, alter, print, or sign the Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed.

- Each valid document template you obtain is yours permanently.

- To acquire another copy of any purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the state/city of your choice.

- Review the form description to confirm you have chosen the appropriate document.

Form popularity

FAQ

Yes, it is possible to be both employed and self-employed in the UK. This arrangement allows you to maintain a stable income while pursuing entrepreneurial ventures. Ensure that you understand your tax responsibilities for both income streams. The Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed can assist in outlining your self-employment terms effectively.

Yes, you can be self-employed in the UK and also work abroad. Many self-employed individuals find opportunities overseas, which can broaden your business scope. Just ensure you understand the tax obligations you have in both countries. Utilizing the Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed can help you navigate any contracts associated with your international work.

Yes, it is entirely legal to work for two companies simultaneously in the UK, provided you manage your responsibilities well. Many professionals take on multiple jobs to increase their income. However, be cautious about any conflict of interest clauses in your employment contracts. Consider using the Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed to clarify your commitments.

Absolutely, you can operate as a sole trader while being employed in the UK. This arrangement offers financial flexibility and allows you to build your business gradually. Nevertheless, it is vital to keep clear records for tax purposes. The Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed can help formalize your working terms as a sole trader.

Yes, you can be employed and self-employed in Ireland simultaneously. Many individuals choose this route to diversify their income. However, it's essential to manage your time effectively and understand the tax implications involved. The Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed can provide clarity on contracts related to your self-employment.

The primary difference between self-employed individuals and workers in the UK lies in the level of control and independence. Self-employed individuals operate their business and have the freedom to determine how and when to work. In contrast, workers are employed with specific terms dictated by their employer. If you are venturing into the self-employed space, consider the Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed for guidance on your new responsibilities.

In Mississippi, employment tax rates vary depending on your business type and the specific circumstances of your operations. For self-employed individuals, it is crucial to stay informed about federal and state tax obligations, including social security and Medicare. By utilizing the Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed, you can ensure you meet all necessary requirements in a compliant way.

To prove self-employment in the UK, you typically need to provide evidence such as tax returns, bank statements, and invoices. These documents confirm your income and demonstrate your independent status. Using the Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed can establish clear terms, making it easier to showcase your self-employed status when necessary.

In the UK, being self-employed means running your own business and being responsible for your own income. This status allows you to work independently and set your hours, but it also requires you to handle your taxes and business expenses. The Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed can assist in clarifying your responsibilities and rights as a self-employed individual.

In the UK, you must register as self-employed if your earnings exceed £1,000 in a tax year. This threshold ensures that small side jobs stay under the radar while providing an opportunity for those who wish to formalize their self-employment. Consider using the Mississippi Agreement and Release for Working at a Novelty Store - Self-Employed to streamline your operations and keep your records in order.