Mississippi General Guaranty and Indemnification Agreement

Description

How to fill out General Guaranty And Indemnification Agreement?

Selecting the appropriate official documents template can be a challenge. Certainly, there are numerous templates accessible online, but how can you locate the correct type you require.

Utilize the US Legal Forms website. The platform offers a plethora of templates, including the Mississippi General Guaranty and Indemnification Agreement, which you can utilize for both business and personal needs. All forms are reviewed by experts and comply with federal and state regulations.

If you are already a member, Log In to your account and click the Obtain button to download the Mississippi General Guaranty and Indemnification Agreement. Use your account to browse the legal documents you have previously acquired. Go to the My documents section of your account and acquire another copy of the document you need.

Choose the file format and download the official document template to your device. Complete, edit, print, and sign the downloaded Mississippi General Guaranty and Indemnification Agreement. US Legal Forms is the largest repository of legal forms where you can find a wide range of document templates. Use the service to acquire professionally crafted documents that meet state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

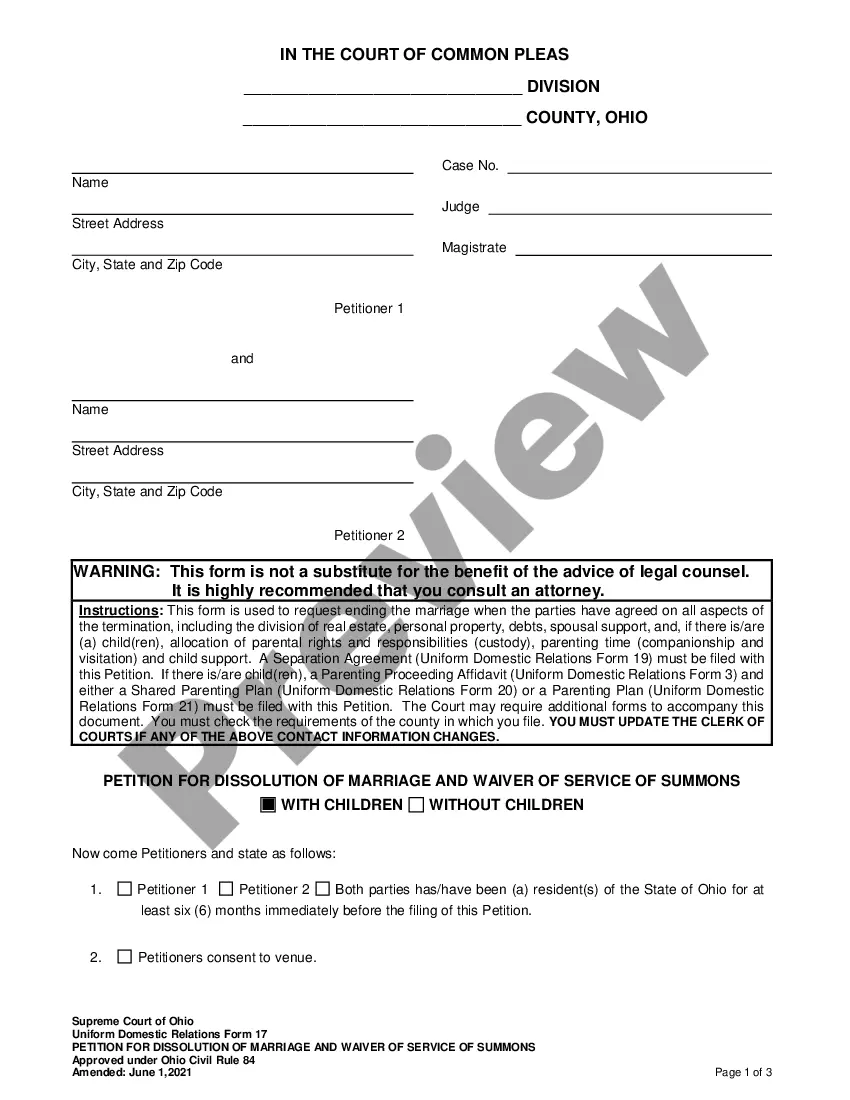

- First, ensure that you have selected the correct document for your region/state. You can view the form using the Preview option and read the form description to confirm it is suitable for you.

- If the document does not meet your standards, utilize the Search field to find the right form.

- Once you are certain that the document is correct, click the Acquire now button to obtain the document.

- Select the payment plan you wish and enter the required information.

- Create your account and pay for the transaction using your PayPal account or credit card.

Form popularity

FAQ

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

An indemnity is a contract by one party to keep the other harmless against loss, but a contract of guarantee is a contract to answer for the debt, default or miscarriage of another who is to be primarily liable to the promisee .

Indemnity is when one party promises to compensate the loss occurred to the other party, due to the act of the promisor or any other party. On the other hand, the guarantee is when a person assures the other party that he/she will perform the promise or fulfill the obligation of the third party, in case he/she default.

Company/Business/Individual Name shall fully indemnify, hold harmless and defend and its directors, officers, employees, agents, stockholders and Affiliates from and against all claims, demands, actions, suits, damages, liabilities, losses, settlements, judgments, costs and expenses (including but not

A contract by which one party promises to save the other from loss caused to him by the conduct of the promisor himself, or by the conduct of any other person, is called a contract of indemnity. Illustration.

Indemnity is a comprehensive form of insurance compensation for damages or loss. In this type of arrangement, one party agrees to pay for potential losses or damages caused by another party.

An indemnification agreement provides additional protection for businesses by ensuring that they are not held liable for damages or losses that occur outside of their control. This agreement allows the company to continue its operations while protecting against lawsuits.

Differences between guarantees and indemnitiesa guarantee is a secondary liability, which means that there will be another person who is primarily liable for the obligation; whereas, an indemnity imposes a primary liability.

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c

An indemnity agreement is a contract that protect one party of a transaction from the risks or liabilities created by the other party of the transaction. Hold harmless agreement, no-fault agreement, release of liability, or waiver of liability are other terms for an indemnity agreement.200c