Mississippi Sample Letter to City Clerk regarding Ad Valorem Tax Exemption

Description

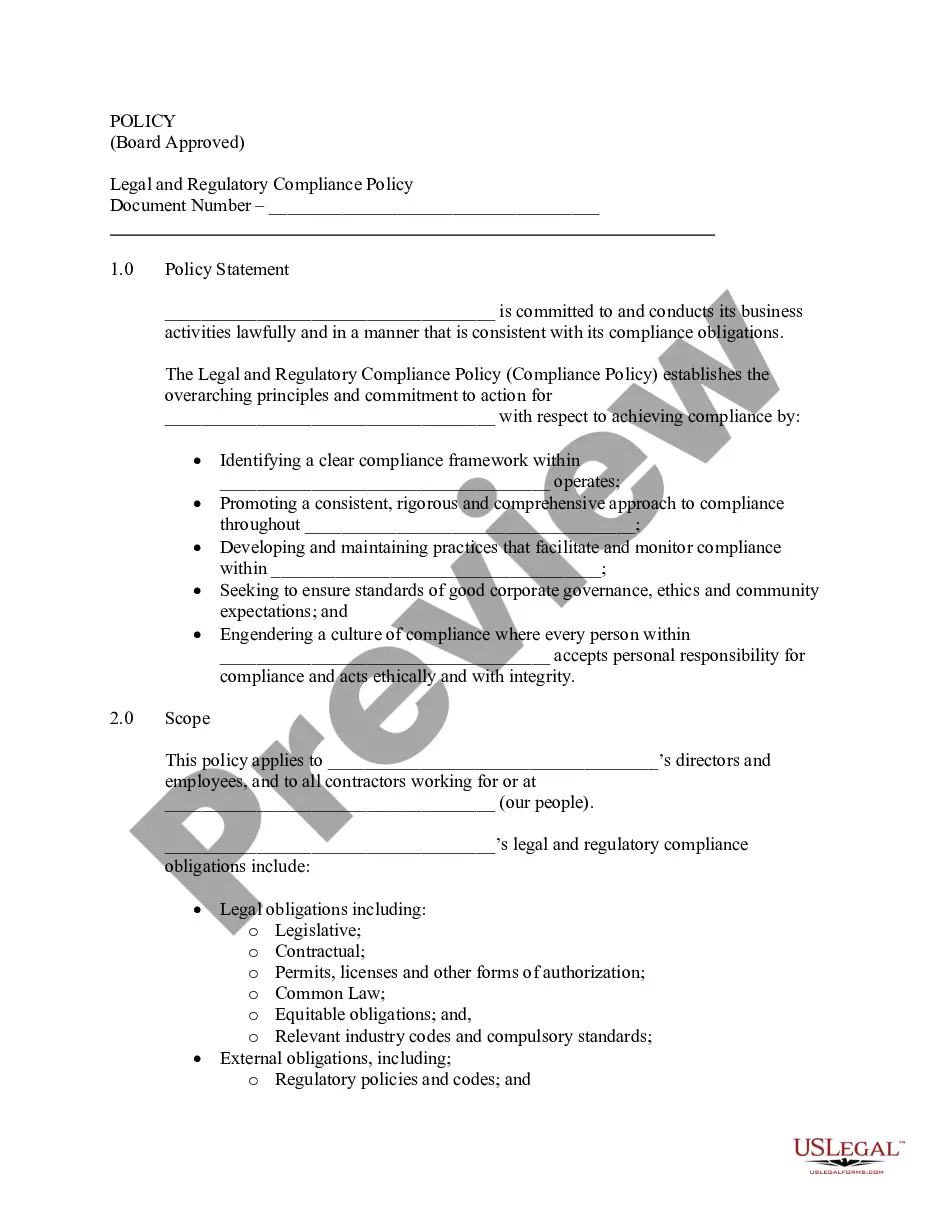

How to fill out Sample Letter To City Clerk Regarding Ad Valorem Tax Exemption?

Selecting the optimal authentic document template can be challenging. Naturally, there are numerous templates accessible online, but how do you locate the genuine one that you require? Utilize the US Legal Forms website. This service provides a vast array of templates, such as the Mississippi Sample Letter to City Clerk concerning Ad Valorem Tax Exemption, which can be utilized for both business and personal purposes. All of the forms are reviewed by professionals and comply with state and federal regulations.

If you are currently a member, Log In to your account and click the Acquire button to download the Mississippi Sample Letter to City Clerk regarding Ad Valorem Tax Exemption. Use your account to search for the legitimate forms you may have previously obtained. Navigate to the My documents section of your account to download another copy of the document you need.

If you are a new user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have selected the correct form for your city/county. You can review the form using the Preview button and read the form description to verify that it is suitable for you. If the form does not meet your requirements, utilize the Search area to find the appropriate form. Once you are confident that the form is suitable, click the Purchase now button to acquire the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the authentic document template to your device. Fill out, edit, print, and sign the acquired Mississippi Sample Letter to City Clerk regarding Ad Valorem Tax Exemption.

US Legal Forms is an invaluable resource for accessing a comprehensive selection of legal templates tailored to meet various document needs.

- US Legal Forms is the largest repository of legitimate forms where you can find a variety of document templates.

- Utilize the service to obtain professionally-crafted paperwork that adhere to state requirements.

- Ensure you have the correct form before proceeding.

- Review the form description for suitability.

- Use the search feature for finding the right form.

- Complete the payment process to acquire your documents.

Form popularity

FAQ

Rather state law simply exempts the homeowner from ad valorem taxes for up to $7,500 in as- sessed value. In other words, a home with a true value of $75,000 or less would be exempt from all property taxes (municipal, school district, and county).

Each qualified homeowner under sixty-five (65) years of age on January 1 of the year for which the exemption is claimed, and who is not totally disabled as herein defined shall be exempt from ad valorem taxes in the amount prescribed in Section 27-33-69, 27-33-71, 27-33-73 or 27-33-75, whichever is applicable to the ...

When are property taxes due? Taxes are due on or before February 1 for property assessed the preceding year. If February 1 falls on a weekend or legal holiday, taxes may be paid the following Monday without penalties or interest.

A person requesting homestead exemption must make a written application, must be a natural person, the head of a family, have ownership and eligible property, occupy the dwelling as a home, and be a Mississippi resident. Each of these requirements are discussed in detail.

The applicant must come in person to the Tax Assessor's office the first time to file for homestead exemption benefits. Each year after that the homestead exemption benefits are automatically renewed unless there is a change in the filing status.

Mississippi exempts all forms of retirement income from taxation, including Social Security benefits, income from an IRA, income from a 401(k) and any pension income. On top of that, the state has low property taxes and moderate sales taxes.

Persons who are 65 years of age and older or who are disabled, upon application and proof of eligibility, are exempt from all ad valorem taxes up to $7,500.00 of assessed value.