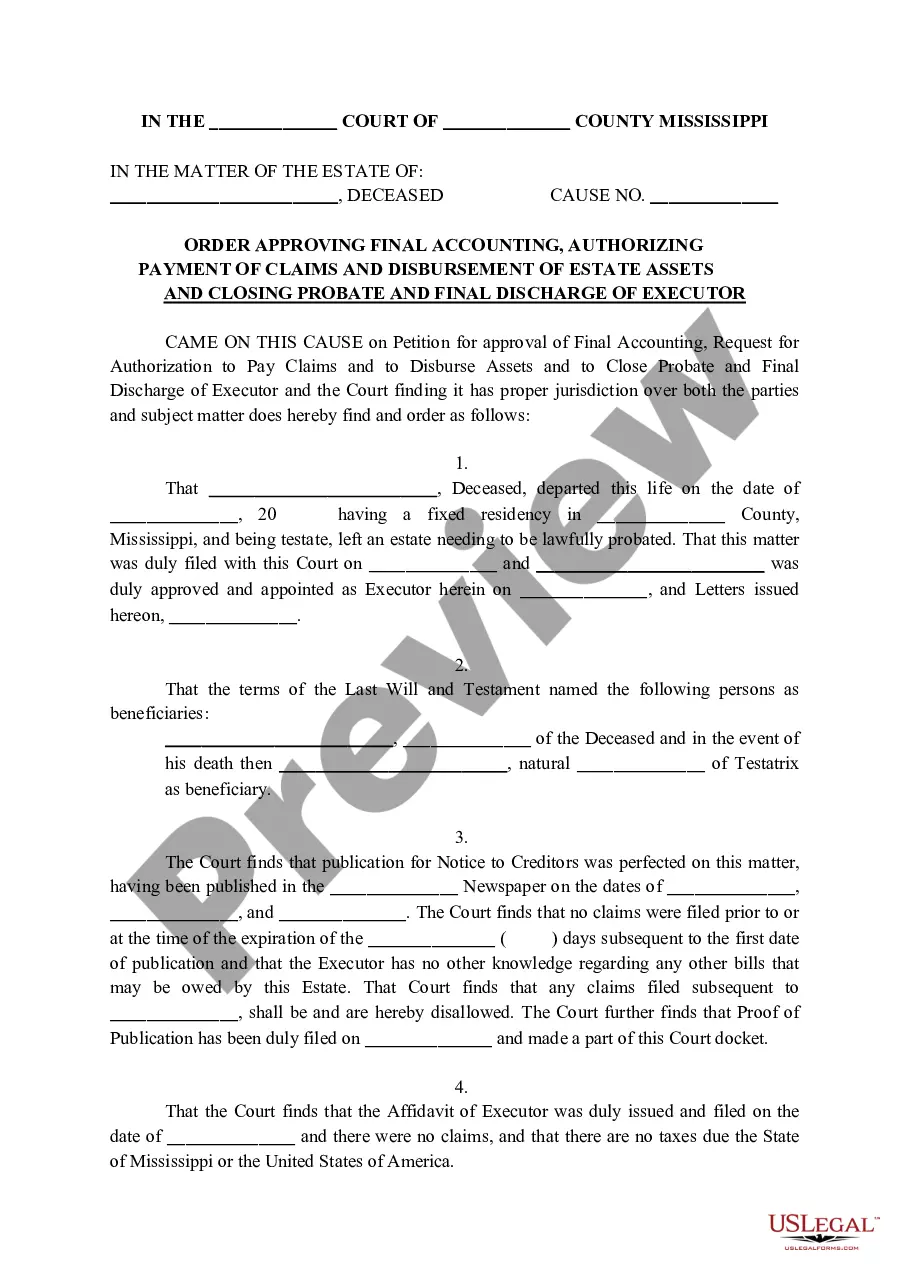

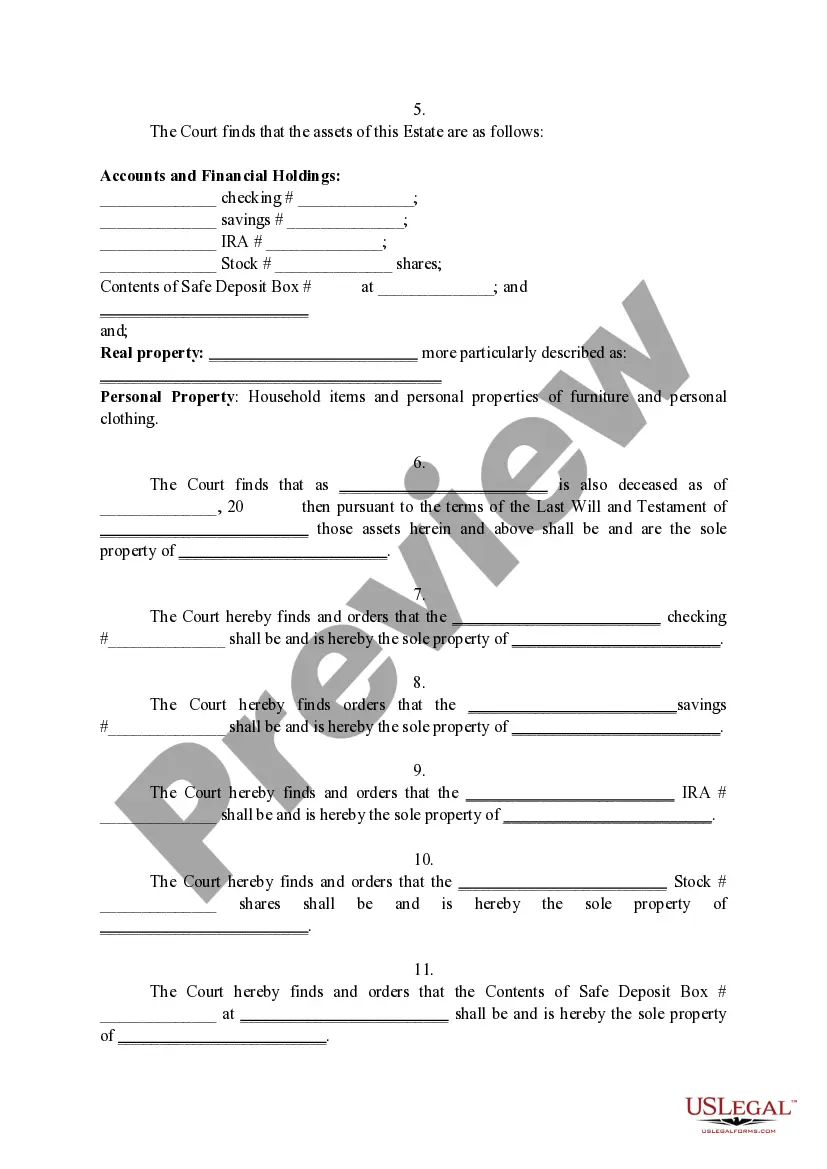

