Mississippi Sample Letter for Request for Tax Clearance Letter

Description

How to fill out Sample Letter For Request For Tax Clearance Letter?

Are you presently in the location that you need to possess documentation for both business or personal purposes nearly every working day.

There is a multitude of legal document templates accessible on the web, but locating forms you can trust isn’t easy.

US Legal Forms provides thousands of template documents, such as the Mississippi Sample Letter for Request for Tax Clearance Letter, which are designed to fulfill state and federal requirements.

When you find the right template, just click Get now.

Select the pricing plan you want, fill in the required details to create your account, and pay for your order using your PayPal or credit card.

- If you are already familiar with the US Legal Forms site and have an account, just Log In.

- After that, you can download the Mississippi Sample Letter for Request for Tax Clearance Letter template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the template you need and ensure it is for your specific city/region.

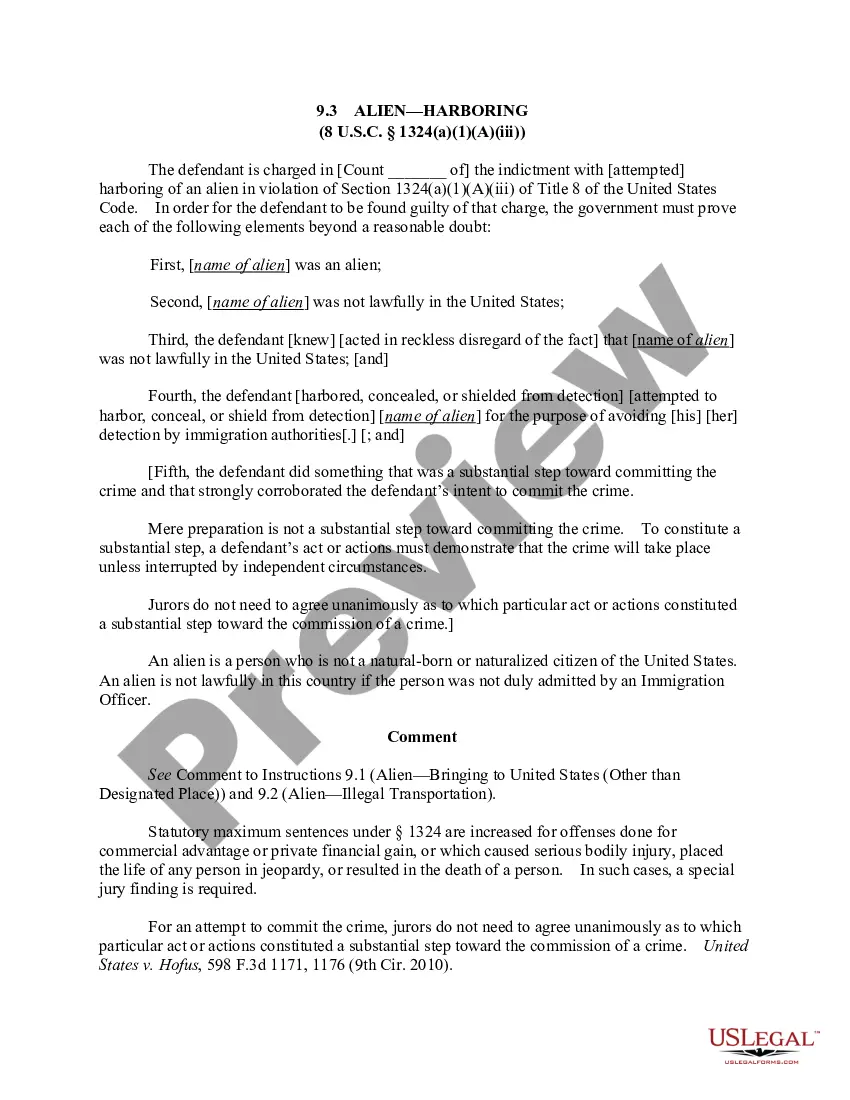

- Utilize the Review feature to examine the form.

- Check the description to ensure that you have chosen the correct template.

- If the template isn’t what you are looking for, use the Search box to find the document that suits your needs and requirements.

Form popularity

FAQ

Mississippi's economic nexus threshold is $250,000 in sales in the prior 12 months. To calculate the threshold, you should include gross sales. You should register for a sales tax permit on the next transaction after crossing the threshold, as presumed by the state notice.

A clearance certificate certifies that all amounts for which the taxpayer is, or can reasonably be expected to become, liable under the Act at or before the time of distribution have been paid, or that the Minister of National Revenue has accepted security for payment.

To get a tax clearance letter from the Mississippi Department of Revenue, you'll need to send a written request. In your letter, include your Mississippi LLC's name and the signature of a manager or member. You can send it by mail or fax.

Mississippi considers a seller to have physical nexus if you have any of the following in the state: Owns an office or place of business. Has employees or agents of the business who service customers in Mississippi or solicit or accept orders for merchandise.

Mississippi's Republican-controlled legislature passed legislation in 2022 that will eliminate the state's 4% income tax bracket starting in 2023.

What is economic nexus? The term economic nexus refers to a business presence in a US state that makes an out-of-state seller liable to collect sales tax there once a set level of transactions or sales activity is met.

Under the economic presence nexus standard, an out-of-state corporation may trigger nexus by conducting a certain amount of economic activity within the state (e.g., $100,000 of annual sales to customers in the state) even if the corporation lacks a physical presence within the state's borders.

Most commonly, states issue clearance certificates, demonstrating that an individual is compliant with all taxes and other obligations as of the date of the certificate. Those seeking clearance certificates will have to request them from state authorities, usually the state's Department of Revenue.