Mississippi Minimum Checking Account Balance - Corporate Resolutions Form

Description

How to fill out Minimum Checking Account Balance - Corporate Resolutions Form?

Selecting the correct legal document template could pose a challenge.

Naturally, numerous templates are accessible online, but how do you find the legal document you require.

Utilize the US Legal Forms platform.

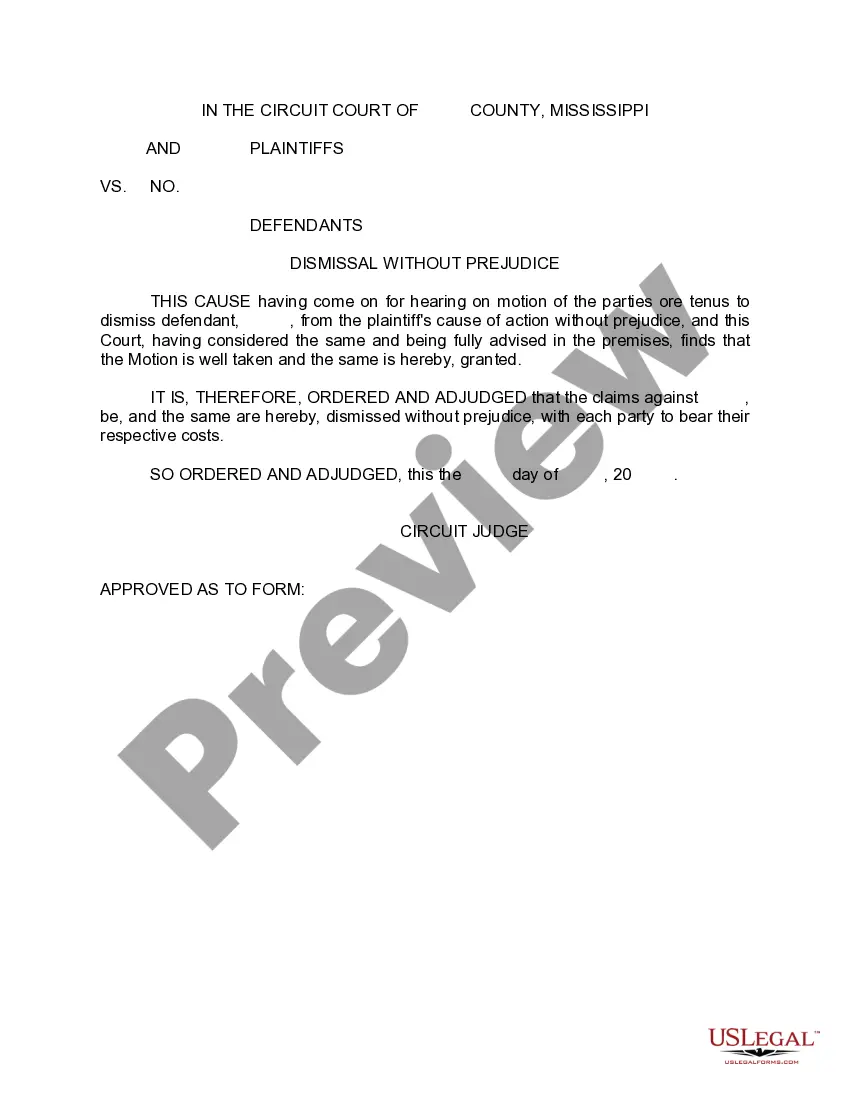

First, ensure you have selected the correct document for your city/region. You can review the form using the Preview button and check the description of the document to confirm it is suitable for you.

- The service offers a multitude of templates, such as the Mississippi Minimum Checking Account Balance - Corporate Resolutions Form, suitable for both business and personal purposes.

- All forms are reviewed by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Mississippi Minimum Checking Account Balance - Corporate Resolutions Form.

- Use your account to search through the legal documents you may have previously purchased.

- Go to the My documents section of your account and download another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

Form popularity

FAQ

Minimum corporate income tax in Mississippi is designed to ensure that even small businesses contribute to the state's revenue. This tax is fixed and applies regardless of income levels. To ensure compliance, keep your corporate resolutions and tax documents organized, which can be efficiently managed using the US Legal platform.

The amount you retain from $100,000 after taxes in Mississippi depends on the applicable corporate tax rates and any deductions. It's essential to calculate your specific situation accurately. Utilizing the Mississippi Minimum Checking Account Balance - Corporate Resolutions Form can aid in financial planning for your business expenses.

The corporate tax rate in Mississippi is based on your earnings and the type of business entity you operate. This rate can affect how much you owe in taxes annually. To navigate tax complexities, consider using the US Legal platform for handling your corporate resolutions documentation.

The lowest corporate tax rate in Mississippi applies to qualifying entities with specific income levels. Understanding these thresholds can help you plan better financially. Use resources like the Mississippi Minimum Checking Account Balance - Corporate Resolutions Form to ensure all related documents are accurately prepared.

To obtain a tax clearance letter in Mississippi, you must ensure that all your tax obligations are fulfilled. The easiest way to navigate this process is through the Mississippi Department of Revenue's website. You can also utilize the US Legal forms to prepare and organize your documents effectively.

Mississippi imposes a minimum corporate tax that applies to all businesses operating in the state. This tax varies depending on your business structure and income. To stay compliant and ensure your documents are in order, consider using the US Legal platform for your corporate resolutions.

The Pass-Through Entity (PTE) rate in Mississippi is determined by the income earned by the entity. It’s crucial to understand how this rate impacts your business's tax obligations. The Mississippi Minimum Checking Account Balance - Corporate Resolutions Form can help you document your earnings efficiently.

Yes, if your business operates in Mississippi and meets certain income thresholds. Filing state taxes ensures compliance with Mississippi regulations, which is important for maintaining your corporate resolutions. You can streamline this process by utilizing resources like the US Legal platform for managing corporate documents.

At US Bank, there are specific accounts that do have a minimum balance requirement. Maintaining the Mississippi Minimum Checking Account Balance can help you avoid fees while also providing additional benefits. Always confirm the current terms of your account, as requirements can change. If you want to keep things organized, consider using the Corporate Resolutions Form from uslegalforms to ensure you meet all bank requirements.

Yes, most checking accounts have a minimum balance requirement. This minimum ensures that you avoid maintenance fees and can access additional services. The Mississippi Minimum Checking Account Balance can vary significantly by the bank and the type of account, so checking with your financial institution is important. By using our Corporate Resolutions Form, you can better organize your banking details.