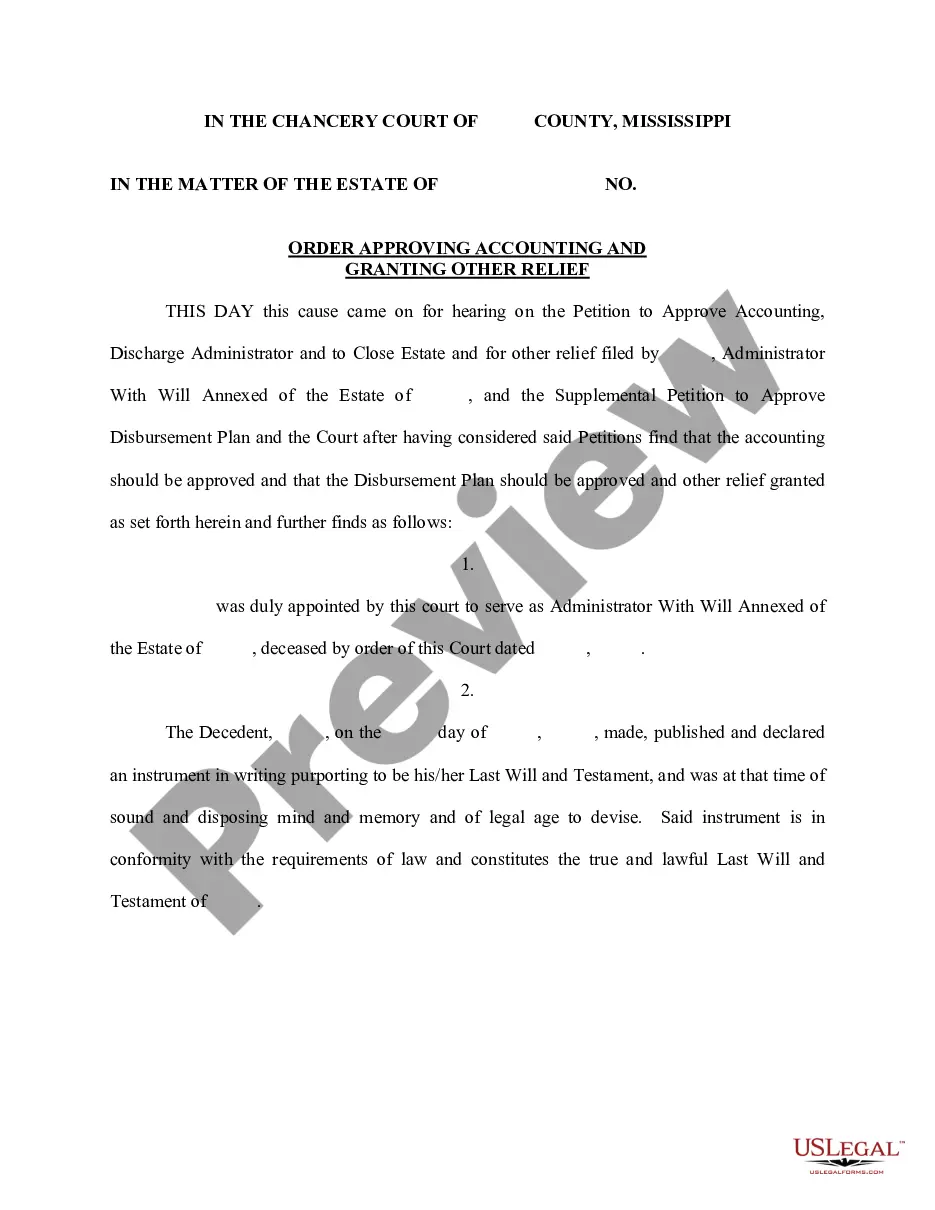

Mississippi Order Approving Final Accounting, Payment of Claims and Closing of Probate Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

