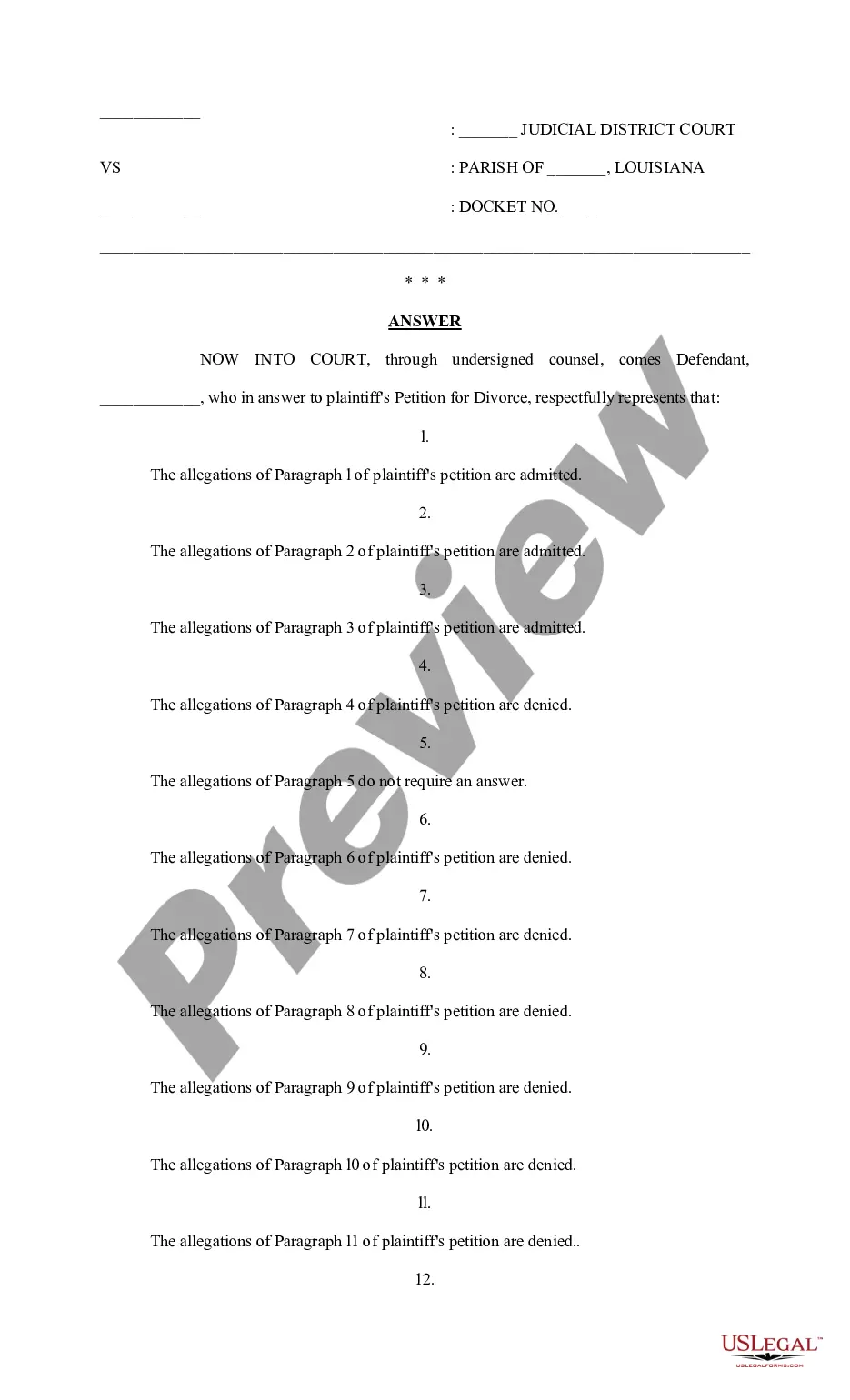

A Conversion of Reserved Overriding Royalty Interest to Working Interest form. The assignee shall be entitled to recover, out of the total proceeds derived from the sale of oil and gas produced from each well drilled and completed as a well capable of producing oil or gas in paying quantities on the Land, the total cost of drilling, completing, and equipping such well together with the cost of operating such well until the time of such recovery.

Missouri Conversion of Reserved Overriding Royalty Interest to Working Interest

Description

How to fill out Conversion Of Reserved Overriding Royalty Interest To Working Interest?

If you wish to full, down load, or print lawful file themes, use US Legal Forms, the largest variety of lawful varieties, that can be found on the Internet. Use the site`s simple and convenient look for to obtain the documents you require. A variety of themes for organization and individual purposes are sorted by classes and states, or keywords. Use US Legal Forms to obtain the Missouri Conversion of Reserved Overriding Royalty Interest to Working Interest within a handful of mouse clicks.

If you are currently a US Legal Forms consumer, log in for your profile and then click the Download key to find the Missouri Conversion of Reserved Overriding Royalty Interest to Working Interest. You can even access varieties you in the past acquired within the My Forms tab of your profile.

Should you use US Legal Forms for the first time, follow the instructions below:

- Step 1. Be sure you have chosen the shape for your proper metropolis/country.

- Step 2. Take advantage of the Review solution to look over the form`s content. Don`t overlook to read the information.

- Step 3. If you are not happy using the type, utilize the Search discipline at the top of the screen to discover other variations from the lawful type template.

- Step 4. Once you have found the shape you require, click the Purchase now key. Opt for the prices program you choose and put your accreditations to sign up to have an profile.

- Step 5. Approach the transaction. You can use your bank card or PayPal profile to finish the transaction.

- Step 6. Find the format from the lawful type and down load it on the system.

- Step 7. Comprehensive, change and print or indication the Missouri Conversion of Reserved Overriding Royalty Interest to Working Interest.

Each and every lawful file template you get is your own property permanently. You may have acces to every type you acquired in your acccount. Click the My Forms portion and decide on a type to print or down load yet again.

Contend and down load, and print the Missouri Conversion of Reserved Overriding Royalty Interest to Working Interest with US Legal Forms. There are thousands of skilled and state-specific varieties you may use for your personal organization or individual requires.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

What Determines the Value of an Overriding Royalty Interest? Mineral interest location. One in a shale basin with high production is worth more. Producing oil and gas wells. Wells currently producing are valued more. ... Production reserves and levels. ... Prices.

An overriding royalty is ?carved out of? the working interest. If ABC Oil Company acquires an oil and gas lease covering Blackacre that reserves a 25% royalty, ABC has a 75% net revenue interest. ABC can convey a share of that net revenue interest as a royalty.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

The value of a royalty interest is derived from expected future revenues generated by leasing and/or production, which are largely determined by oil and gas market prices and the current drilling environment.