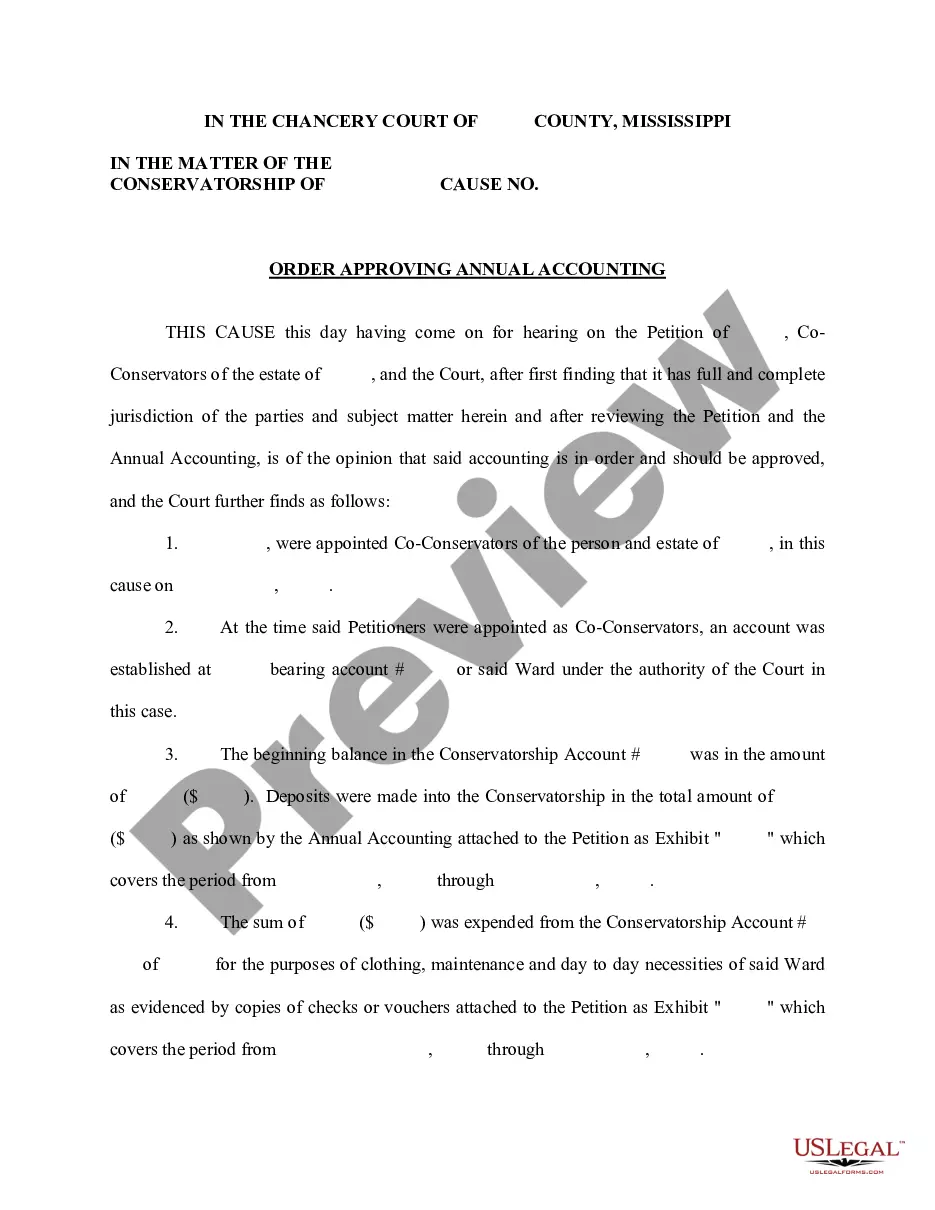

Mississippi Sample Order Approving Annual Accounting

About this form

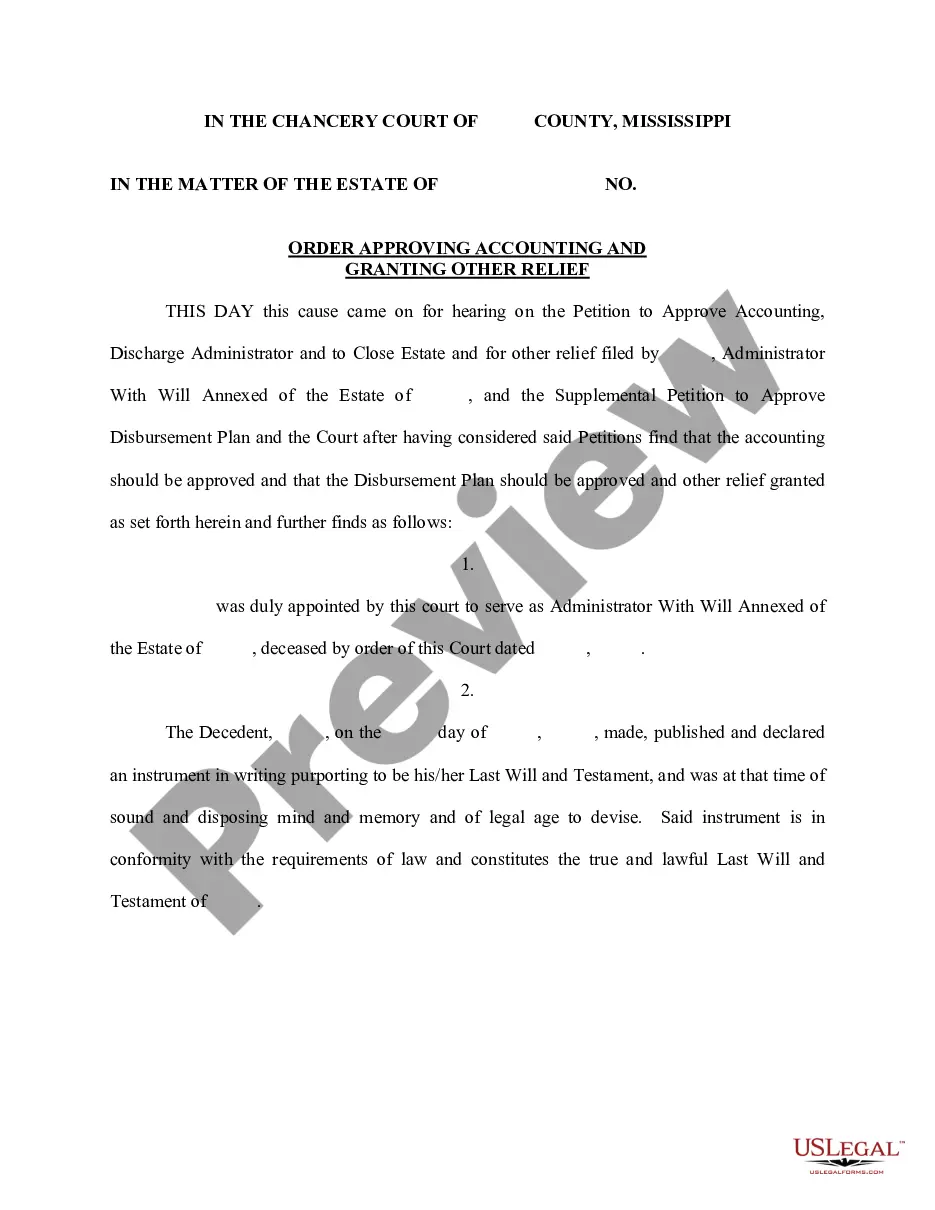

The Sample Order Approving Annual Accounting is a legal document issued by a Probate Court. Its purpose is to authorize the annual accounting of a probated estate after the executor or administrator has filed their report for the year. This form is essential for verifying the financial activities of an estate and differs from other probate forms due to its specific focus on accounting approvals.

Key parts of this document

- Party details, including the conservator and the estate being accounted for.

- A statement of the accounting period covered by the report.

- Itemized account of all receipts and disbursements, including assets on hand.

- Provisions for compensation of the conservator and any legal fees incurred.

- Authorization for the continued investment of estate funds and payment of necessary expenses.

Common use cases

This form should be used when a conservator needs to obtain court approval for their annual financial accounting of an estate. It is particularly relevant after a conservator has completed one full year of managing an estate and must formally present all transactions, ensuring compliance with probate regulations.

Who should use this form

This form is intended for:

- Conservators managing estates or conservatorships.

- Executors of a will who require court approval for financial accounting.

- Legal representatives assisting conservators or executors with the approval process.

Completing this form step by step

- Enter the name of the county and the details of the conservatorship at the top of the form.

- Fill in the names of the conservator and the estate involved.

- Specify the accounting period covered by the report.

- Provide a detailed itemized account of receipts, disbursements, and assets.

- Include any pertinent documentation, such as proofs of expenses and contributions to the trust.

- Obtain signatures from relevant parties and submit the form to the Probate Court for approval.

Does this form need to be notarized?

To make this form legally binding, it must be notarized. Our online notarization service, powered by Notarize, lets you verify and sign documents remotely through an encrypted video session.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Typical mistakes to avoid

- Failing to include all required documentation of receipts and expenditures.

- Not accurately reflecting the accounting period in the form.

- Omitting signatures of interested parties or the conservator.

- Providing incomplete or unclear itemized accounts.

Benefits of completing this form online

- Immediate access to a professional template ensures accuracy and compliance with legal standards.

- Easy to edit and customize for specific estate details.

- Reduces processing time by allowing quick downloads and submissions.

- Reliable content drafted by licensed attorneys provides peace of mind.