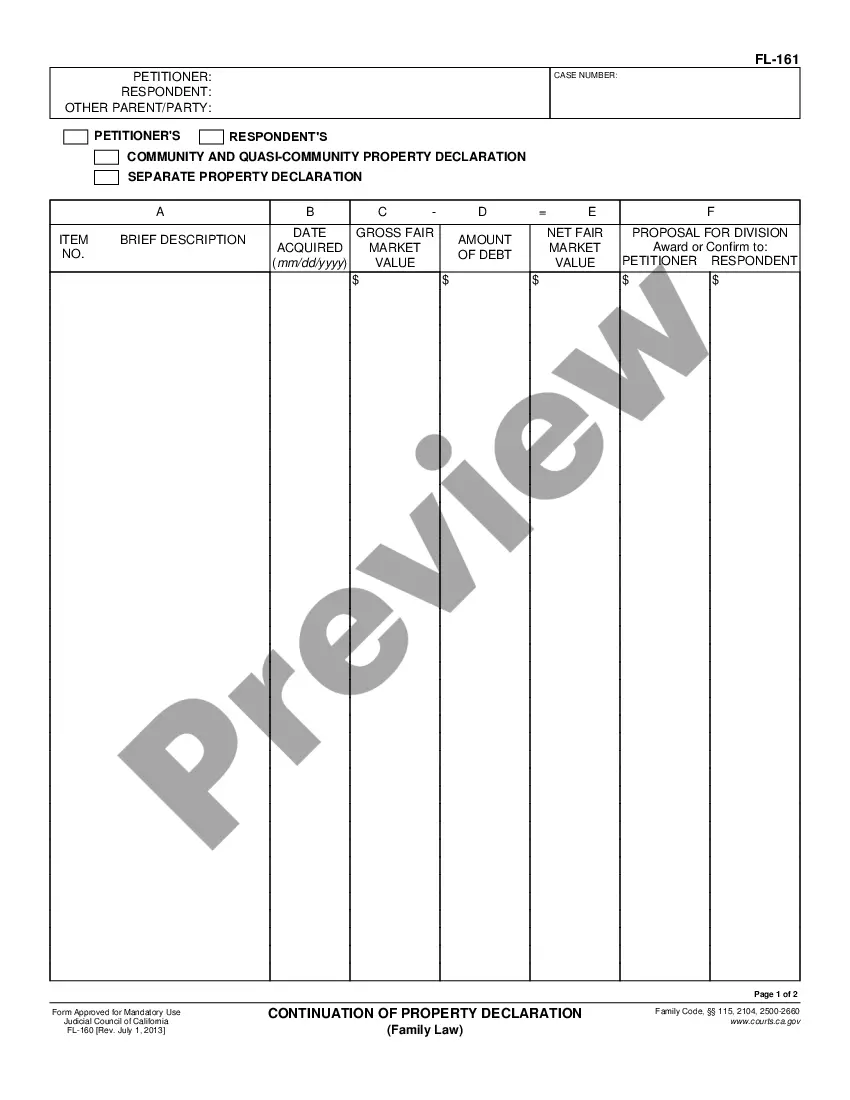

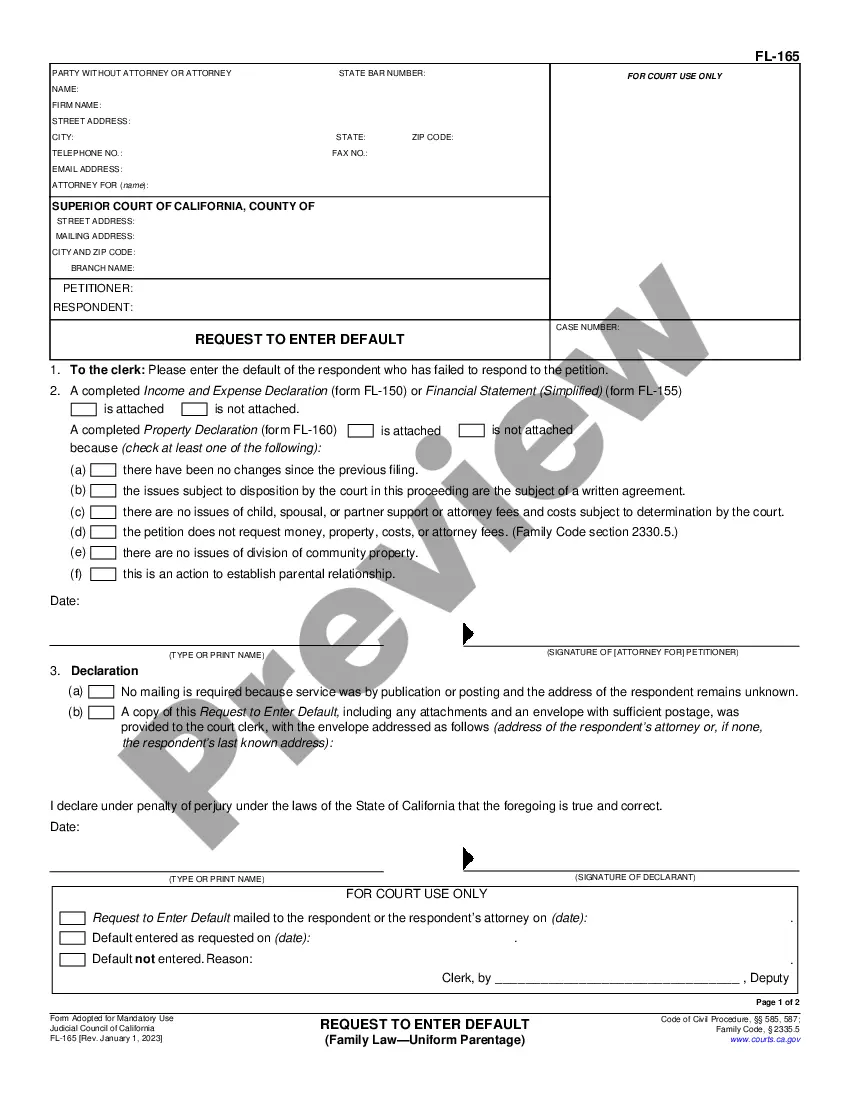

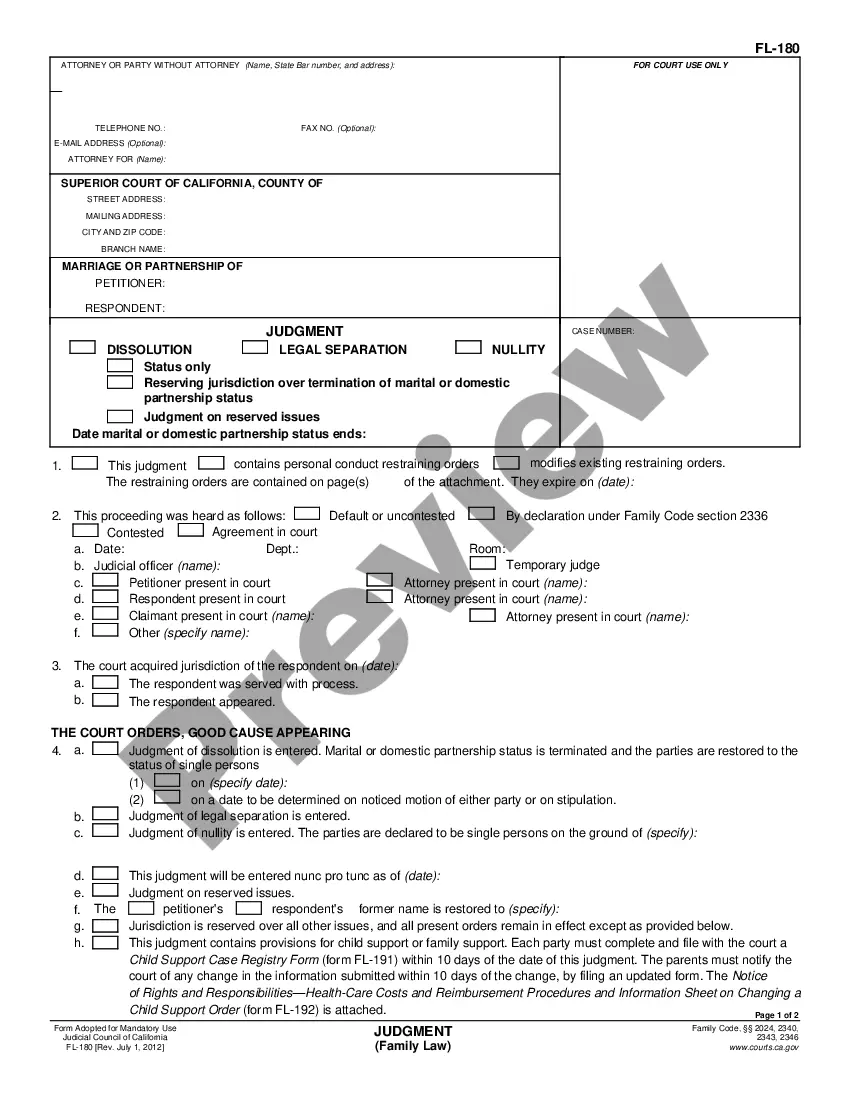

Looking for another form?

How to fill out Mississippi Order Approving Final Accounting, Payment Of Claims And Closing Of Probate Estate?

Acquire a printable Mississippi Order Approving Final Accounting, Payment of Claims and Closing of Probate Estate in just a few clicks in the largest collection of legal electronic files. Discover, download, and print professionally crafted and verified samples on the US Legal Forms website. US Legal Forms has been the leading provider of cost-effective legal and tax documents for US citizens and residents online since 1997.

Clients who already possess a subscription must Log In to their US Legal Forms account, download the Mississippi Order Approving Final Accounting, Payment of Claims and Closing of Probate Estate, and find it stored in the My documents section. Clients without a subscription need to follow the steps below.

After you have downloaded your Mississippi Order Approving Final Accounting, Payment of Claims and Closing of Probate Estate, you can fill it out in any online editor or print it and complete it manually. Utilize US Legal Forms to access 85,000 professionally prepared, state-specific documents.

- Ensure your form complies with your state's regulations.

- If accessible, browse the form's description for more details.

- If available, examine the form to view additional information.

- Once you are certain the template suits your needs, click Buy Now.

- Set up a personal account.

- Choose a plan.

- Make payment via PayPal or credit card.

- Download the template in Word or PDF format.

