Mississippi Agreement between General Sales Agent and Manufacturer

Description

How to fill out Agreement Between General Sales Agent And Manufacturer?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal form templates that you can obtain or print.

By using the platform, you can access thousands of forms for both business and personal purposes, categorized by type, state, or keywords. You can find the most recent versions of forms such as the Mississippi Agreement between General Sales Agent and Manufacturer in mere seconds.

If you already hold a monthly membership, Log In to obtain the Mississippi Agreement between General Sales Agent and Manufacturer from the US Legal Forms library. The Download option will be available on every form you view. You can access all previously downloaded forms in the My documents section of your account.

Next, choose the pricing plan you would like and provide your details to create an account.

Complete the payment process. Use your credit card or PayPal account to finalize the transaction. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Mississippi Agreement between General Sales Agent and Manufacturer. Every template you save in your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply go to the My documents section and select the form you need. Access the Mississippi Agreement between General Sales Agent and Manufacturer through US Legal Forms, the most extensive collection of legal form templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- If you are looking to use US Legal Forms for the first time, follow these straightforward steps to get started.

- Ensure you have selected the correct form for your locality.

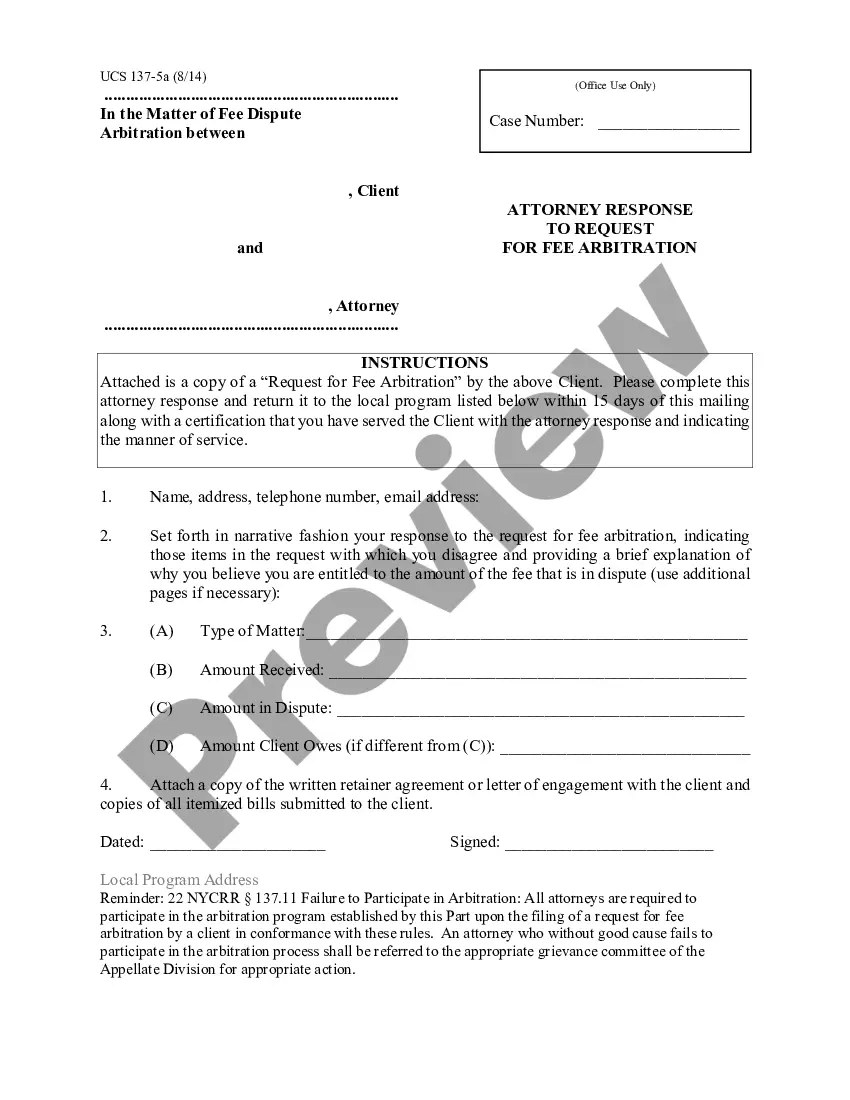

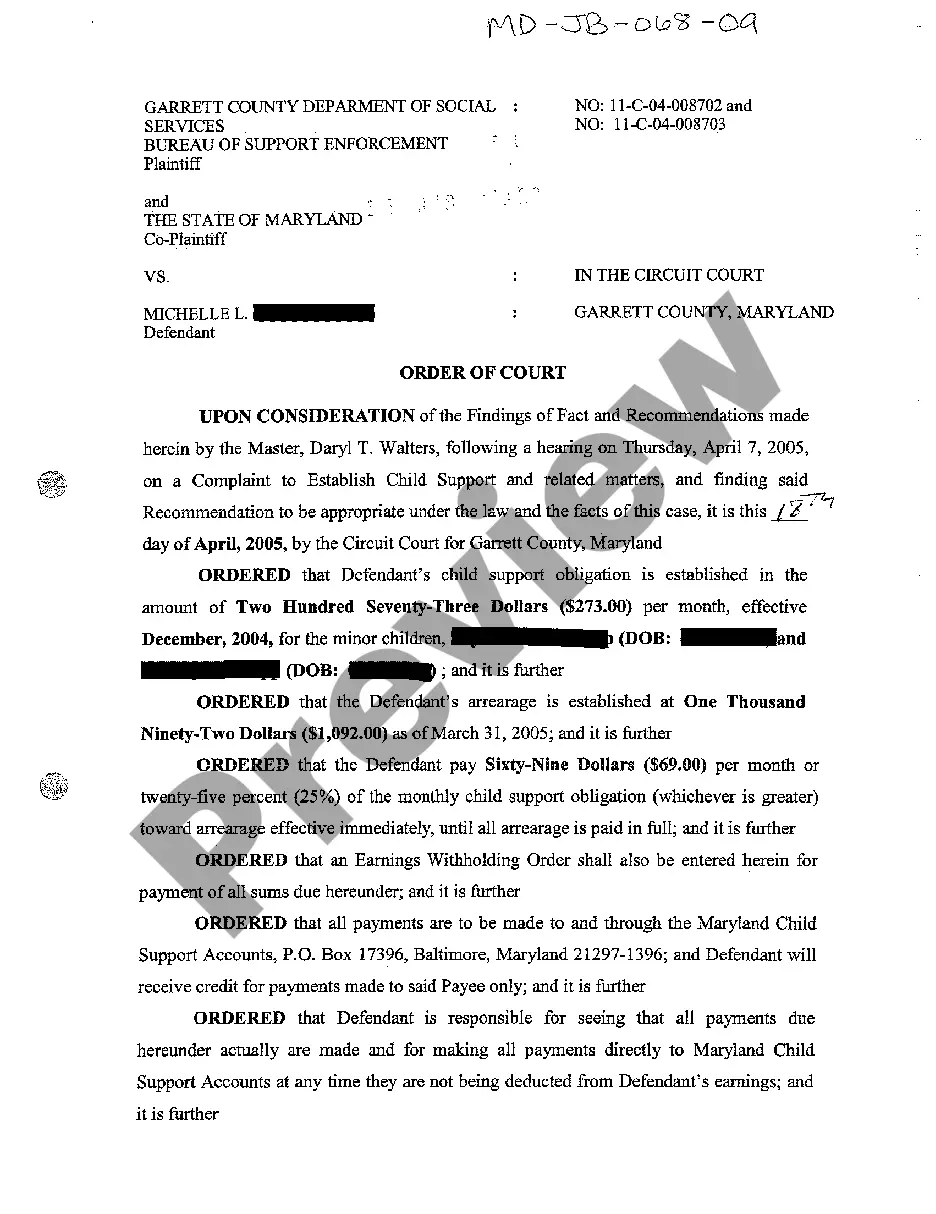

- Use the Preview option to review the form's details.

- Read the form information to confirm that you have selected the right one.

- If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Acquire now button.

Form popularity

FAQ

An MPC number is a unique identification number assigned to each manufacturer by the Mississippi Department of Revenue. This number is essential for tax reporting and compliance purposes. If you are part of a Mississippi Agreement between General Sales Agent and Manufacturer, acquiring your MPC number ensures you maintain proper business operations.

The MPC tax, or Manufacturer's Privilege Tax, is a tax assessed on manufacturers operating in Mississippi. It is designed to encourage business growth while providing revenue to the state. If you engage in a Mississippi Agreement between General Sales Agent and Manufacturer, being aware of the MPC tax can help you navigate financial responsibilities effectively.

In Mississippi, the individual income tax rate varies based on your income level. The rate ranges from 0% to 5%, with higher earners paying a greater percentage. For individuals involved in agreements like a Mississippi Agreement between General Sales Agent and Manufacturer, understanding these tax implications is crucial for accurate financial planning.

