Missouri Request for Copy of Tax Form or Individual Income Tax Account Information

Description

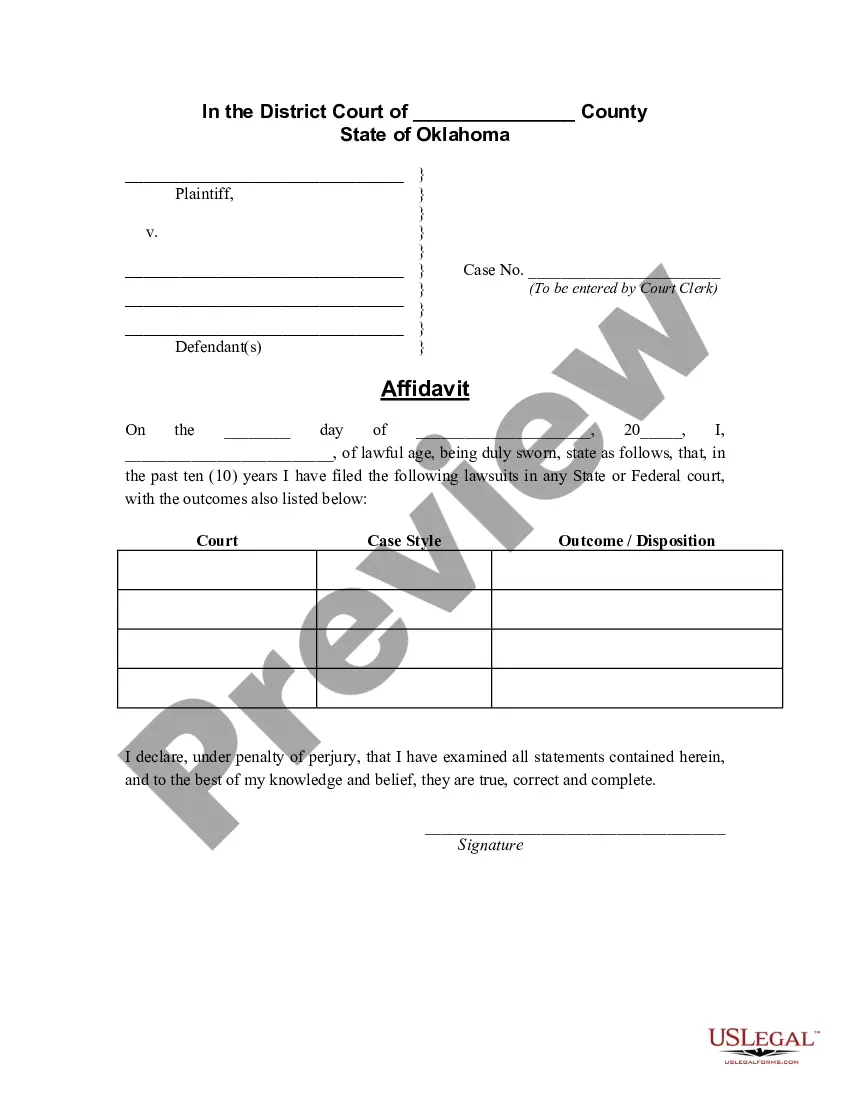

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

If you need to complete, download, or print out authorized file themes, use US Legal Forms, the largest collection of authorized kinds, which can be found on-line. Utilize the site`s simple and easy handy look for to discover the documents you need. Various themes for organization and specific reasons are sorted by groups and claims, or search phrases. Use US Legal Forms to discover the Missouri Request for Copy of Tax Form or Individual Income Tax Account Information with a handful of click throughs.

Should you be currently a US Legal Forms buyer, log in in your profile and then click the Acquire switch to get the Missouri Request for Copy of Tax Form or Individual Income Tax Account Information. You can even gain access to kinds you in the past delivered electronically within the My Forms tab of the profile.

If you are using US Legal Forms initially, follow the instructions listed below:

- Step 1. Be sure you have selected the form for that proper city/nation.

- Step 2. Take advantage of the Review method to check out the form`s articles. Don`t forget about to read through the information.

- Step 3. Should you be not satisfied with the form, use the Research area near the top of the display screen to find other models in the authorized form format.

- Step 4. Once you have located the form you need, click on the Buy now switch. Pick the prices plan you like and add your accreditations to sign up for an profile.

- Step 5. Process the transaction. You may use your bank card or PayPal profile to perform the transaction.

- Step 6. Find the file format in the authorized form and download it on the product.

- Step 7. Full, modify and print out or indication the Missouri Request for Copy of Tax Form or Individual Income Tax Account Information.

Each authorized file format you purchase is your own for a long time. You possess acces to every single form you delivered electronically with your acccount. Click on the My Forms portion and select a form to print out or download again.

Be competitive and download, and print out the Missouri Request for Copy of Tax Form or Individual Income Tax Account Information with US Legal Forms. There are millions of expert and state-specific kinds you may use for your organization or specific requirements.

Form popularity

FAQ

Missouri Tax Rates, Collections, and Burdens Missouri has a graduated individual income tax, with rates ranging from 2.00 percent to 4.95 percent. There are also jurisdictions that collect local income taxes. Missouri has a 4.0 percent corporate income tax rate.

The individual income tax (or personal income tax) is a tax levied on the wages, salaries, dividends, interest, and other income a person earns throughout the year. The tax is generally imposed by the state in which the income is earned.

If you choose not to e-file, you may print any Missouri tax form from our website at dor.mo.gov/forms.

You can also request a transcript by mail by calling our automated phone transcript service at 800-908-9946. Visit our Get Transcript frequently asked questions (FAQs) for more information.

General Revenue. $8,286,127,225. The main sources of General Revenue are: Individual Income Tax; Sales & Use Tax; Corporate Income Tax & Franchise Tax; ... Federal Funds. ... Other. ... Other funds are resources dedicated to specific. ... Highway and Road; Conservation, Parks, Soil. ... Total Available after Refunds.

1. Tax Return Copies of Returns PREPARED via eFile.com. Description:The last three years of your returns are stored here for free. Select the PDF icon for the respective tax year; based on your browser settings, the PDF will either open in a tab or prompt you to download the file.

A tax return is a documentation filed with a tax authority that reports income, expenses, and other relevant financial information. On tax returns, taxpayers calculate their tax liability, schedule tax payments, or request refunds for the overpayment of taxes.

Access your individual account information including balance, payments, tax records and more. If you're a new user, have your photo identification ready. More information about identity verification is available on the sign-in page.

For 2023, the first $1,000 of income is tax-exempt. The top tax rate is also reduced from 5.3% to 4.95% (on more than $8,968 of taxable income). (Note: Kansas City and St. Louis also impose an earnings tax.)

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.