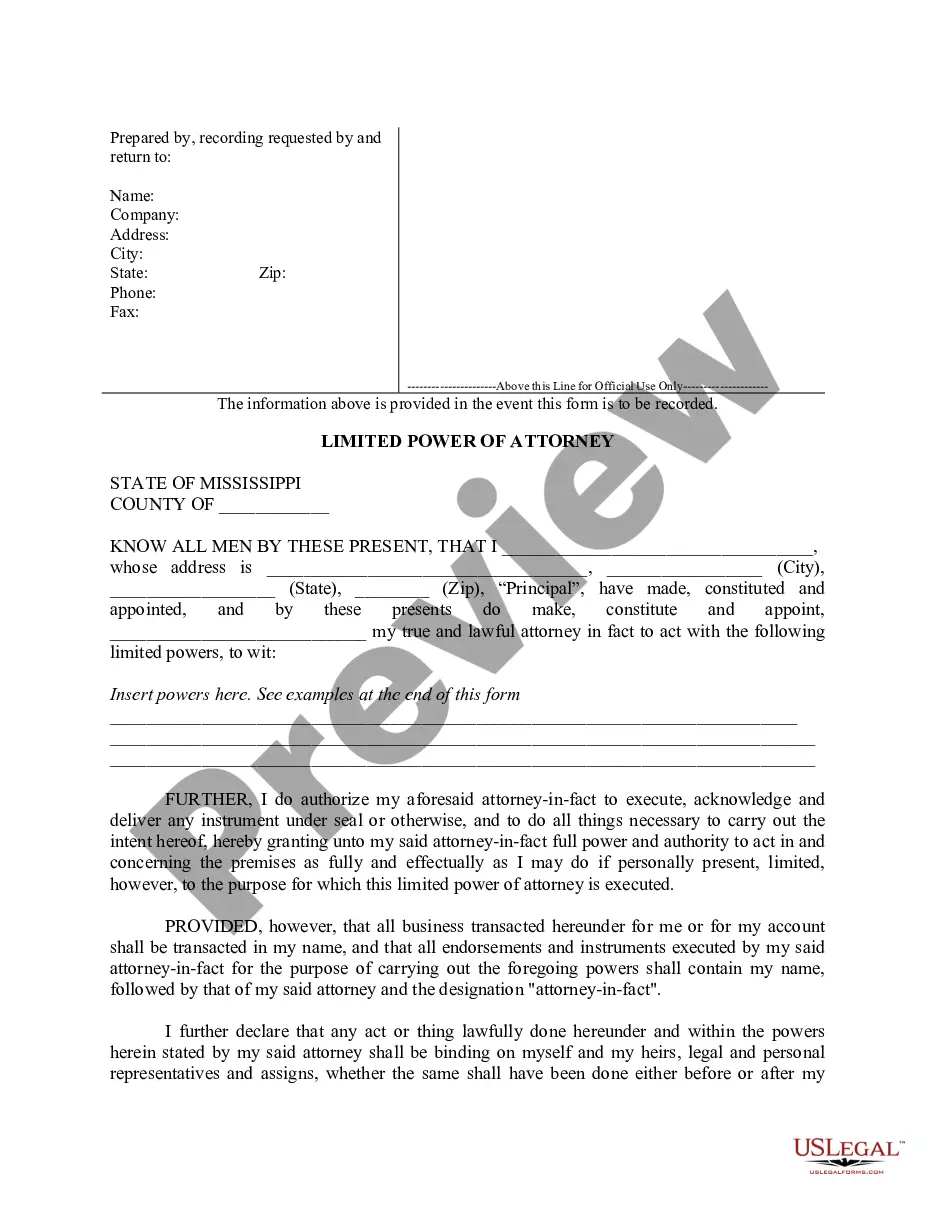

Mississippi Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Mississippi Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Obtain a printable Mississippi Limited Power of Attorney where you Define Powers with Sample Powers Included in just a few clicks from the most extensive collection of legal electronic documents.

Discover, download, and print expertly prepared and validated samples on the US Legal Forms website. US Legal Forms has been the leading provider of affordable legal and tax templates for US citizens and residents online since 1997.

After you’ve downloaded your Mississippi Limited Power of Attorney where you Define Powers with Sample Powers Included, you can complete it in any online editor or print it out and fill it in by hand. Utilize US Legal Forms to gain access to 85,000 professionally drafted, state-specific documents.