To secure local government contracts, begin by researching the types of goods or services your local government requires. Attend pre-bid meetings and network with officials to better understand their needs. Use tools like uslegalforms to draft a solid Mississippi Agreement between General Sales Agent and Manufacturer, demonstrating your commitment to compliance and professionalism during the application process.

Several websites specialize in listing government contracts, but the best one depends on your specific needs. Websites like SAM and local procurement sites can be valuable resources for finding both federal and local government contracts. Additionally, platforms like uslegalforms provide guidance and templates relevant to a Mississippi Agreement between General Sales Agent and Manufacturer, helping you navigate the submission process.

The easiest government contracts to obtain often include small purchases and simplified purchases. These contracts tend to have fewer requirements and less paperwork. If you focus on local opportunities and familiarize yourself with procedures specific to them, especially regarding a Mississippi Agreement between General Sales Agent and Manufacturer, you'll increase your chances of securing a contract.

Selling to state and local government involves understanding their procurement processes. Research specific regulations and qualifications required to participate in government contracts. Establish relationships with local government agencies, and consider using platforms like uslegalforms to ensure your Mississippi Agreement between General Sales Agent and Manufacturer meets all necessary requirements and standards.

To find local government bids, start by visiting your state and local government websites. Many times, these websites have a dedicated bidding section where they advertise upcoming contracts. You can also check with local chambers of commerce or business associations that often share information about available government opportunities, including contracts related to a Mississippi Agreement between General Sales Agent and Manufacturer.

Exemptions from sales tax in Mississippi include various essential goods and services, which can significantly impact consumers and vendors alike. For instance, certain agricultural products, prescription medications, and non-profit purchases often qualify as tax-exempt. For businesses, understanding these exemptions is vital when drafting a Mississippi Agreement between General Sales Agent and Manufacturer to ensure proper tax treatment and compliance.

An MPC, or Mississippi Professional Corporation, is a specific type of legal entity created for professional services. This structure can be beneficial for professionals like lawyers and accountants, as it limits personal liability. When drafting documents like the Mississippi Agreement between General Sales Agent and Manufacturer, incorporating the correct legal entities and structures can be crucial for legal protection and compliance.