Form popularity

FAQ

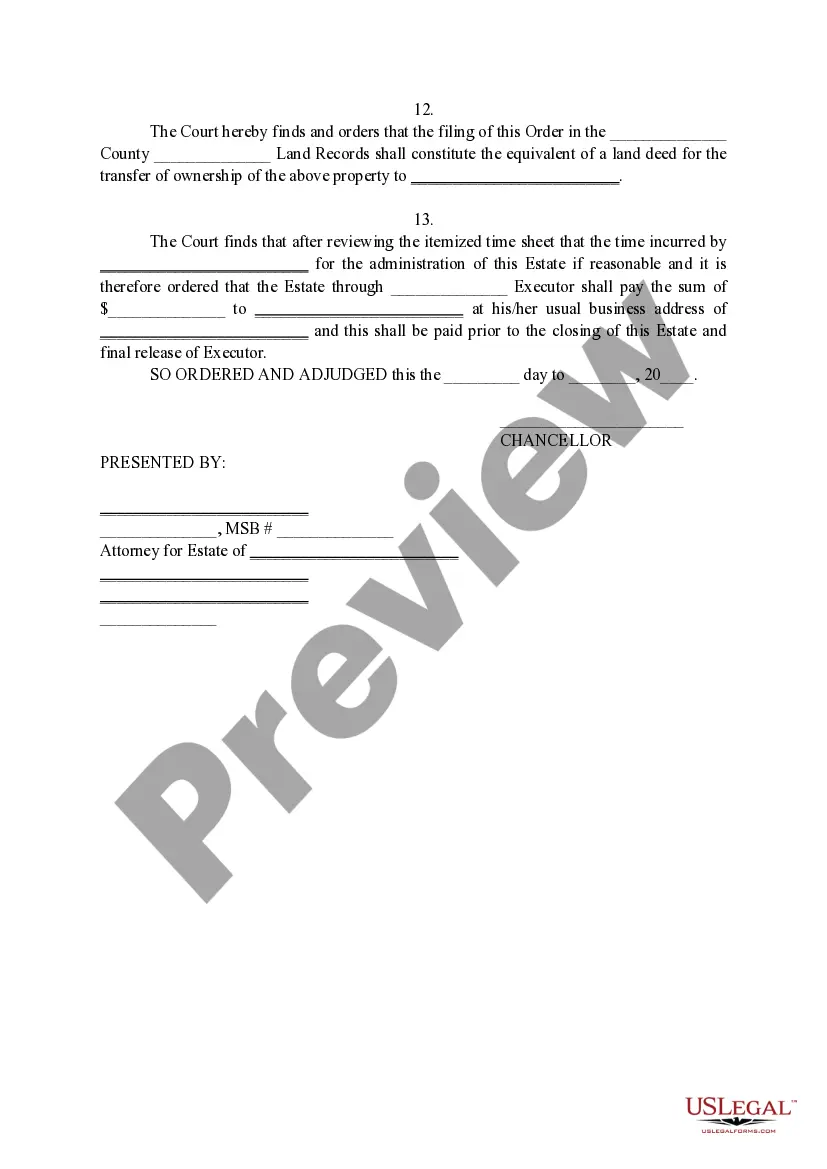

Closing the Estate as an Executor Once the petition has been filed with the closing statement, time counts down for one year. At the end of that year, the executor's appointment is terminated. During this time, beneficiaries and creditors have a right to file a claim against the estate or the executor.

The Executor's Final Act, Closing an Estate The personal representative, now without any estate funds to pay his lawyer, must respond. Even if the charges are baseless, the executor is stuck paying the legal bill. Instead, before making any distribution, the administrator should insist on receiving a release.

Guide to probate. Register the death.Find out if there's a will. Before you do anything else, find out if there's a will.Apply for a grant of probate and sort inheritance tax.Tell ALL organisations and close accounts.Pay off any debts.Claim on any life insurance plans.Value the estate.Share out the remaining assets.

3 attorney answers That means that the estate has been closed. In other words, all the matters of the distribution of the estate have been resolved. If your sister did not follow proper procedure, you may be able to re-open the estate.

If an estate is not properly probated and closed in a timely manner, there may be a number of consequences that can jeopardize the estate: The statute of limitations for creditors' claims is extended. Assets may lose value or be lost altogether. The state may claim the assets.

However, if the other beneficiary is someone you do not know well, someone who you suspect will spend all the money right away, or someone who will not readily help you pay for a future bill, then you should keep the account open, perhaps until two years have passed since the date of death.