- Users who already possess a subscription must Log In directly to their US Legal Forms account, obtain the Mississippi Limited Power of Attorney where you Define Powers with Sample Powers Included, and find it stored in the My documents section.

- Clients who do not have a subscription should follow the steps outlined below.

- Ensure your form complies with your state’s regulations.

- If available, review the form’s description to learn more.

- If provided, assess the form for additional content.

- Once you are certain the template meets your requirements, click Buy Now.

- Establish a personal account.

- Select a plan.

- Make payment via PayPal or credit card.

Form popularity

FAQ

Download the form. In just a few minutes, you can locate appropriate power of attorney forms from reputable sources. Appoint an agent. Your agent is the person you authorize to act on your behalf. Draft a statement of authority. Set time limits. Sign and date the form.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner.Before signing an LPOA, the client should be aware of the specific functions they have delegated to the portfolio manager, as the client remains liable for the decisions.

Draft a list of special powers. Decide what powers are springing. Pick an agent and a successor agent. Note the expiration date. Compile the information into one document. Execute the power of attorney letter.

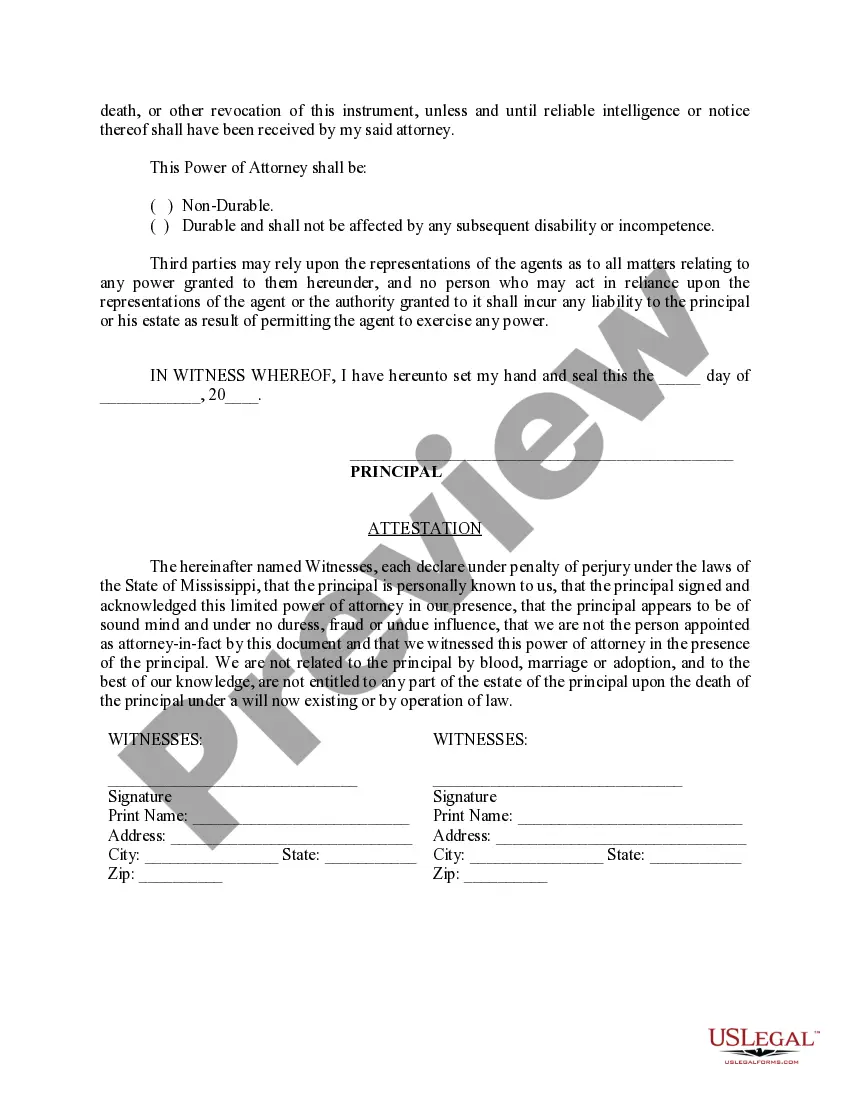

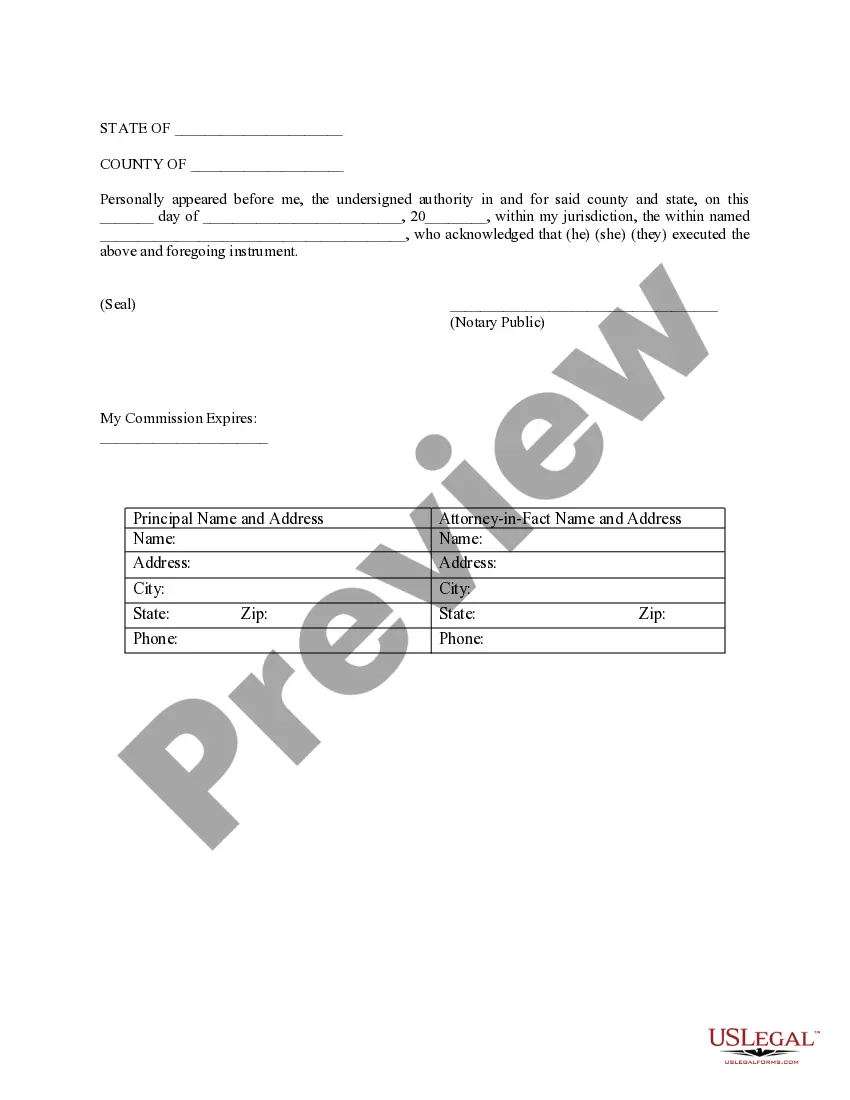

The requirements for a valid durable power of attorney in Mississippi are: Created by an adult or emancipated minor.Signed by two adult witnesses, at least one of whom isn't related to principal OR acknowledged by a notary public. Specifically authorizes the agent to make health care decisions.

When you give someone the POA, there are important limitations to the power the agent has. First, your agent must make decisions within the terms of the legal document and can't make decisions that break the agreement, and the agent can be held liable for any fraud or negligence.

A Power of Attorney is a legal document which appoints a person (the Attorney-in-Fact, AIF) to act on your behalf. A durable Power of Attorney authorizes your AIF to act on your behalf even if you become incapacitated and unable to handle matters on your own.

In many states, notarization is required by law to make the durable power of attorney valid. But even where law doesn't require it, custom usually does. A durable power of attorney that isn't notarized may not be accepted by people with whom your attorney-in-fact tries to deal.

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

Signature Requirements In all states, the principal must sign the document and have it notarized. Some states also mandate two witnesses to the signature. As of 2018, some 23 states have adopted the Uniform Power of Attorney Act, which requires neither witnesses nor the agent's signature.