If you are named as an executor in the deceased's will, you must produce proof of your executor status and provide a certified copy of the death certificate before the bank will provide access to the account.Present either of these letters to the bank along with the death certificate to close the account.

Notify all creditors. File tax returns and pay final taxes. File the final accounting with the probate court. Distribute remaining assets to beneficiaries. File a closing statement with the court.

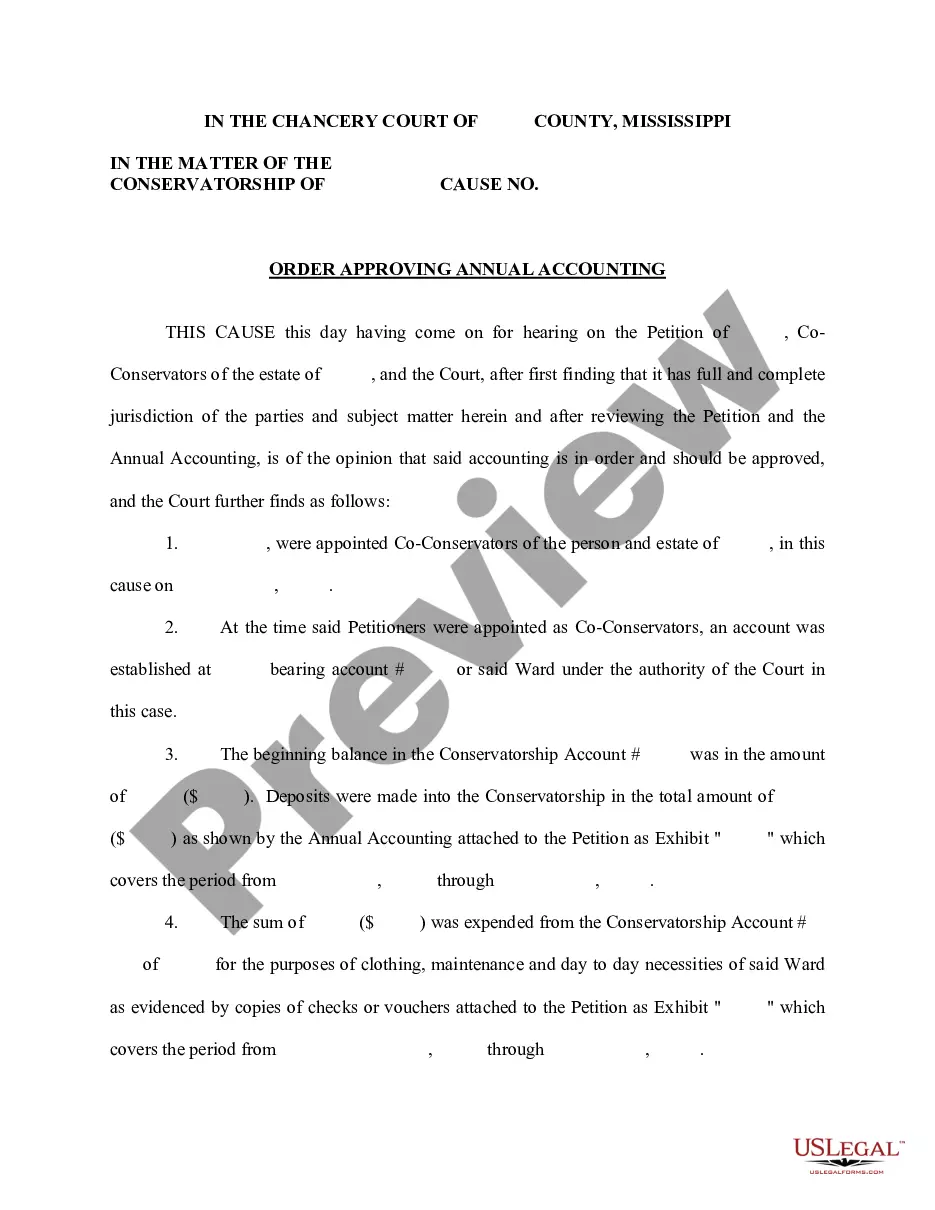

In the best of circumstances, the Mississippi probate process usually takes 4 to 6 months. This would only be possible if the estate was fairly simple, all interested parties are agreeable, and documents are signed and returned to the probate attorney in a timely manner.